The Japanese yen has posted losses in the Tuesday session, continuing the downward movement we saw on Monday. In North American trade, USD/JPY is trading at 109.67, up 0.31% on the day. On the release front, manufacturing PMIs are in focus. Japanese Manufacturing PMI improved to 53.8, beating the estimate of 53.3 points. In the US, ISM Manufacturing PMI is expected to dip to 58.4 points. On Wednesday, Japan releases consumer confidence, with the markets expecting a weak reading of 44.6 points. Market attention will shift to US employment indicators in the latter part of the week, starting with ADP Nonfarm Employment Change on Wednesday. As well, the Federal Reserve will release a rate statement.

There was a surprise development last week at the Bank of Japan, which removed its target timeframe for reaching its inflation target. Governor Haruhiko Kuroda stated that the removal of the timeframe would prevent market speculation on additional easing each time the BoJ pushed back the timeframe for reaching its inflation goal. The bank has pushed back its inflation timeframe six times, due to weak inflation. In his remarks, Kuroda said that the reluctance of the business sector to raise wages continued to hamper the inflation outlook. In its quarterly review, the bank projected an inflation rate of 1.8% in fiscal 2019. The bank is expected to hold course and maintain its ultra-accommodative monetary policy until inflation moves closer to BoJ target of around 2 percent.

All eyes will be on the Federal Reserve on Wednesday when it concludes a 2-day policy meeting. The markets are expecting the Fed to maintain the benchmark rate at a range between 1.50% and 1.75%, and analysts will be keeping a close eye on the rate statement – a hawkish statement could propel the US dollar to higher levels. There is growing sentiment that the Federal Reserve will raise interest rates four times this year, although Fed policymakers have not changed their forecast of three increases in 2018. One scenario envisions the Fed raising rates once each quarter until the economy shows signs of slowing down. If inflation continues to move higher and economic conditions remain strong, the dollar should continue to shine against its major rivals.

USD/JPY Fundamentals

Monday (April 30)

- 20:30 Japanese Final Manufacturing PMI. Estimate 53.3. Actual 53.8

Tuesday (May 1)

- 9:45 US Final Manufacturing PMI. Estimate 56.5

- 10:00 US ISM Manufacturing PMI. Estimate 58.4

- 10:00 US Construction Spending. Estimate 0.5%

- 10:00 US ISM Manufacturing Prices. Estimate 78.3

- All Day – US Total Vehicle Sales. Estimate 17.1M

- 19:50 Japanese Monetary Base. Estimate 9.2%

Wednesday (May 2)

- 1:00 Japanese Consumer Confidence. Estimate 44.6

- 8:15 US ADP Nonfarm Employment Change. Estimate 200K

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

*All release times are DST

*Key events are in bold

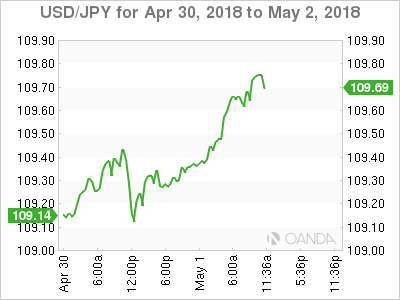

USD/JPY for Tuesday, May 1, 2018

USD/JPY May 1 at 9:30 DST

Open: 109.34 High: 109.70 Low: 109.24 Close: 109.65

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.29 | 108.00 | 108.89 | 110.11 | 111.22 | 112.06 |

USD/JPY edged higher in the Asian session and has recorded further gains in European trade. The pair is flat early in the North American session

- 108.89 is providing support

- 110.11 is the next resistance line

Further levels in both directions:

- Below: 108.89, 108.00, 107.29 and 106.64

- Above: 110.11, 111.22 and 112.06

- Current range: 108.89 to 110.11

OANDA’s Open Positions Ratios

USD/JPY ratio is showing little movement in the Tuesday session. Currently, long positions have a majority (60%), indicative of trader bias towards USD/JPY continuing to move to higher ground.