(Reuters) - SoftBank Group Corp's Vision Fund 2 and private equity firm Tiger Global Management have invested in Redis Labs, a real-time cloud analytics platform provider, in a late-stage funding round valuing the firm at over $2 billion.

Existing investor TCV also participated in the round which raised $110 million, bringing the net amount so far to $347 million, the company said on Wednesday.

The company's other investors include Bain Capital Ventures, Francisco Partners, Goldman Sachs (NYSE:GS) Growth, Viola Ventures and Dell Technologies (NYSE:DELL) Capital.

Founded in 2011 by Ofer Bengal and Yiftach Shoolman in Tel Aviv, Israel, Redis Labs' platform helps organizations process, analyze and forecast data effectively. It has deployed over 1 million databases so far.

The Mountain View, California-based firm has more than 8,000 paying customers including MasterCard Inc, Dell Technologies Inc, Fiserv Inc (NASDAQ:FISV), Home Depot Inc (NYSE:HD) and Microsoft Corp (NASDAQ:MSFT).

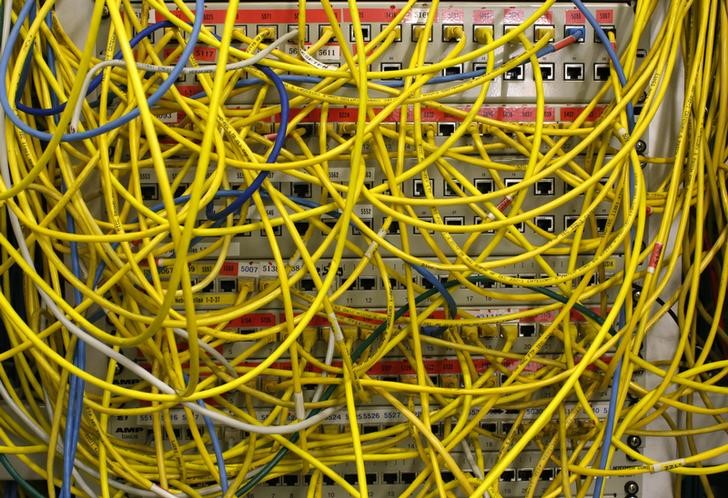

Redis Labs' products include in-memory database Redis and Redis Enterprise Cloud, a database-as-a-service offering. The company has an alliance with Microsoft to bring its Redis Enterprise-powered tiers to Azure Cache for Redis.

Its revenue grew by 54% over the last three years ended Jan. 3, 2021.

"As workloads increasingly move to the cloud, we believe Redis Labs is a leader who is transforming the database market," said Vikas Parekh, Partner at SoftBank Investment Advisers.

Japan's SoftBank has made serial investments in multiple tech companies in the past few weeks, such as U.S. genetic diagnostics company Invitae (NYSE:NVTA) Corp and Facebook-backed Indian social commerce startup Meesho.

Earlier on Wednesday, SoftBank Vision Fund 2 also led a $640 million funding round for image recognition technology firm Trax along with BlackRock Inc (NYSE:BLK).