If you only look at the price, you may get the impression that Bitcoin hasn’t moved much since late August. The cryptocurrency reached an intraday high of $28 142 on August, 29th, and as of this writing trades below $28 300. That’s a gain of just over 0.5%, which is rather small even for a stable Forex pair like EUR/USD, for example.

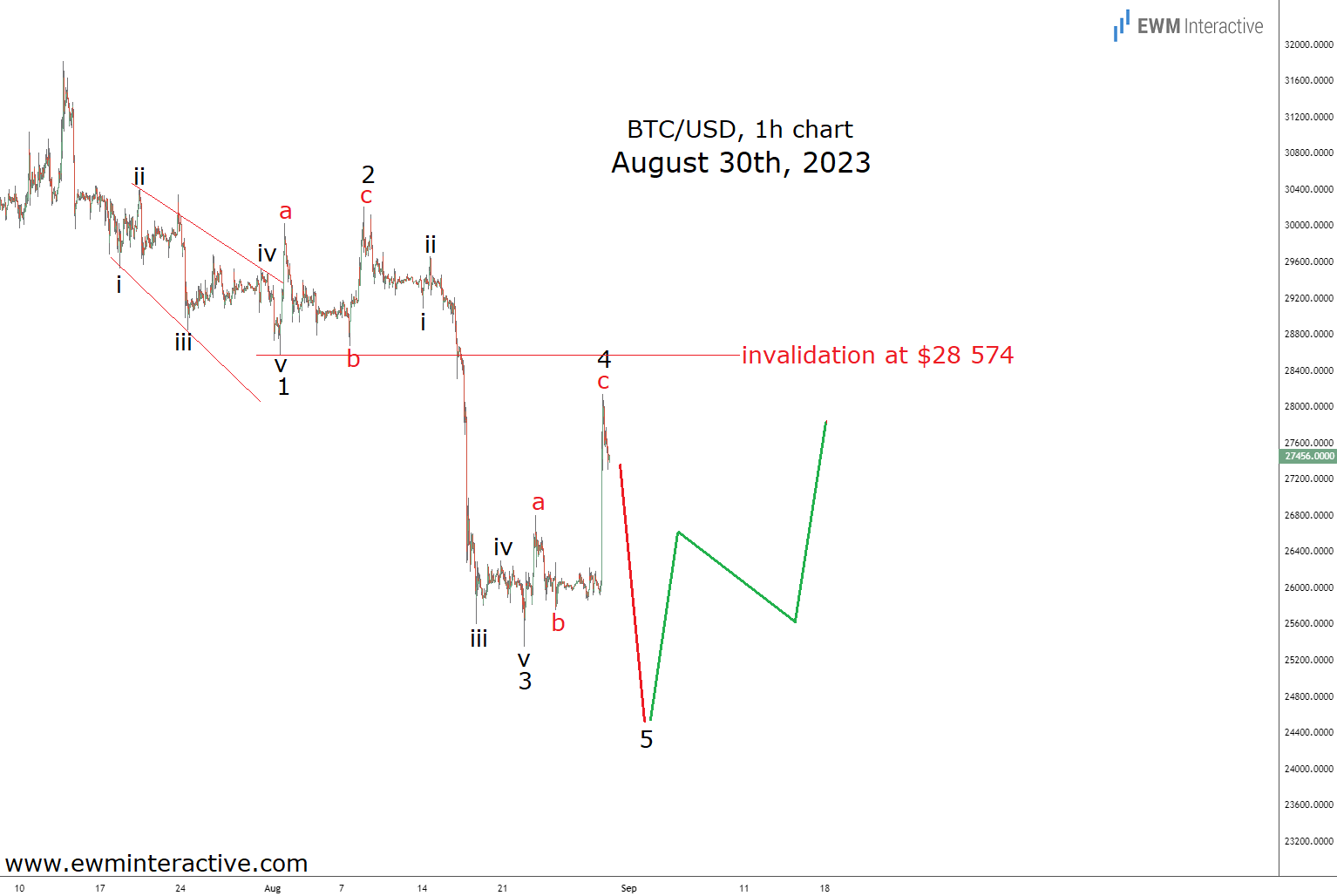

That's a false impression, though. Bitcoin may no longer be as volatile as it once was, but it is still far from boring. In reality, the month of September included a drop to under $25k and a recovery of more than 10% to nearly $ 27,500. Elliott Wave analysis put us ahead of both. The chart below, posted as an EW Pro update on Wednesday, August 30th, explains how.

Having already reviewed the weekly and daily charts of Bitcoin, we thought that the decline from $ 31,818 was likely to evolve into a five-wave impulse. Waves 1-through-4 were already in place. Wave 1 was an expanding leading diagonal and the five sub-waves of wave 3 were visible, as well. Both waves 2 and 4 were labeled as simple a-b-c zigzag correction.

In practice, we rarely chase fifth waves, because a three-wave move can always remain a three-wave move. In this case, however, the risk/reward ratio was quite attractive. According to the Elliott Wave theory, the first and fourth waves of an impulse must not overlap. This immediately allowed us to identify the bottom of wave 1 at $28,574 as the invalidation level for this count. As long as Bitcoin traded below it, downside targets near $25k would make sense.

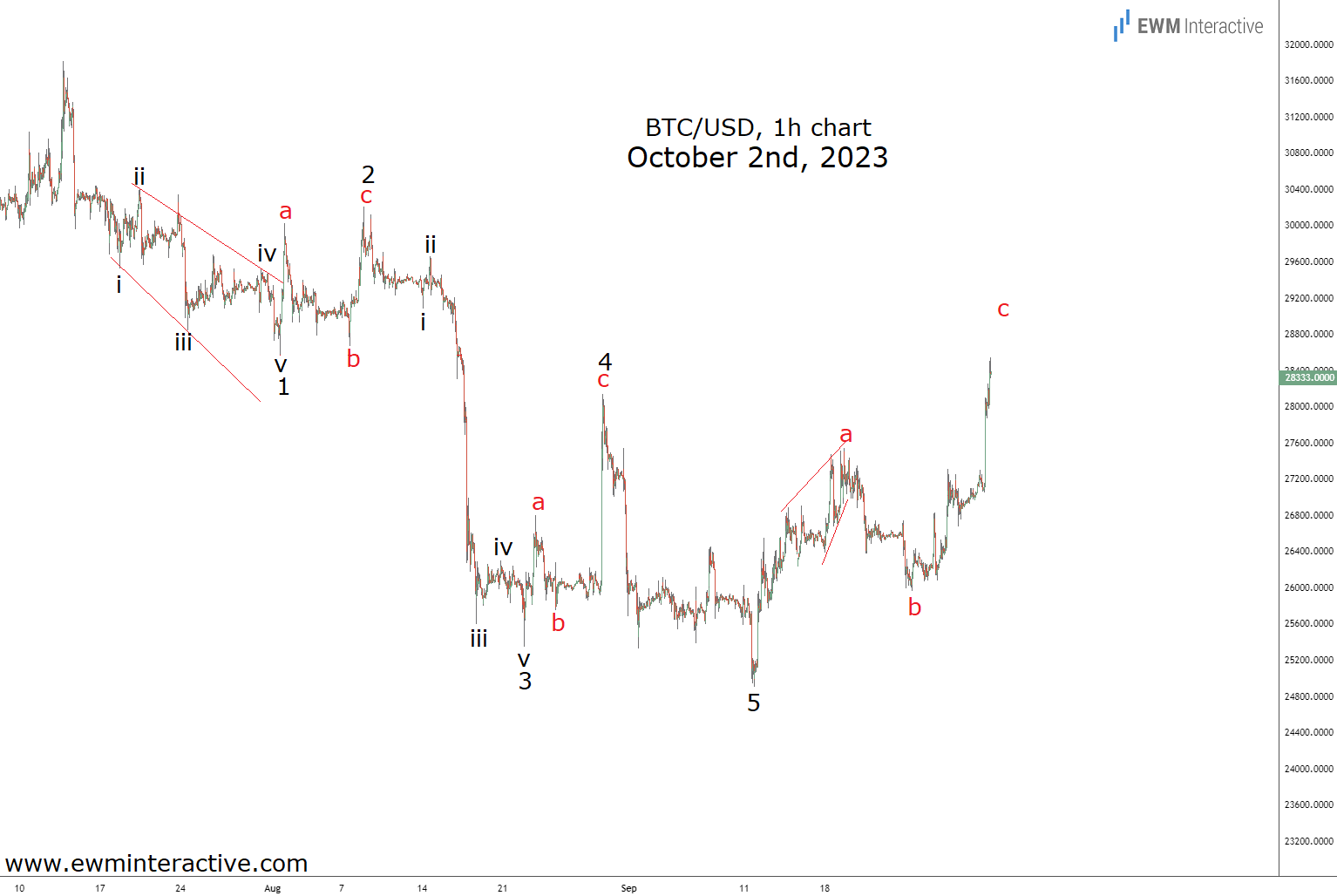

On the other hand, a three-wave correction follows every impulse and usually erases the entire fifth wave. This meant that a bullish reversal was likely to occur near the $25k mark to trigger a recovery back to the resistance near $28k. One “boring” September later, the updated chart below shows that this is exactly what happened.

Similar Elliott Wave setups occur in the Forex, commodity, and stock markets, as well. Our Elliott Wave Video Course can teach you how to uncover them yourself!

Wave 5 found a bottom at $ 24,920 on September 11th. Instead of losing hope, the bulls regrouped and managed to lift the price of Bitcoin by 14.3% so far to $28 492 earlier today. That’s far from a boring return in just twenty days, although nobody could’ve picked the bottom, of course, except by chance.

There is more than one way to succeed in the financial markets. The sleep-good-at-night buy-and-hold strategy makes sense for picking stocks as long-term investments. But when it comes to short-term trading of instruments with no intrinsic value such as Bitcoin, Elliott Wave analysis is our method of choice.