A unit of The Western Union Company’s (NYSE:WU) recently upgraded the capabilities of its WU EDGE platform. Concurrently, the affiliate – Western Union Business Solution – expanded the “fee-free” network of the platform to seven markets.

This fee-free network of the Enterprise Digital Global Exchange ‘EDGE’ mainly aims to expedite overseas transactions. Hence, it is designed to be compatible with 51 currencies across 13 countries of the world. The platform was initially launched in six markets.

This aforesaid technological innovation by Western Union Business Solution is expected to be developed further in order to facilitate real time connection and payments between buyers and sellers across the world. To this end, the EDGE platform integrates accounts payable and accounts receivable workflows with Electronic Invoice Presentment and Payment (EIPP).

Apart from establishing a worldwide connection between buyers and sellers, this fee-free B2B platform would enable Small and Medium Enterprises (SME) to conduct business globally with their existing and new trade partners. This would also enable the firms understand forex risks and opportunities associated with international trade. Moreover, customers will gain useful insight on foreign cash management and trade intelligence.

Western Union remains focused on developing its technology offerings. In order to keep up with the technological advancement in the money transfer business, the company had developed numerous services like prepaid, westernunion.com, mobile money transfer, WU Connect. The company believes that these offerings to generate higher revenues over the long term.

The company made huge investments in technology to position itself for the future and rolled out further compliance and anti-money laundering products. The digital business of Western Union continues to be a long-term growth driver as the company plans to increase its usage through added capabilities, enhanced value propositions and expanded reach.

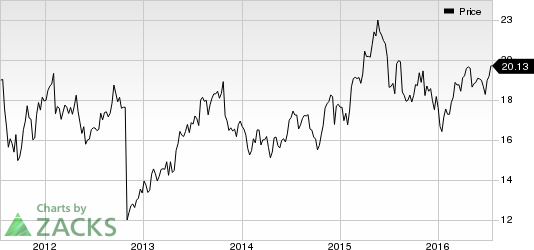

Western Union is set to release second-quarter 2016 results on Aug 3. The Zacks Consensus Estimate is currently pegged at 40 cents, which reflects a year-over-year decline of 2.3%. Also, our proven model does not conclusively show that the company will beat earnings this quarter. This is because the company carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%, which make surprise prediction difficult.

Stocks to Consider

Some better-ranked stocks from the financial transaction services industry are Visa Inc. (NYSE:V) , Qiwi Plc (NASDAQ:QIWI) and Total System Services Inc. (NYSE:TSS) Each of these stocks holds Zacks Rank #2 (Buy).

VISA INC-A (V): Free Stock Analysis Report

TOTAL SYS SVC (TSS): Free Stock Analysis Report

WESTERN UNION (WU): Free Stock Analysis Report

QIWI PLC-ADR (QIWI): Free Stock Analysis Report

Original post

Zacks Investment Research