Shares of the chinese specialty online retailer Vipshop Holdings Ltd. (NYSE:VIPS) rallied 1.42% in New York after-hours trading on May 15 after posting better-than-expected results in the first quarter of 2017.

Quarter in Detail

The Chinese online discount retailer reported adjusted earnings of 19 cents per share. Earnings beat the Zacks Consensus Estimate of 16 cents by 18.75%. Net income increased 26% on local currency on a year-over-year basis, driven by higher sales.

Revenues surged 31.1% to $2.32 billion in the quarter, beating the Zacks Consensus Estimate of $2.26 billion by 2.76%, despite a challenging macro environment. Accelerated growth in active customers, repeat customers and total orders over the past quarter led to better-than-expected earnings.

During the quarter, the number of active customers increased 32% to 26.0 million. The number of total orders increased 23% to 72.1 million from 58.7 million in the prior-year period.

Margins

Gross profit soared 25.0% in local currency to $536.7 million. However, gross margin contracted 110 basis points (bps) to 23.2% due to the company's promotional pricing to attract customers. The company expects to manage gross margin in the near term as it is making efforts to balance promotional activities and sales with its marketing expenses.

Adjusted operating income increased 31.2% to $145.9 million. Operating margin remained flat at 6.3% in the first quarter.

Other Financial Data

As of Mar 31, 2017, the company had cash and cash equivalents of $644.3 million, capital expenditure of $85.1 million. At the end of the quarter, operating cash flow was $107.04 million, while free cash flow was $62.3 million.

Last week, Vipshop's board authorized the company to explore a proposed spin-off of its Internet finance business into a dedicated entity. The objective of this proposal is to lessen the financial impact of Internet finance business on the company's core e-commerce business and shift any associated incentives and risks to this dedicated entity.

Second-Quarter 2017 Guidance

For the second quarter, the company expects total net revenue to increase in the range of approximately 26–30% on a year-over-year basis.

Our Take

We are impressed by the fact that Vipshop has delivered impressive results in a difficult macroeconomic environment. This was driven by the addition of new customers in the first quarter, which fueled top-line growth. The company also witnessed the addition of younger and more Internet- and mobile-savvy shoppers to its customer base.

Vipshop now expects to target these expanding demographics and offer products tailored for shoppers in various age groups. The company will also focus on delivering more personalized products and services to customers.

The ongoing macroeconomic slowdown in China and increasing competition in the retail space remain the major deterents.

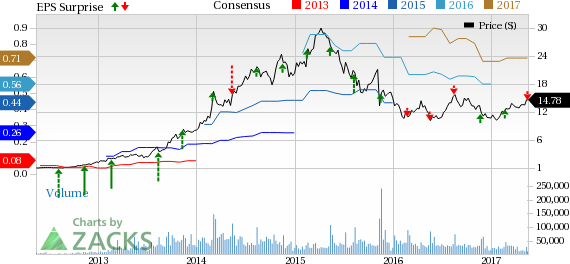

Stock Price Movement

A glimpse of Vipshop’sstock performance shows that its shares have been underperforming the Zacks categorized Internet – Delivery Services industry since the past six months. Shares have inched up 0.66% in the said time frame, as against the Zacks categorized industry’s growth of 19.9% in the past six months. Notably, the industry is part of the bottom 27% of the Zacks Classified industries (194 out of the 265). The broader Consumer Staples sector is placed at the top 44% of the Zacks Classified sectors (7 out of 16).

Vipshop currently carries a Zacks Rank #3 (Hold).

Stocks that Warrant a Look

A better-ranked stock in the same industry is MakeMyTrip Limited (NASDAQ:MMYT) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other better-ranked players in the broader sector include Agilent Technologies, Inc. (NYSE:A) and AMTEK, Inc. (NYSE:A) . Both of the stocks carry a Zacks Rank #2. While Agilent Technologies has a long-term earnings growth rate of 9.65%, AMTEK has a growth rate of 11.1%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

MakeMyTrip Limited (MMYT): Free Stock Analysis Report

Vipshop Holdings Limited (VIPS): Free Stock Analysis Report

Agilent Technologies, Inc. (A): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research