- Despite a decline in Q1 2024 earnings, Saudi Aramco announced a hefty dividend payout.

- Aramco remains committed to rewarding shareholders, projecting a total 2024 dividend payout of $124.3 billion.

- While Aramco's profits have slowed due to fluctuating oil prices, its dividend strategy remains top-notch.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

Despite reporting a 14% decline in net income compared to the prior year, oil giant Saudi Aramco (TADAWUL:2222) announced a hefty $31 billion dividend payout, exceeding analyst expectations.

Aramco expects to distribute a total of $124.3 billion in dividends throughout 2024, consisting of an $81.2 billion base dividend and a $43.1 billion performance-related dividend. Notably, this figure surpasses Aramco's record-breaking $121.3 billion profit in 2023, solidifying its position as a leader in global earnings.

Balancing Profits and Dividends

While Aramco's profits are experiencing a slowdown, primarily due to fluctuating oil prices, the company prioritizes its dividend distribution. This strategy directly benefits the Saudi government, which owns 98% of Aramco's shares. These dividends contribute significantly to funding government initiatives and ambitious infrastructure projects envisioned by Crown Prince Mohammed bin Salman.

Looking to Buy the Stock? Here's What You Should Know

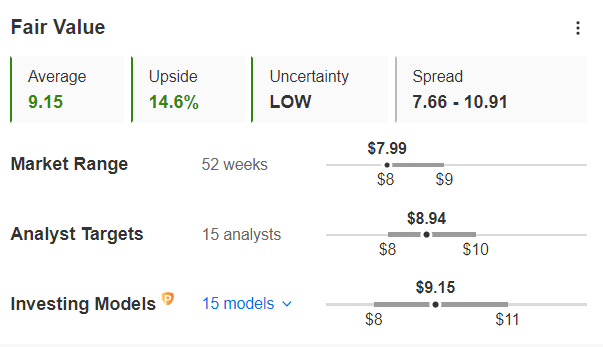

Despite the recent dip in profits, analysts see potential for future growth in Aramco's stock. InvestingPro's Fair Value analysis estimates an intrinsic value of $9.15 per share, a 14.6% increase from the current trading price. Similarly, analysts surveyed by InvestingPro project an average target price of $8.94 per share within the next year, with some projections reaching as high as $10 per share.

Source: InvestingPro

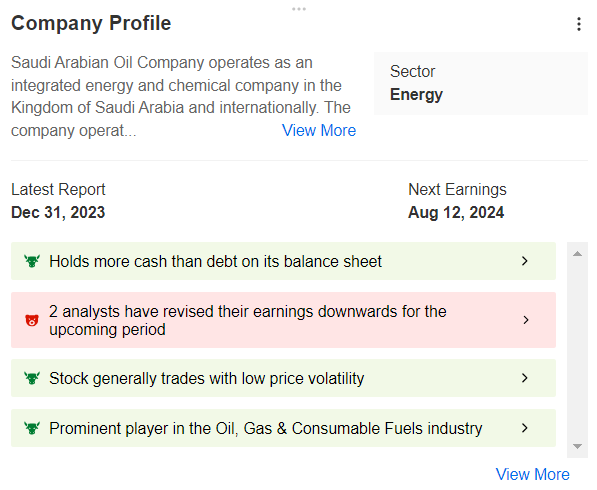

InvestingPro's analysis highlights Saudi Aramco's financial strength. The company boasts a significant war chest and superior cash flow generation compared to competitors. Their ebit/interest payable ratio sits at a staggering 173.2x, dwarfing the industry average of 14.2x.

Source: InvestingPro

However, dividends remain the crown jewel for Saudi Aramco. After returning a hefty $97.8 billion to shareholders in 2023 (a 30% increase from 2022), the company projects a further 27% rise in dividends to $124.3 billion this year.

Is the Stock Overvalued Now?

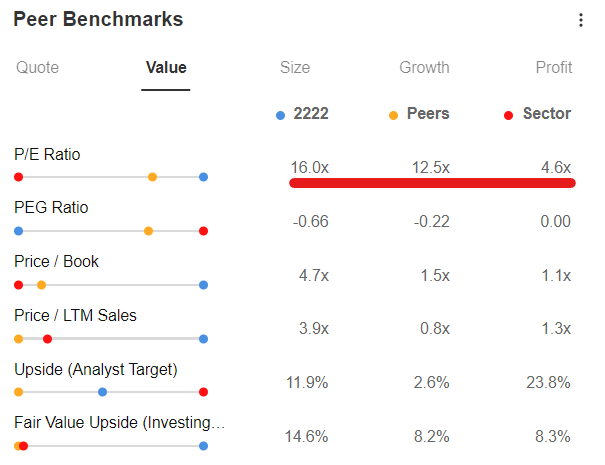

InvestingPro+ data also reveals that Aramco shares trade at a hefty premium. Their current price-to-earnings ratio of 16x is nearly four times higher than the energy sector average (4.6x). They also command a higher valuation than competitors like Shell (NYSE:SHEL) at 12.9x and Chevron (NYSE:NYSE:CVX) at 14.8x.

Source: InvestingPro

Possible Headwinds Ahead

Despite the recent earnings decline (attributable to Saudi government-mandated lower crude prices), both the company and the country face significant challenges in diversifying their revenue streams away from oil dependence. Saudi Arabia's ambitious Vision 2030 project may need to undergo adjustments, as Finance Minister Mohammed Al Jadaan acknowledges a challenging economic environment.

The nation's key concern is ensuring long-term profitability in the face of the global energy transition. This may necessitate strategic adjustments, even if it means sacrificing some short-term profit gains. However, maintaining their generous dividend policy remains a top priority.

***

DISCOUNT CODE.

You can conduct in-depth analysis on more than 180,000 companies worldwide with InvestingPro+.

Take advantage of a special discount to subscribe to InvestingPro+ and take advantage of all our tools to optimize your investment strategy. (The link directly calculates and applies the discount of an additional 10%. In case the page does not load, you enter the code proit2024 to activate the offer.)

You will get a number of exclusive tools that will enable you to better cope with the market:

Take advantage HERE AND NOW of the opportunity to get the annual Investing Pro+ plan at a special discount. Use code proit2024 and get an additional 10% discount on your 1-year subscription.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.