The dust is settling here in Cyprus after the past fortnight’s unprecedented events. Gone are many of the uncertainties and fears that were coursing through the collective mind, what remain now are a new set of worries for the future along with a palpable sense of sadness and betrayal. Last night the president addressed the public about his battle with the eurogroup. He tried his level best to convince the Cypriot people that the bailout agreement reached early Monday morning represented the very best of a bad situation, a chance for the island to start afresh. But as rousing as his rhetoric attempted to be, it seemed more like the weedy kid trying to put a positive spin on his recent encounter with the school bully.

Laiki’s woes are to be addressed by the adoption of the good-bank-bad-bank model. Insured deposits (up to 100,000 euros) are safe, while 4.2 billion euros of uninsured deposits (as well as shares and bonds) are to be lost. The Bank of Cyprus will absorb the good portion of Laiki, as well as 9 billion euros worth of Laiki’s Emergency Liquidity Assistance. In addition to this a 30-40% bail-in will be imposed on uninsured Bank of Cyprus accounts with share and bond holders also being wiped out there. All this in return for the 10 billion euro bailout from the Troika.

Effect On The Average Joe

So Cyprus has avoided bankruptcy, exit from the euro zone and a return to a massively devalued Cypriot pound, but what will the agreement mean for people on the ground in Cyprus? Well, to begin with capital controls are now in effect and the president gave no specifics as to when they would be lifted, saying only that they would be eased gradually. Daily withdrawal restrictions will be in place as well as restrictions on non-cash transactions. This includes electronic transfers, debit/credit card transactions, and the cashing of cheques. Basically the movement of money is to be severely impeded in an attempt to curtail an exodus of capital from the country. What we can expect to see in the short to medium term, aside from the growth of a cash economy, is a massive drop in consumer spending. Suddenly that new chenille armchair and footstool ensemble/smartphone/German car/holiday abroad is looking distinctly non-essential. Small to medium sized businesses will be dropping like flies in the wake of their accounts being raided. Cyprus’s financial services sector will be knocked for six. Mass unemployment will ensue, and up to a third reduction in the island’s GDP is pretty-much inevitable. In other words hard times are ahead for all of us.

There are a number of points that ought to be made though. Firstly what has happened to Cyprus over the past couple of weeks has set a precedent that citizens in other euro-zone nations would do well to take note of. The seizing of bank deposits is now officially on the table in all future crisis talks, something that could never have been justified before this. Also we now know that when the Troika comes to a town near you, they have no due process to guide them, but rather make things up on the fly. So soon enough a handful of hounded officials could be hammering out your future in the wee hours of the morning like some deranged divorce negotiation. In a nutshell what Europe stood for has forever changed in the minds of many many people.

Secondly the imposition of capital controls means that while Cyprus is still in the euro, it’s actually using a different currency than that enjoyed by the rest of Europe. Essentially it’s a euro that you can only use in one place, and even there you’ll have considerable difficulty moving it around in anything other than petty cash sums. So much for the notion of a monetary union, the last time I checked it was about free movement and uniform value. Holding a Cypriot euro today strangely doesn’t feel like being much part of anything other than an ailing island economy. Jeremy Warner of the Telegraph likened it to Scots being told they can’t use their pounds in England.

Thirdly nobody is asking why BOC depositors should shoulder the burden of Laiki’s ELA. This is one of the most preposterous terms of the agreement; effectively absolving Greece of having any part to play in the downfall of Laiki, even though a substantial portion of this fund was used to finance the hit that Laiki’s Greek branches took.

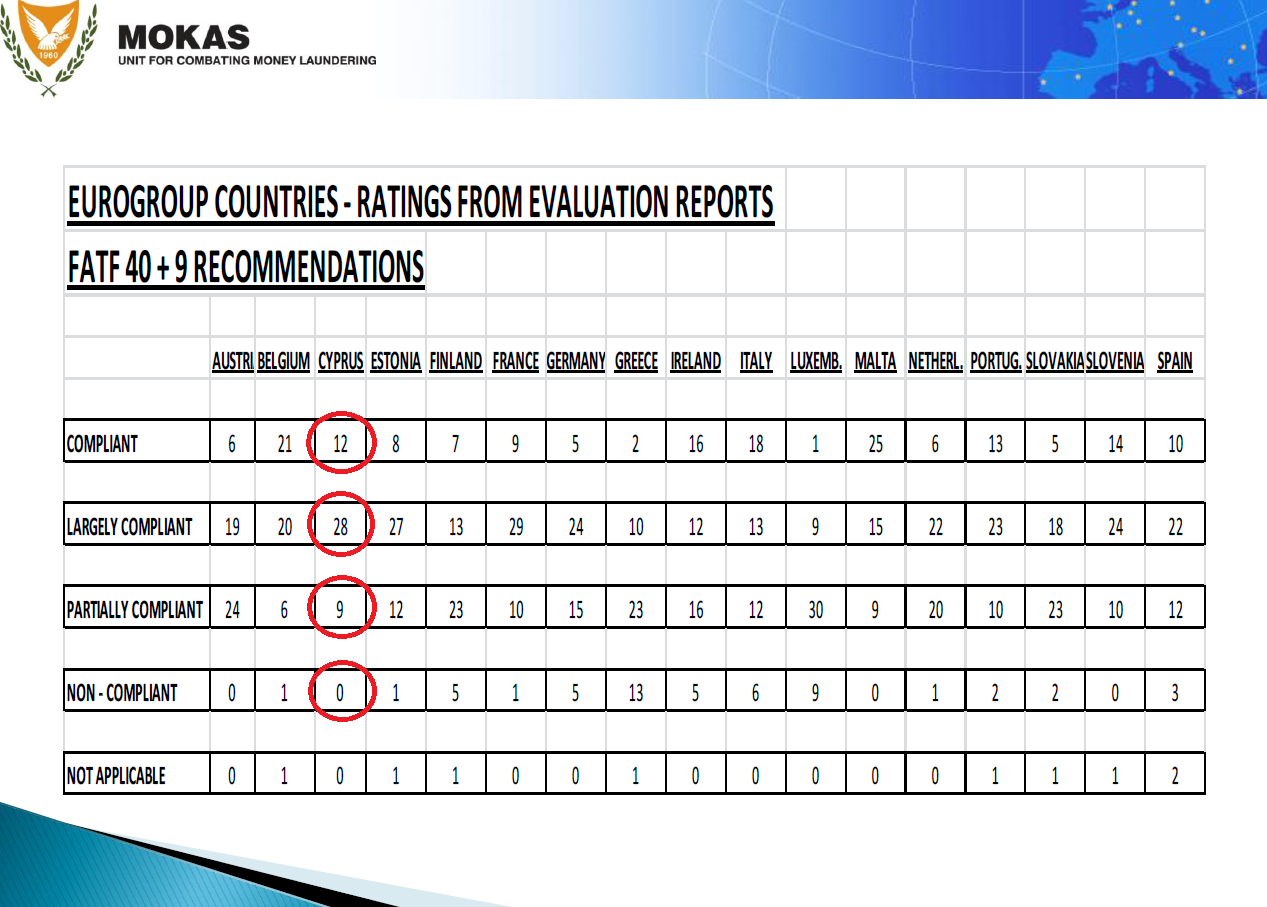

Finally we really should have seen this coming purely by virtue of how Cyprus was being portrayed by the global media in the build-up to the bailout negotiations. The coverage was tantamount to a PR campaign intent on turning opinion against Cyprus on the eve of it being taken to the slaughter. I want to see a word cloud generated from the big news outlets’ coverage of Cyprus in the run-up to these events. I’m sure you can already picture what it would look like. “Russian”, “oligarchs”, “dirty money”, “money-laundering” and “tax-avoidance” would no-doubt feature prominently in big bold letters. It didn’t seem to matter, nor of course does it now, that Cyprus is an exemplary OECD (Organization of Economic Co-operation and Development) low tax jurisdiction country (not to be confused with a tax haven like the Caymans), and operates double-taxation treaties with all 52 of its OECD partners. In addition to this, as the table below clearly demonstrates, Cyprus is highly compliant with the FATF’s (Financial Action Taskforce On Money-Laundering) 40 + 9 recommendations, scoring higher than Austria, France, Germany, and Luxembourg among others.

Germany's Dirty Laundry

In fact Germany has quite severe money-laundering issues of its own, making it all the more intriguing that it was German and Dutch political leaders who spearheaded the campaign against Cyprus. Gerhard Schick, a member of the German Bundestag’s financial committee has said on the matter of German money-laundering: "Unfortunately, circumstances in Germany still encourage money laundering… There's still a lack of awareness about its vast proportions." Germany is said to hold between 50 to 60 billion Euros originating from blackmailing, drug/arms trading, and has caused the European Union to launch an infringement procedure against it due to its reluctance to act being perceived as a green light to the funding of terrorism (see full article http://www.dw.de/germany-a-safe-haven-for-money-laundering/a-16343313).

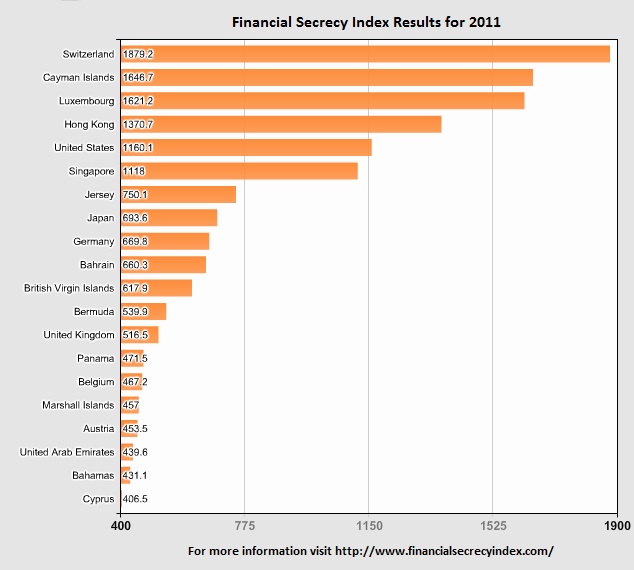

I saw no mention of any of this from any of the ”reputable” news sources. Nor did I come across the following through them, which is taken from the FSI’s website:

The Financial Secrecy Index turns the spotlight on the providers of international financial secrecy. In doing so it has important implications for how we understand and tackle the world of financial secrecy. The index reveals that the traditional stereotype of tax havens is misplaced. The FSI reveals without doubt that the world’s most important providers of financial secrecy are not small, palm-fringed islands as many suppose, but some of the world’s biggest and wealthiest countries (www.financialsecrecyindex.com).

Interesting data in the light of the PR smear campaign the global media has perpetrated against Cyprus recently. See the chart below for a list of countries that have scored poorer than Cyprus in the FSI’s most recent rankings.

The Feel On The Ground

Of course none of this is here nor there now. Cyprus is being punished for a wider systemic failure, and of course the island’s own bankers and politicians have a great deal to answer for themselves, as do the average citizens among us who have been living beyond our means for some time now. Being on the ground here feels like having just been sucker punched twice, once by the crisis itself, which we have been feeling since 2010 (and failed to respond to intelligently as a nation), and the second time now being plunged into a full blown recession/depression. The thing is… it feels distinctly like being held under rather than drowning on your own steam. Many now dread the prospect of spending the next decade or so trying to scratch by rather than build for the future. A job, any job, is now something to be deeply grateful for. The phrase beggars can’t be choosers might as well be our national motto from now on.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Morning After The Day After The Week That Changed Everything

Published 03/26/2013, 11:08 AM

Updated 04/25/2018, 04:40 AM

The Morning After The Day After The Week That Changed Everything

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.