Sunrun Inc. (NASDAQ:) is scheduled to report third-quarter 2018 results on Nov 7, after the market closes. Last quarter, the company reported a negative earnings surprise of 82.86%.

Let’s see how things are shaping up prior to this announcement.

Factors Under Consideration

Due to the increasing wildfires and extreme weather causing outages during the third quarter, the demand for solar energy witnessed considerable growth that is ought to benefit leading solar companies like Sunrun. Considering this, we may expect the upcoming results to reflect megawatt deployments growth, similar to that of 20% improvement witnessed during the second quarter of 2018.

Moreover, the company expects to double the installation of its Brightbox battery storage systems in the second half of 2018 as compared to the first half. This again should reflect a favorable impact on sales in the third quarter.

In line with such notable developments, the Zacks Consensus Estimate for Sunrun’s third-quarter revenues is pegged at $176 million, reflecting an annual rise of 24.5%.

Sunrun has been achieving 9% annual cost reductions for the last three years and we expect this trend to continue further and positively impact bottom-line results in the to-be-reported quarter.

Evidently, the Zacks Consensus Estimate for Sunrun’s third-quarter earnings, which is pegged at 34 cents, reflects an annual rise of 36%.

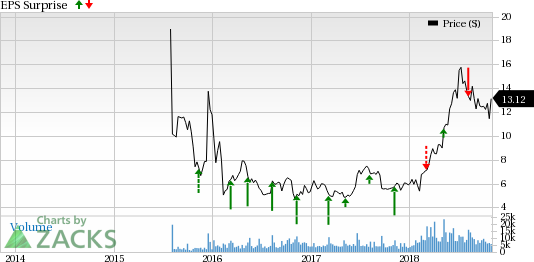

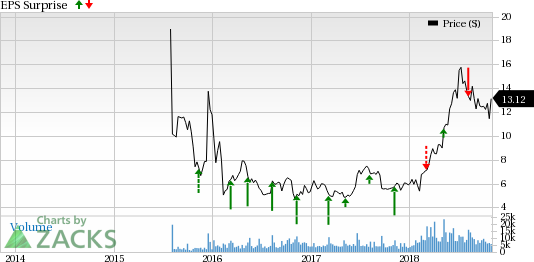

Sunrun Inc. Price and EPS Surprise

Sunrun Inc. Price and EPS Surprise | Sunrun Inc. Quote

Earnings Whispers

Our proven model does not show an earnings beat for Sunrun this quarter. That is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen.

That is not the case here as you will see below.

Earnings ESP: Sunrun has an Earnings ESP of +150.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #5 (Strong Sell), which makes surprise prediction difficult, even when combined with a positive ESP.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Upcoming Oil-Energy Releases

TC PipeLines, LP (NYSE:) has an Earnings ESP of +13.29% and a Zacks Rank of 1. It is expected to report third-quarter 2018 earnings on Nov 9. The company carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penn Virginia Corporation (NASDAQ:) is scheduled to announce third-quarter results on Nov 14. It has an Earnings ESP of +6.38% and a Zacks Rank #2.

Woodlands, TX-based Summit Midstream Partners, LP (NYSE:) has a Zacks Rank #1 and an Earnings ESP of +64.00%. The company is scheduled to report third-quarter earnings on Nov 8.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

TC PipeLines, LP (TCP): Free Stock Analysis ReportSummit Midstream Partners, LP (SMLP): Free Stock Analysis ReportSunrun Inc. (RUN): Free Stock Analysis ReportPenn Virginia Corporation (PVAC): Free Stock Analysis ReportOriginal postZacks Investment Research