You write a covered call on a stock trading at $165.00 and sell the $170.00 call option. A few days later, your stock is trading at $28.00 and the strike you sold no longer appears on option chains. What do we do? Panic? Curl up into the fetal position and feel sorry for ourselves? Research the matter and respond in a non-emotional manner? So much for the rhetorical questions.

In August 2017, TAL Education Group (NYSE:TAL) was a stock listed on our Premium Member Stock Report at a price of $165.60. On August 16th the listed price was $28.00. The strike prices for options associated with this security were also much lower than they had been prior to the 16th. The first explanatory event that should come to mind is a stock split.

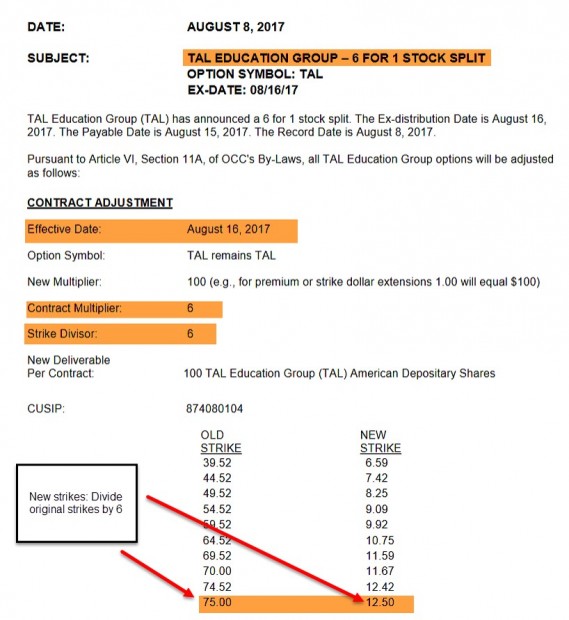

TAL Education Group- 6-for-1 stock split

TAL: 6-for-1 Stock Split Contract Adjustments

By speaking with our brokers, checking CBOE.com/contract adjustments or simply googling “TAL/stock split” we will access the information highlighted in the screenshot above:

- TAL underwent a 6-for-1 stock split on 8/16/2017

- For every 1 share owned, the holder now owns 6 shares

- Share price is reduced to 1/6 its previous value resulting in no change in total value

- Strike prices are also divided by 6 so the $75.00 strike becomes a $12.50 strike

- Had we sold 1 $170.00 call option, that will change to 6 contracts of the $28.33 strike

The key takeaway is that there is no change in value of our total position, either positive or negative. Stock splits are maneuvers by Boards of Directors to lower share price and allow retail investors the opportunities to purchase shares in 100 share increments. Another example is when Apple (NASDAQ:AAPL) Computer was trading over $700.00 per share and then split 7-for-1 (where are you Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN)?).

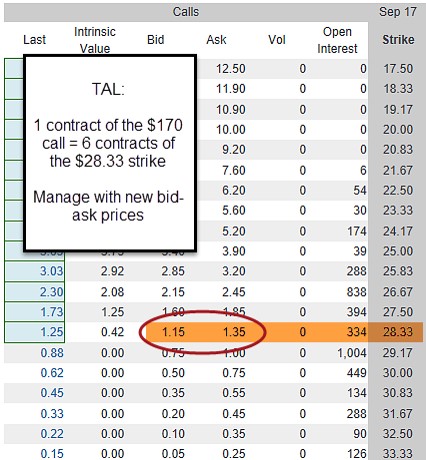

TAL updated option chain

TAL Post-Split Option Chain

Had we sold the $170.00 pre-split call, the new option chain will show the $28.33 ($170.00/6) strike with a bid-ask spread of $1.15 – $1.35. These are now the prices we refer to when managing our new positions (we now are responsible for six times the number of short contracts).

Discussion

All trading and investment strategies must be managed non-emotionally. When share price drops dramatically and strike prices disappear from option chains, the first event that should come to mind is a stock split that will result in contract adjustments. These corporate events will not add to or detract from our portfolio value but rather must be managed from a new perspective. Panic and fear should have no place in our position management arsenal.

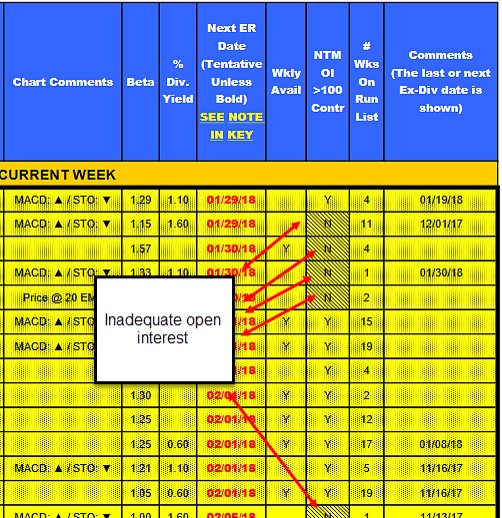

Why show stocks with inadequate open interest in our premium reports?

This is a question that has come up quite a bit lately. The reasons are:

- Open interest can change after the report was produced

- We have many members that use these reports for buying and selling stocks without the option component and so open interest is not a factor

Below is a screenshot of where open interest is located in our member reports (Y means more then 100 contracts and N means less than 100 contracts for near-the-money strikes):

Open Interest and the BCI Premium Stock Reports

For the week, the S&P 500 rose by 0.55% for a year-to-date return of 2.76%%

Summary

IBD: Market in confirmed uptrend

GMI: 3/6- Buy signal since market close of February 20, 2018

BCI: Market volatility (VIX) has dipped under 20, a positive. If this trend continues, I plan to take more aggressive stances on my positions. Currently, I hold an equal number of in-the-money and out-of-the-money strikes and remain fully invested.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral outlook. In the past six months, the S&P 500 was up 14% while the VIX (16.49) moved up by 39%.

Wishing you much success,