Last week’s review of the macro market indicators saw heading into August options expiration the equity markets took a blow to the head but shook it off and recovered by the end of the week. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) might pause in its pullback. The US Dollar Index ($DXY) continued the slow grind higher in a wide channel while US Treasuries (TLT) might also pause in their uptrend.

The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) had resumed their path lower. Volatility ($VXXB) had picked up slightly making the path higher a bit tougher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts showed good recoveries from a shock in the short run, with continued strength in the SPY and QQQ in the long term chart, while the IWM consolidated in a range.

The week played out with Gold pushing higher but then falling back and Crude Oil ran a similar path, giving up mid-week gains. The US Dollar marched higher in its broad range while Treasuries continued higher to a Thursday peak before retrenching. The Shanghai Composite drifted up to resistance and stopped while Emerging Markets held and consolidated at the recent lows.

Volatility held at the higher levels, keeping the bias lower for equities. The Equity Index ETF’s ran a volatile week, rising sharply Tuesday only to give it all back and more Wednesday, both triggered by news. They drifted higher at the end of the week to finish slightly lower on the week. The IWM fared the worst with the SPY next and the QQQ down only a fraction. What does this mean for the coming week? Let’s look at some charts.

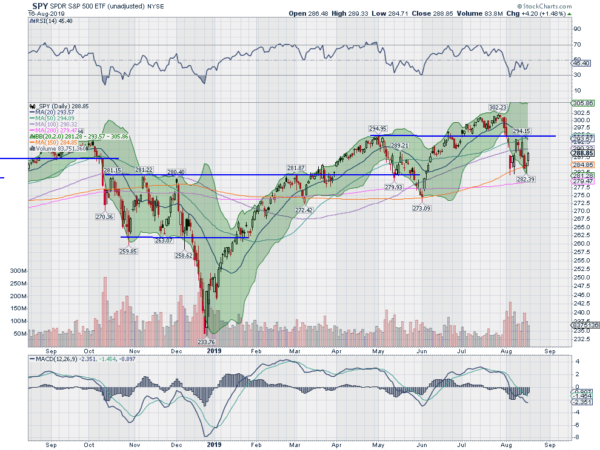

SPY Daily, $SPY

The SPY had bounced up, closing the gap down, at the end of last week, so it had some strength entering the new week. It survived a gap down Monday, recovering Tuesday, but then dropped and ran lower Wednesday. The bearish kicker candle did not play out though as it held Thursday with a Hammer and then confirmed a reversal with a move higher Friday.

The daily chart shows the possible “W” bottom forming that has been present in many pullbacks. The RSI is coiling under the mid line with the MACD leveling and slightly negative. Follow through higher next week will likely bring in buys over the 50 day SMA and April high.

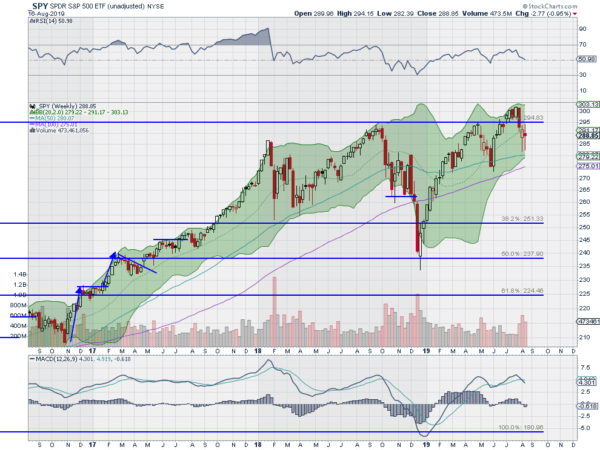

The weekly chart shows a conflicting candle though, with a red doji not confirming last week’s Hammer. The RSI on this timeframe is pulling into the mid line with the MACD crossed down and positive. There is resistance at 290 and 292 then 294 and 295 before 296.75. Support lower comes at 287 and 285 then 284 and 282 before 280. Consolidation in Pullback.

SPY Weekly, $SPY

As August options expiration comes to a close the equity index ETF’s had a wild week finishing slightly lower in consolidation. Elsewhere look for Gold to continue in its uptrend while Crude Oil consolidates in its downtrend. The US Dollar Index seems content to continue the slow drift higher while US Treasuries are possibly starting to pullback. The Shanghai Composite and Emerging Markets look to continue to the downside.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. They are all showing consolidation in the short run charts with it happening at higher lows for the SPY and QQQ. The IWM remains in a broad consolidation. On the longer charts the back to back indecision candles may have some losing sleep this weekend. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.