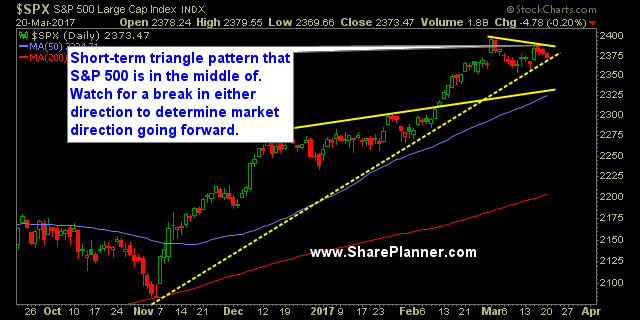

Short-term triangle pattern on SPX

SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past five trading sessions, and could easily bounce here and breakout of the triangle to the upside.

Watch for a move in one direction or the other and plan your trades accordingly. These light volume pullbacks that are extremely shallow. Check this out. The S&P has finished down four out of the last five days. On 3/13 SPX finished the day at 2373.47. Yesterday it closed at 2373.47! Crazy, right? Basically, despite the market pulling back 80% of the time during that time frame, it is still at the same place it started. That isn't a pullback!

Hang tight out there. Don't get ahead of yourself, and always put the risk first in all of your trades.

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 6 long positions

Recent Stock Trade Notables:

- Broadcom (NASDAQ:AVGO): Long at 218.63, Closed at 222.71 for a 1.9% profit.

- American Airlines Group (NASDAQ:AAL): Short at 44.76, Closed at 44.03 for a 1.6% profit.

- ProShares UltraPro S&P500 (NYSE:UPRO) (Day-Tade): Long at 95.35, closed at 96.50 for a 1.2% profit.

- Bank of the Ozarks (NASDAQ:OZRK): Long at $56.12, closed at $54.69 for a 2.5% loss.

- Finisar Corporation (NASDAQ:FNSR): Long at $34.25, closed at 34.70 for a 1.3% profit.

- UPRO (Day-Tade): Long at 96.92, closed at 98.03 for a 1.2% profit.

- JP Morgan Chase (NYSE:JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

- Chevron (NYSE:CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

- Flex Ltd (NASDAQ:FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Baidu Inc (NASDAQ:BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollies Bargain Outlet Holdings Inc (NASDAQ:OLLI): Long at 33.20, closed at $32.50 for a 2.1% loss.

- Corning Incorporated (NYSE:GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (NYSE:ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott International Inc (NASDAQ:MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.