Currently, the S&P 500, the main index of the U.S. economy, is in correction around the 5337.0 level. With the end of the corporate earnings season, the index's performance now heavily depends on the bond market and macroeconomic statistics.

Yesterday, data released in the U.S. showed a drop in sales of existing homes from 4.22 million in the previous month to 4.14 million in April, below the expectation of 4.21 million. Quotes were supported by the reduction of the 30-year mortgage rate, according to the Mortgage Bankers Association (MBA), from 7.08% to 7.01%, along with the increase in the mortgage market index from 198.1 points to 201.9 points.

The bond market has stabilized a bit. For the second consecutive week, major debt securities did not show an upward trend. Yesterday, the 30-year bond yield fell to 4.635% from 4.818% in the last issuance. The 10-year bond yield was 4.433%, instead of 4.502%, and the 20-year bonds traded at 4.641%, down from 4.690% on Monday.

Among the growth highlights in the index are First Solar Inc (NASDAQ:FSLR). (+18.69%), Moderna (NASDAQ:MRNA) Inc. (+13.67%), Analog Devices Inc (NASDAQ:ADI). (+10.86%), and Enphase Energy (NASDAQ:ENPH) Inc. (+8.73%). On the other hand, the negative highlights were Target Corp. (NYSE:TGT) (-8.03%), Lululemon Athletica (NASDAQ:LULU) Inc. (-7.23%), and Freeport-McMoran Copper & Gold Inc (NYSE:FCX). (-5.69%).

Support and Resistance Levels

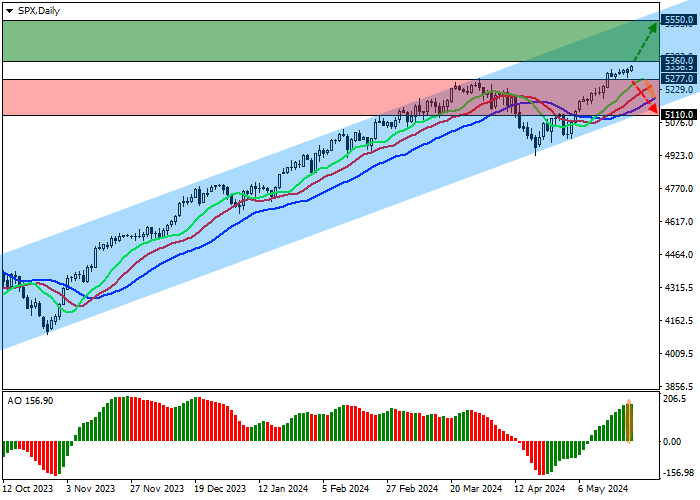

On the daily chart, the index quotes are moving towards the resistance line of the 5550.0–5110.0 channel. Technical indicators continue to strengthen the buy signal: the fast EMAs on the "Alligator" indicator are moving away from the signal line, and the AO histogram, which is in the buy area, is forming ascending bars.

Supports: 5277.0, 5110.0

Resistances: 5360.0, 5550.0

Trading Scenarios

If the asset's growth continues and the price consolidates above the resistance level of 5360.0, buy positions will be favorable, with a target of 5550.0. I recommend setting the Stop Loss at 5300.0. The realization period is 7 days or more.

On the other hand, if the asset reverses and declines, and the price consolidates below the support level of 5277.0, sell positions will be recommended, with a target of 5110.0. In this case, the Stop Loss should be set at 5330.0.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500 Heading Towards Resistance in the 5550.0 - 5110.0 Channel

Published 05/23/2024, 06:03 AM

S&P 500 Heading Towards Resistance in the 5550.0 - 5110.0 Channel

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.