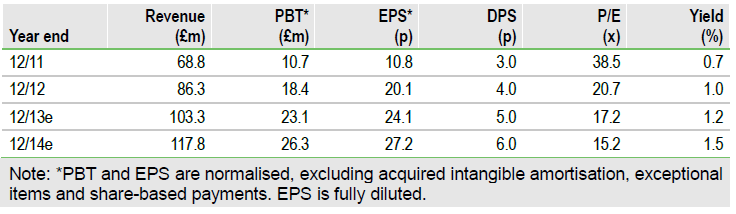

Rapid adoption of inkjet by the Chinese ceramics production industry propelled acceleration in growth in Q4 and looks set to drive growth through our forecast period, supported by inkjet adoption in laminate and label printing. The development of a new P3 print head for graphic arts and collaborations in fields such as ‘direct-to-shape’ seed the medium-term growth picture, while long-term prospects benefit from increased investment in P4. 2013 EPS is upgraded by 26% and despite a re-rating upwards, we still consider the current valuation to be undemanding.

Ceramics momentum set to continue

The rapid digitalisation of the Chinese ceramics production industry (c 46% of global production) drove acceleration in growth in Q4, which has continued into Q1. Digital penetration of Chinese production is estimated at 10% and other major producers such as Brazil and India are earlier on the adoption curve. With payback periods for digitalisation typically less than 12 months, we feel the growth opportunity in ceramics should last two to three years at least.

Other applications set to add to the mix

While individually smaller opportunities than ceramics, a number of other applications look set to contribute to growth, starting with laminates and labelling in 2013. The Xaar (XAR.L) 501 print head could drive a recovery in graphic arts in 2014 and ‘direct-to-shape’ (eg to a bottle or container) printing is seen as a substantial opportunity if technical hurdles can be overcome. Longer-term developments such as the P4 architecture (with which Xaar hopes to achieve a generational shift in resolution and speed) and collaborations in advanced lithography seed potentially significant longer-term growth opportunities.

Valuation: Still undemanding given its qualities

FY12 sales of £86.3m were up 26% y-o-y and 3% ahead of our forecast. Operational gearing drove 74% growth in PBT adjusted to £18.4m (12% ahead) and 76% growth in EPS adjusted to 20.1p (23% ahead), helped by a lower tax charge. We have upgraded our 2013 sales, EPS adjusted and year-end net cash estimates by 12%, 21% and 3% respectively, despite increasing opex and capex forecasts, to support the medium and longer-term growth opportunity. The dividend has also been raised to 4p and our 2013 estimate raised from 3p to 5p. The fall in P/E of 17.2x 2013 earnings to 15.2x in 2014 still looks undemanding given the company’s upgrade trajectory, long-term growth potential, market position and IP.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Quickview: Xaar (Ink) Jet Propelled

Published 03/26/2013, 07:13 AM

Updated 07/09/2023, 06:31 AM

Quickview: Xaar (Ink) Jet Propelled

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.