Pioneer Natural Resources Company (NYSE:PXD) is expected to report third-quarter 2018 results on Nov 6, after the closing bell.

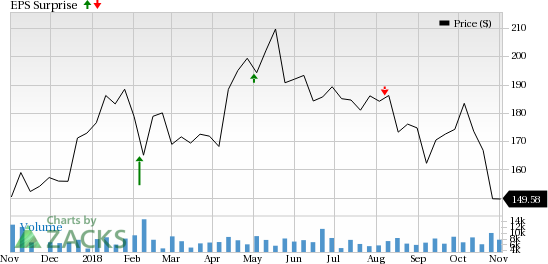

Pioneer Natural beat the Zacks Consensus Estimate in three of the trailing four quarters, with average positive earnings surprise of 30.5%.

Let’s see how things are shaping up for this announcement.

Which Way are Estimates Treading?

Let’s take a look at the estimate revision trend to get a clear picture of analysts’ opinion on the stock prior to the earnings release.

The Zacks Consensus Estimate of $1.69 for third-quarter earnings has been revised downward over the past 30 days, with four firms being bullish and 12 firms adopting a bearish stance. The figure reflects a year-over-year improvement of more than 250%.

Further, the Zacks Consensus Estimate for revenues is pegged at $2.28 billion, depicting an increase of 56% from the year-ago level.

What is Driving the Bottom Line?

Based in Irving, TX, Pioneer Natural is an independent oil and gas exploration, as well as production company.

The Zacks Consensus Estimate for total production is pegged at 318 thousand barrels of oil equivalent per day (MBoe/d), sequentially down from 328 MBoe/d but up from the year-ago quarter’s 276 MBoe/d. The Zacks Consensus Estimate for average oil equivalent sales price is pegged at $46.68 per barrel, reflecting an increase from $43.12 in second-quarter 2018 and $33.72 in the year-ago period.

The company’s volume mix is biased toward crude oil. In the last reported quarter, 56.6% of its total production comprised crude oil. The Zacks Consensus Estimate for third-quarter oil production is 192 thousand barrels per day (MBbl/d), up 3.2% sequentially and 18.8% year over year. The Zacks Consensus Estimate for average crude oil sales price is pegged at $63 per barrel, reflecting an increase from $61 per barrel in second-quarter 2018 and $45.35 recorded a year ago.

The Zacks Consensus Estimate for third-quarter natural gas liquids production is 63 MBbl/d, up from the year ago period’s 57.3 MBbl/d but down from 64.5 MBbl/d in second-quarter 2018. The Zacks Consensus Estimate for third-quarter average sales price of natural gas liquids is pegged at $30.04 per barrel, reflecting an increase from $28.83 in the last reported quarter and $18.96 in the year-ago quarter.

The Zacks Consensus Estimate for third-quarter natural gas production is 379 million cubic feet per day (MMcf/d), up from the year-ago period’s 340.4 MMcf/d but down from 466 MMcf/d in second-quarter 2018. The Zacks Consensus Estimate for average sales price of natural gas liquids for the third quarter is pegged at $2.12 per thousand cubic feet, depicting an increase from $1.97 in the last reported quarter but a decrease from $2.58 in the year-ago quarter.

Higher total production along with a rise in crude oil and natural gas liquids prices are expected to positively impact the company’s third-quarter results. However, lower prices of natural gas can hurt its revenues.

Earnings Whisper

Our proven model does not conclusively show that Pioneer Natural is likely to beat estimates in the to-be-reported quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Earnings ESP: Earnings ESP of the company is -0.50%. This is because the Most Accurate Estimate of $1.68 is pegged below the Zacks Consensus Estimate of $1.69. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Pioneer Natural currently carries a Zacks Rank #2, which when combined with -0.50% Earnings ESP, makes surprise prediction difficult.

Please note that we caution investors against stocks with a Zacks Rank #4 or 5 (Sell Rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies from the energy sector, which, according to our model, have the right combination of elements to post an earnings beat in the to-be-reported quarter:

Calgary, Canada-based Enbridge Inc. (NYSE:ENB) carries a Zacks Rank #1 and has an Earnings ESP of +5.26%. The company is anticipated to report quarterly results on Nov 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Woodlands, TX-based Summit Midstream Partners, LP (NYSE:SMLP) holds a Zacks Rank #1 and has an Earnings ESP of +64.00%. The company is scheduled to report third-quarter earnings on Nov 8.

Houston, TX-based Penn Virginia Corporation (NASDAQ:PVAC) has a Zacks Rank #2 and an Earnings ESP of +6.38%. The company will report third-quarter earnings on Nov 14.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Summit Midstream Partners, LP (SMLP): Free Stock Analysis Report

Enbridge Inc (ENB): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Penn Virginia Corporation (PVAC): Free Stock Analysis Report

Original post

Zacks Investment Research