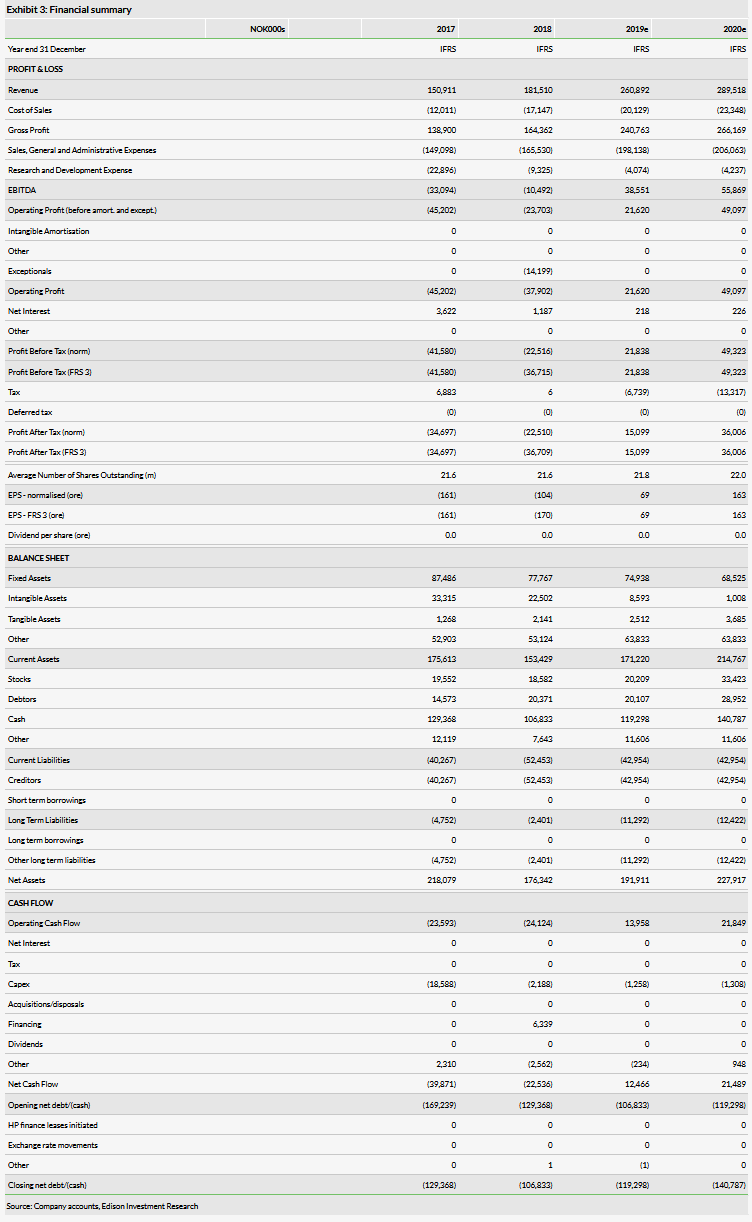

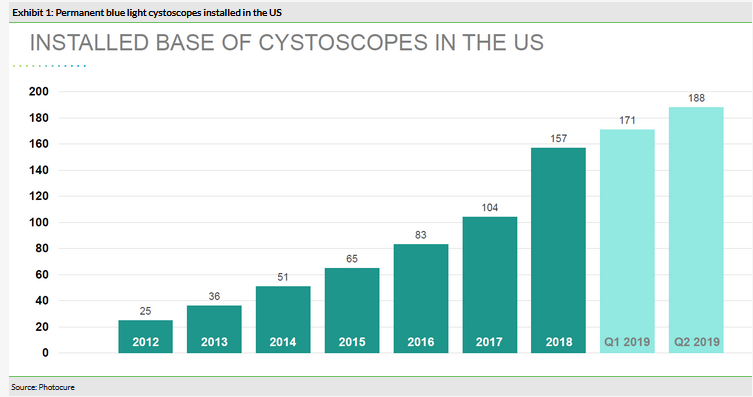

Photocure (LON:0IMT) announced results for Q219, with 23% revenue growth for the Hexvix/Cysview franchise (vs Q218) to NOK52.1m. Sequentially, however, Hexvix/Cysview sales only grew 2% due to lower Nordic and partner region revenues, which offset strong US sales. In the US, sales increased 52% over the same quarter in the previous year and 16% sequentially. This was driven mainly by improved reimbursement and a higher installed base of blue light cystoscopes. There are now 188 installed cystoscopes in the US, indicating 10% growth in the installed base over the quarter.

Solid US growth

Q219 sales in the US increased 52% to NOK24.5m. This was helped by volume growth, a strong US dollar and increased prices. In US dollar terms, sales were up 41% compared to last year and unit sales increased 34% during the quarter. The total installed base of blue light cystoscopes (both rigid and flexible) increased to 188, up 20% from the 157 installed at the beginning of 2019.

Improved reimbursement aiding US growth

One of the reasons for the strong US growth has been improved reimbursement, which came in the form of a new reimbursement code from the US Centers for Medicare and Medicaid Services (CMS) that covers blue light cystoscopy with Hexvix/Cysview when used in physician offices and other sites. CMS also continued a specific complexity adjustment for certain procedures in hospital outpatient departments. As 73.4% of bladder cancer patients are over 65 (according to the National Cancer Institute), they are hence covered by Medicare.

Nordic sales down slightly, partner sales up

Nordic revenues were NOK10.7m, down 1% in Q219 compared to Q218 and down 18% sequentially though year-to-date revenues are still up 4%. Partner revenue increased 8% in the second quarter (down less than 1% sequentially), while in-market unit sales were up 4% due to increases in Germany and France. Year-to-date partner revenue is up 8%.

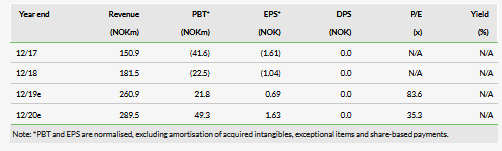

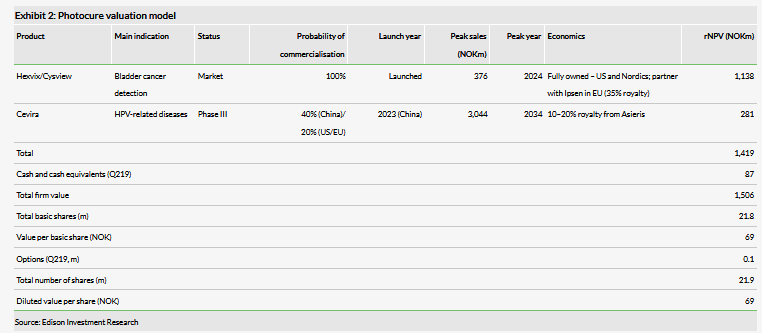

Valuation: NOK1,506m or NOK69 per share

We have slightly lowered our valuation from NOK1,529m or NOK70 per basic share to NOK1,506m or NOK69 per basic share. The decrease was mainly due to slightly lower revenue estimates and a lower level of cash and was partially offset by rolling forward our NPVs. With NOK87m in cash, Photocure should have enough capital to meet its needs, as we continue to expect profitability in 2019.

Second quarter results

Photocure reported total revenue of NOK53.0m for Q219, representing 16% growth over Q218. Hexvix/Cysview sales were up 23%, growing to NOK52.1m. Sales in the US continued to be strong, up 52% compared to Q218 (up 41% in US dollar terms), and up 16% sequentially. End-user unit sales were also strong, growing 34% for the quarter compared to last year, driven in part by an increase in the number of permanent blue light cystoscopes installed (currently 188, up from 171 at the end of last quarter and 157 at the beginning of the year; see Exhibit 1). This growth in the installed base is a good indicator of growth in upcoming periods. As indicated by Photocure CEO Daniel Schneider in our Edison Talks podcast interview, usually a small group of champions at a practice helps get the cystoscope installed and then the base of users grows in any given centre over time.

Revenues in the Nordic region decreased 1% to NOK10.7m and were down 18% sequentially. Year-to-date Nordic sales are still up 4%. Results in partnered areas increased 8% to NOK16.9m in the quarter compared to the same period last year and are up 8% in H119, driven mainly by France and Germany.

SG&A for Q2 was up 32% to NOK49.9m compared with last year, and up 5% sequentially. As a reminder, the company is increasing the number of customer-facing roles by 50% in the US over the course of this year, which will allow it to cover 75% of the metropolitan areas in the US and more than 700 accounts. R&D expenses remained under control at NOK1.1m, down 58% compared to Q218, as the regulatory work surrounding FDA approval for the surveillance market has now been completed. EBITDA for the company was a loss of NOK2.6m, slightly worse than the positive NOK0.7m seen in Q218.

Valuation

We have slightly lowered our valuation from NOK1,529m or NOK70 per basic share to NOK1,506m or NOK69 per basic share. The decrease was mainly due to slightly lower revenue estimates and a lower level of cash and was partially offset by rolling forward our NPVs.

Financials

We have decreased our revenue estimate for 2019 to NOK260.9m, from NOK285.0m, and lowered 2020 by NOK5.2m to NOK289.5m. The estimates were lowered in part due to weakness outside the US (especially Nordic areas) and due to factoring in a typically seasonally soft Q3 for the US. Note that our 2019 estimates include NOK43m ($5m) in licensing revenues from Asieris for Cevira and without that, our full year revenue estimates would be NOK218.0m. We have also increased our SG&A estimates by NOK6.8m for 2019 and NOK7.1m for 2020 due to the higher run rate of spending and our expectation that the company will continue to increase its investment in the US market. The company ended Q219 with NOK87m in cash, and we do not expect it to require further financing. We currently forecast profitability in 2019, though that is dependent upon the licensing revenue from Asieris; without that we would expect profitability in 2020.