PG&E Corporation (NYSE:PCG) is expected to report third-quarter 2019 results soon.

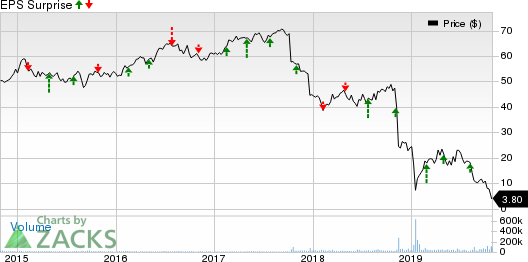

In the last reported quarter, the company delivered a positive earnings surprise of 13.40%. The bottom line also surpassed the Zacks Consensus Estimate in the trailing four quarters, the average positive surprise being 14.72%.

Let’s see, how things are shaping up prior to this announcement.

Factors at Play

During most of the third quarter, PG&E witnessed above-average and above-normal temperatures in its service territory. Moreover, the company witnessed significant wet weather conditions led by above-normal precipitation in California. Cumulatively, this indicates increased use of electricity by its consumers for cooling purposes.

These are likely to have boosted the company's top line in the soon-to-be-reported quarter. In line with this, the Zacks Consensus Estimate for the top line is pegged at $4.39 billion, suggesting growth of approximately 0.3% from the year-ago quarter’s reported figure.

Over the last few quarters, PG&E has been witnessing increasing wildfire-related costs, financing expenses and associated fines, which might have negatively impacted its bottom line. This might have led the company to incur significant expenses, which are likely to reflect on its bottom-line performance in the to-be-reported quarter.

In line with this, the Zacks Consensus Estimate for earnings of 99 cents in the third quarter indicates a 12.4% decline from the year-ago quarter’s reported figure.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for PG&E in the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

PG&E has an Earnings ESP of +3.03% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pacific Gas & Electric Co. Price and EPS Surprise

Other Stocks That Warrant a Look

Here are a few other players from the Utilities sector that have the right combination of elements to post an earnings beat this quarter.

PPL Corporation (NYSE:PPL) is scheduled to release third-quarter 2019 results on Nov 5. It has an Earnings ESP of +1.37% and a Zacks Rank of 3.

Exelon Corporation (NASDAQ:EXC) has an Earnings ESP of +0.06% and a Zacks Rank #3. The company is scheduled to release third-quarter 2019 results on Oct 31.

Eversource Energy (NYSE:ES) is scheduled to release third-quarter 2019 results on Nov 6. It has an Earnings ESP of +1.06% and a Zacks Rank of 2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

PPL Corporation (PPL): Free Stock Analysis Report

Exelon Corporation (EXC): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Original post

Zacks Investment Research