PayPal Holdings, Inc. (NASDAQ:) delivered non-GAAP earnings of 86 cents per share in the second quarter of 2019, which surpassed the Zacks Consensus Estimate by 11 cents and surged 48.3% on a year-over-year basis.

The company’s strategic investment in MercadoLibre (NASDAQ:) , Uber Technologies (NYSE:) and others acted as a key catalyst throughout the quarter. Notably, these investments contributed 14 cents to the reported EPS figure.

Net revenues of $4.305 billion increased 12% from the year-ago quarter. However, the figure missed the Zacks Consensus Estimate of $4.333 billion.

Strong performance of Venmo and One Touch drove year-over-year revenue growth. Further, rapidly increasing net new active accounts and strengthening customer engagement on the company’s platform that provided a significant boost to the total active accounts also contributed to the results.

However, sale of the U.S. consumer credit receivables portfolio to Synchrony continued to affect the top line. In fact, excluding the impact, revenues would have improved 19%.

Following lower-than-expected revenues in the reported quarter and weak revenue outlook for 2019, shares of the company plunged 4.12% in the after-hours trade.

Nevertheless, the company’s continuous efforts toward strengthening services portfolio remain a key catalyst. Further, its two-sided platform enables it to develop and maintain direct financial relationship with both customers and merchants.

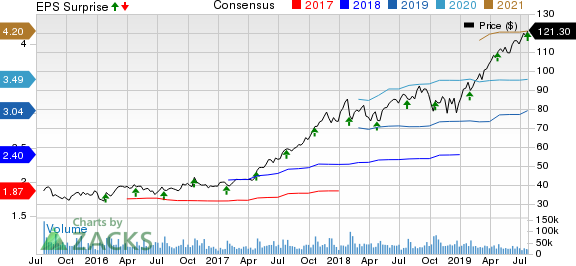

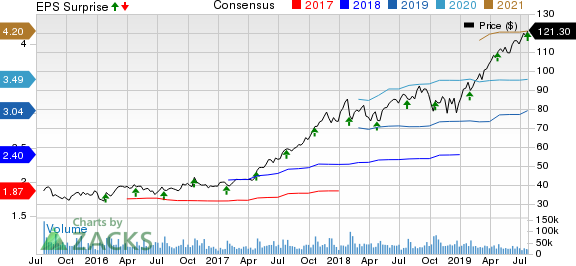

Coming to the price performance, PayPal has gained 44.3% on a year-to-date basis, outperforming the industry’s rally of 37.9%.

.jpg)

Top Line in Detail

By Type: Transaction revenues came in at $3.878 billion (90% of net revenues), up 17% from the year-ago quarter. Other value added services generated $427 million of revenues (accounting for 10% of net revenues), decreasing 20.8% year over year. The decline can be attributed to the sale of PayPal’s credit receivables portfolio to Synchrony.

By Geography: Revenues from the United States came in at $2.297 billion (53% of net revenues), up 7% on a year-over-year basis. International revenues were $2.008 billion (47% of revenues), increasing 18% from the prior-year quarter.

Quarter in Detail

PayPal’s strategic partnerships and portfolio strength continued to strengthen customer and merchant base throughout the reported quarter, which in turn aided its total payment volume (TPV).

During the second quarter, the company invested $500 million in Uber and extended partnership with the latter by announcing plans to explore future commercial payment collaborations.

Further, the company launched a new solution, PayPal Commerce Platform, which is expected to aid it in gaining momentum across e-commerce companies, marketplaces and crowdfunding platform by allowing merchants to accept payments and shoppers to checkout via their PayPal accounts globally.

Furthermore, the company rolled out PayPal business loan product to merchants in Canada.

Additionally, the company continued to deliver enhanced experience to Venmo users. In the reported quarter, it introduced Bitmojis to the Venmo app in order to offer personalized experience to users. Moreover, PayPal witnessed the addition of Fandango, Stitch Fix, 1-800-Flowers, TodayTix and TicketNetwork in the Venmo merchant partners list.

PayPal Holdings, Inc. Price, Consensus and EPS Surprise

PayPal Holdings, Inc. price-consensus-eps-surprise-chart | PayPal Holdings, Inc. Quote

Key Metrics to ConsiderSupported by these endeavors, the company witnessed year-over-year growth of 17% in total active accounts with the addition of 9 million net new active accounts during the reported quarter. The total number of active accounts was 286 million in the quarter, beating the Zacks Consensus Estimate of 282 million.

Additionally, the total number of payment transactions came in at 2.973 billion, up 28% on a year-over-year basis. The figure topped the Zacks Consensus Estimate of 2.967 billion.

Further, the company’s payment transactions per active user were 39 million, which increased 9.2% from the year-ago quarter reflecting strong customer engagement on PayPal’s platform. However, the figure lagged the Zacks Consensus Estimate of 39.45 million.

TPV came in at $172.36 billion in the reported quarter, exhibiting year-over-year growth of 24% and 26% on spot rate and currency neutral basis, respectively. Further, the figure outpaced the Zacks Consensus Estimate of $171.53 billion. Growth in TPV was driven by robust Venmo, which accounted for $24 billion of TPV, soaring 70% on a year-over-year basis driven by its strong monetization efforts. Further, growing momentum of core peer to peer (P2P) contributed $46 billion, up 40% from the prior-year quarter. Moreover, merchant services volume was up 30% year over year.

However, eBay (NASDAQ:) volume, which was down 4%, remains a concern. Further, it accounted for 9% of TPV, contracting 300 bps from the year-ago quarter.

Further, mobile TPV were above $73 billion in the reported quarter, primarily driven by robust mobile checkout services of One Touch, which had 13 million merchants and 149 million customers at the end of the second quarter.

Operating DetailsPayPal’s operating expenses were $3.6 billion in the second quarter, climbing 9.6% from the prior-year quarter.

Non-GAAP operating income rose 21.7% year over year to $998 million. Further, non-GAAP operating margin came in at 23.2%, expanding 200 bps on a year-over-year basis.

Balance Sheet & Cash FlowAs of Mar 31, 2019, cash equivalents and investments came in at $8.4 billion, up from $7.8 billion on Mar 31, 2019.

PayPal generated $1.17 billion of cash from operations, up from $1.03 billion in the previous quarter.

Free cash flow came in at $1.03 billion during the reported quarter.

GuidanceFor third-quarter 2019, PayPal expects revenues between $4.33 billion and $4.38 billion, improving in the range of 18-19% at both current spot rate and FX-neutral basis. The Zacks Consensus Estimate for the top line is pegged at $4.33 billion.

Non-GAAP earnings are anticipated in the range of 69-71 cents per share. The company’s investment portfolio is likely to contribute 3 cents to the EPS in the third quarter. The Zacks Consensus Estimate for the bottom line stands at 75 cents.

For 2019, PayPal revised revenues outlook from $17.85-$18.1 billion to $17.60-$17.80 billion. Further, the growth rate declined from 16-17% to 14-15% at both current spot rates and on FX-neutral basis. Sale of U.S. consumer credit receivables portfolio to Synchrony remains a headwind. The Zacks Consensus Estimate for revenues is projected at $18 billion.

Further, the company revised non-GAAP earnings outlook upward from $2.94-$3.01 per share to $3.12-$3.17 per share. This includes benefit of 26 cents from PayPal’s strategic investments in the first and second quarter. Moreover, it includes a gain of 3 cents from its investment portfolio in third quarter. The Zacks Consensus Estimate for earnings is currently pegged at $3.04 per share.

Zacks Rank & Another Stock to ConsiderCurrently, PayPal carries a Zacks Rank #2 (Buy).

Another top-ranked stock in the broader technology sector is Alteryx, Inc. (NYSE:) which sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.Long-term earnings growth rate for Alteryx is currently pegged at 13.66%.

This Could Be the Fastest Way to Grow Wealth in 2019Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>.jpg)