Novartis AG (NYSE:NVS) announced encouraging results from the JULIET trial on Kymriah after 14 months, wherein it was observed that ongoing durable responses are achievable with Kymriah when administered to adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL).

These data were also presented at the 23rd Annual Congress of the European Hematology Association.

The results from the trial showed overall response rate (ORR) of 52% among 93 evaluable patients, who were followed for at least three months or discontinued earlier. In addition, a complete response (CR) was achieved in 40% of patients and 12% achieved a partial response (PR). Of the total patients who had experienced CR at three months, 83% remained on the same at month 12. Moreover, the relapse-free probability at 12 months, after a patient's first response, was 65%, which was encouraging.

The results further emphasize Kymriah’s efficacy with durable responses, and a predictable and consistent safety profile for more than a year, after infused in patients with advanced DLBCL.

With eight months of additional follow up, response rates remained consistent with previous reports with no emergence of new safety signals.

Kymriah, formerly CTL019, is the first chimeric antigen receptor T cell (CAR-T) therapy, approved by the FDA for the treatment of patients up to 25 years of age with B-cell precursor acute lymphoblastic leukemia (ALL) that is refractory or in second or later relapse. The FDA also approved Kymriah for the treatment of adult patients with r/r large B-cell lymphoma, after two or more lines of systemic therapy including DLBCL, high grade B-cell lymphoma and DLBCL arising from follicular lymphoma, based on data from the JULIET study in May 2018.

Meanwhile, Novartis’ Marketing Authorization Application (MAA) for Kymriah, for the treatment of children and young adults with r/r B-cell acute lymphoblastic leukemia (ALL) and for adult patients with r/r DLBCL, is currently under review in Europe.

Novartis has a strong oncology portfolio of drugs like Afinitor, Exjade, Jakavi, Zykadia, Tasigna, Jadenu and Kisqali, which continue to boost its sales. The approval of Kymriah for acute lymphoblastic leukemia is a major boost, given the potential in the CAR-T therapy space.

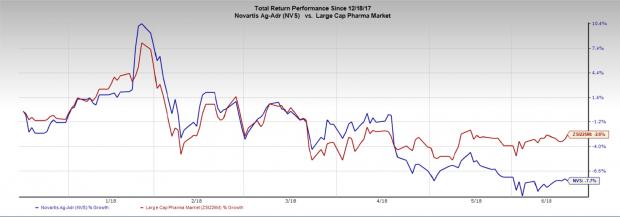

Novartis’ shares have declined 7.7% in the last six months compared with the industry’s decline of 2.6%.

Earlier in 2018, Novartis announced a licensing agreement with Spark Therapeutics (NASDAQ:ONCE) , covering development, registration and commercialization rights to voretigene neparvovec, outside the United States.

Competition is increasing in the gene therapy space. Gilead’s (NASDAQ:GILD) Yescarta was another CAR-T therapy, approved to treat adult patients with certain types of large B-cell lymphoma, who have not responded to or have relapsed after at least two other kinds of treatment.

uniQure (NASDAQ:QURE) is another gene therapy company, which is advancing a pipeline of proprietary and partnered gene therapies to treat patients with liver/metabolic, central nervous system and cardiovascular diseases.

The approval of new drugs bode well for Novartis as the company is facing the loss of patent protection for some of the key drugs.

Novartis also announced results from a new comparison study showing that Jakavi -treated patients with polycythemia vera (PV), who were resistant or intolerant to hydroxyurea (HU), had a significantly reduced risk of thrombosis (blood clots) and death compared to PV patients, who received best available therapy.

Zacks Rank

Novartis carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Novartis AG (NVS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Spark Therapeutics, Inc. (ONCE): Free Stock Analysis Report

uniQure N.V. (QURE): Free Stock Analysis Report

Original post

Zacks Investment Research