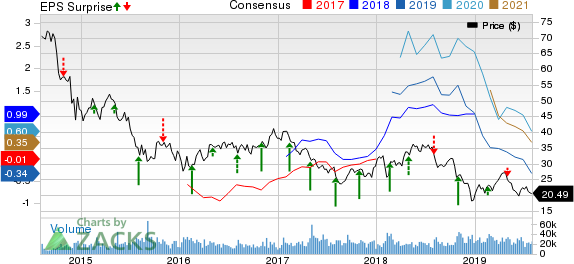

Noble Energy, Inc. (NYSE:NBL) incurred an adjusted loss of 10 cents per share in second-quarter 2019, narrower than the Zacks Consensus Estimate of a loss of 13 cents.

Total Revenues

Noble Energy's total revenues declined 11.1% year over year to $1,093 million in the second quarter. Nevertheless, the top line outpaced the Zacks Consensus Estimate of $1,049 million by 4.2%.

Operational Results

In the quarter under review, sales volume averaged 349 thousand barrels of oil equivalent per day (MBoe/d). U.S. onshore volumes averaged 263 MBoe/d. U.S. onshore assets contributed 75.3% to total sales volume in the second quarter.

The company generated operating income of $32 million compared with $343 million in the year-ago quarter.

Realized Prices

U.S. onshore realized crude oil and condensate prices in the reported quarter dropped 10% to $58.13 per barrel from the year-ago quarter’s level of $64.62.

U.S. onshore natural gas prices were $1.61 per thousand cubic feet, down 29.7% year over year.

U.S. onshore realized prices for natural gas liquids declined 40.4% to $14.54 per barrel.

Financial Highlights

Noble Energy's cash and cash equivalents as of Jun 30, 2019, were $470 million compared with $716 million on Dec 31, 2018.

Long-term debt was $6,866 million as of Jun 30 compared with $6,574 million on Dec 31, 2018.

Cash flow from operating activities in the quarter under review was $564 million, up from $496 million in the prior-year quarter.

Guidance

Considering its impressive run in the first half of the year, the company raised its 2019 sales volume guidance in the range of 353-363MBoe/d from 345-365 MBoe/d.

For the third quarter of 2019, Noble Energy expects U.S. onshore oil volumes in the range of 282-294 MBoe/d. The company anticipates total third-quarter volumes in the range of 370-385 MBoe/d.

Furthermore, the company intends to make organic capital expenditures worth $600-$675 million in the third quarter.

Zacks Rank

Currently, Noble Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oils-Energy Releases

Eni S.p.A. (NYSE:E) reported second-quarter 2019 adjusted earnings per share (EPS) of 36 cents, which lagged the Zacks Consensus Estimate of 65 cents by 44.6%.

BP plc (NYSE:BP) reported second-quarter 2019 EPS of 83 cents, which surpassed the Zacks Consensus Estimate of 78 cents by 6.4%.

Occidental Petroleum Corporation (NYSE:OXY) reported second-quarter 2019 earnings of 97 cents per share, which surpassed the Zacks Consensus Estimate of 91 cents by 6.6%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

BP p.l.c. (BP): Free Stock Analysis Report

Eni SpA (E): Free Stock Analysis Report

Noble Energy Inc. (NBL): Free Stock Analysis Report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

Original post

Zacks Investment Research