- The airline business has shifted towards the leisure traveler

- This trend towards leisure vs. business travel is secular not cyclical

- Southwest stands to benefit form the this shift the most

- Stock may have risk from an all Boeing Boeing fleet and rising cost of crude

- Long term prospects look very bullish

The airline business has shifted towards the leisure traveler

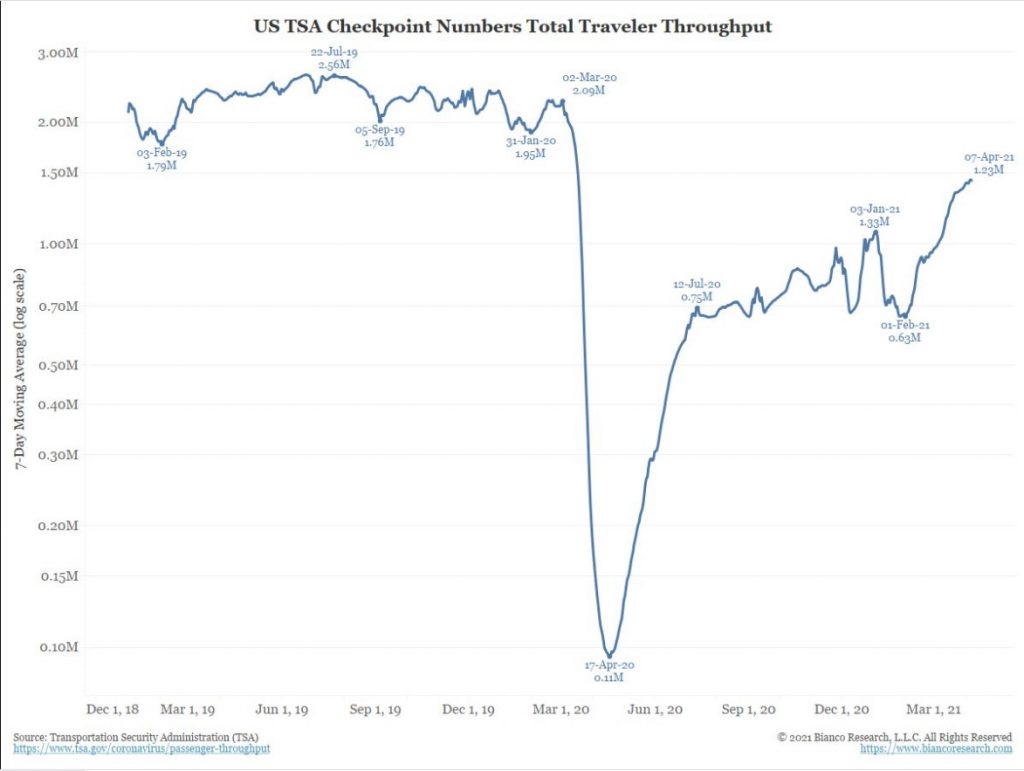

Are Americans ready to travel once again? Yes and no. As the following chart shows TSA figures show a strong recovery in passenger count but traffic remains below the pre-pandemic highs. That clearly suggests that there is a bifurcation in the market. Leisure travel has returned with a vengeance but business travel remains muted.

This trend towards leisure vs. business travel is secular not cyclical

The shift towards personal rather than business travel is likely to a secular rather than cyclical trend. The pandemic has had enormous impact on propagation of new communication technologies such as Zoom Technologies (OTC:ZTNO) that make the vast majority of business travel obsolete. This suggests that there will be major changes in the airline sector which has long relied on the business traveler for the vast majority of its profits. Although business travelers were a smaller percentage of the overall passenger traffic they were far more price insensitive allowing airlines to charge up to three to five times more for such amenities as last minute booking and business seats. Therefore it was not unusual for the airline to generate 60-70% of profits form just 20% of its passenger manifest.

Those days have ended with COVID which clearly demonstrated both the productivity and the savings of virtual communication and it is quite likely that many corporate travel budgets will be slashed or curbed significantly in the coming years.

Southwest stands to benefit form the this shift the most

That’s bad news for most carriers but not for Southwest Airlines (NYSE:LUV) which has always focused on the low cost travel passenger and had only a modest business segment in its customer base. As a value leader that constantly receives some of the highest customer satisfaction ratings in the airline business Southwest stands best positioned to benefit from this sea change in travel habits going forward.

The market has already recognized its potential with the stock tripling from its COVID lows as it trades near all time highs at $62/share. But if the market is indeed in the middle of secular change in travel habits than LUV is perfectly positioned to exploit it business model to expand and take away market share from many of its antiquated rivals

Stock may have risk from an all Boeing fleet and rising cost of crude

The company is well positioned to take advantage of the coming surge in summer travel as consumers are finally able to go on vacations after a year of lockdowns, but it faces two near term problems that could hobble its growth. One, Southwest is all Boeing (NYSE:BA) fleet and has had nightmare experience with quality control issues of Boeing planes. The latest mishap from the manufacturer which reported that it had electrical issues with its 737 Max model forced the carrier to pull 30 planes from its schedule. Although the Boeing production line has been mired in controversy for more than two years, the manufacturer looks like it is finally taking its safety problems seriously. Still LUV’s reliance on BA planes may be a serious weakness in its plan for growth if the quality problems persist.

Secondly, as a low cost carrier LUV is highly vulnerable to spike in input costs, especially aviation fuel. Oil prices have risen rapidly as global demand has recovered and supply remains curtailed, but as long as prices remain near the $60/bbl level Southwest should be able to maintain its margins. Should oil prices move towards $80/bbl, however, LUV stock is sure to see some downward.

Long term prospects look very bullish

Overall Southwest remains one of the premier brands in the airline sector and should see long term growth from the secular changes in travel brought on by the pandemic. The stock however is vulnerable to near term turbulence so shorter term traders may want to use LEAPs rather than stock to limit their risk but still maintain long exposure to the growth story unfolding in the airline business.