- Despite the now-typical verdict from European politicians that “the worst is now behind”, the eurozone continues to dish out bad news. The latest crisis came from Cyprus whose exit from the zone was staved off at the last minute by a “deal” reached with the troika which, not only ensures difficult years ahead for the small nation of the periphery, but also casts further doubts about the zone’s outlook.

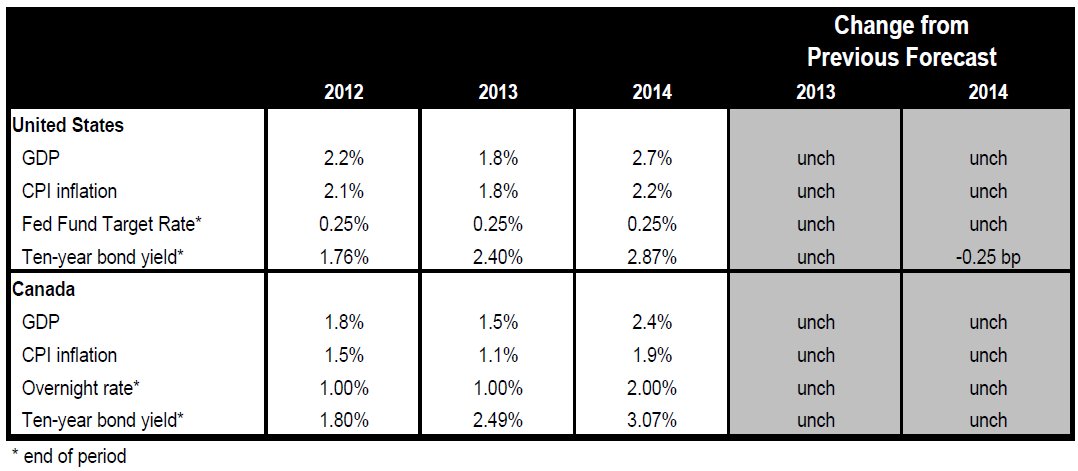

- After a weak end to 2012, the US economy rebounded sharply in the first quarter this year. We’re expecting Q1 growth of around 3% annualized, with likely contributions from consumption spending, business investment and restocking. The two-month delay to the automatic cuts to federal government spending certainly helped. But the negative impacts of the sequester will be felt in Q2, significantly restricting GDP growth in that quarter. The spending cuts of US$40 bn or so this year are much in line with what we had anticipated, and we therefore remain comfortable with our call for 2013 growth of 1.8%.

- In synch with the US economy, Canada is set for a Q1 rebound. But the soft domestic economy coupled with a likely deceleration of trade in response to the growth-restraining impacts of sequestration in the US should cap economic activity later this year, enough to limit 2013 GDP growth to just 1.5%.

World: Rocked by Cyprus

Despite the now-typical verdict from European politicians that “the worst is now behind”, the eurozone continues to dish out bad news. The latest crisis came from Cyprus whose exit from the zone was staved off at the last minute by a “deal” reached with the troika which, not only ensures difficult years ahead for the small nation of the periphery, but also casts further doubts about the zone’s outlook.

That the eurozone continues to dish out bad news shouldn’t be surprising. But what can be surprising is how quickly things can deteriorate. The latest crisis from the zone came from tiny Cyprus (less than 0.2% of eurozone GDP). The latter’s problem is a banking sector whose assets are multiple times the size of its €18 bn economy, and dominated by a few institutions with balance sheets that have been decimated in recent years by losses including haircuts on Greek bonds. The ECB had threatened to cut its lifeline, i.e. the Emergency Liquidity Assistance program, if Cyprus didn’t adopt an EU/IMF program to ensure the solvency of its banks and the sustainability of its public finances. The EU/IMF agreed to a €10 bn lifeline for Cyprus on the condition the latter raises €5.8 bn and shrinks its banking sector. After intense negotiations, the EU and the Cypriot government finally agreed the latter would raise funds by charging a levy on deposits €100,000 and above, while also restructuring and downsizing its banking sector which is now expected to reach the EU average by 2018. Laiki bank, Cyprus’s second largest bank, will be broken up with the “good” assets folded into Bank of Cyprus (the country’s largest bank) while “bad” assets will be run down over time with shareholders and bond holders absorbing the losses. In other words, rather than proposing the usual bail out, the troika (IMF/EU/ECB) this time opted for a “bail in”, i.e. have Cyprus bear the brunt of the losses.

To Read the Entire Report Please Click on the pdf File Below.