Martin Marietta Materials, Inc. (NYSE:MLM) is poised to benefit from its aggregates business, robust underlying construction market fundamentals, higher demand for public sector infrastructure and acquisition synergies.

Recently, the company reported 2019 earnings results, which marked the most profitable year in its history. Improved shipments, pricing and profitability across major part of the Building Materials business helped it to achieve the eighth consecutive year of growth in revenues, gross profit, adjusted EBITDA and earnings per share (read more: Martin Marietta Q4 Earnings Miss Estimates, Up Y/Y).

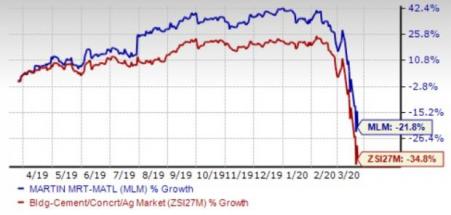

Shares of the company have also outperformed the industry in the past year.

However, weather-related challenges, higher costs, and lower margins aggregates-related downstream operations are concerns.

Let discuss the factors that are driving this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Factors Substantiating Growth

Being a leading supplier of construction aggregates in the United States, Martin Marietta has a vast network of aggregate quarries and distribution centers throughout the southern United States. Also, it operates in the Bahamas and Canada, and has distribution centers along the Gulf of Mexico and Atlantic coasts.

Strong underlying demand is likely to boost its sales and profits at the Aggregates business in the forthcoming quarters. Also, stable public sector spending, as public construction projects are less affected by general economic cycles, is anticipated to benefit the company’s results in the near term. In 2020, it expects infrastructure shipments to grow meaningfully, driven by healthy state Department of Transportation (DOT) budgets and an expected extension or replacement for the Fixing America’s Surface Transportation (FAST) Act.

Increased commercial and heavy industrial construction activities are likely to aid aggregate shipments to the non-residential market (which represented 36% of 2019 aggregate shipments). The company expects large energy-sector projects, particularly along the Gulf Coast, to continue driving growth and boosting aggregates demand over the next several years.

Notably, the company completed more than 90 acquisitions since 1994, which enabled it to enhance and expand its aggregates-led presence in the building materials marketplace.

Potential Headwinds

Martin Marietta’s businesses are subjected to weather-related risks that can significantly affect production schedules and profitability. The first and the fourth quarter of every financial year are affected by winter. In fact, weather, contractor capacity issues and logistics disruptions have put pressure on the company throughout 2018. The asphalt and paving business — which operates solely in Colorado — witnessed lower production days due to continued extreme weather. The trend witnessed a 4.1% decline in asphalt shipments in fourth-quarter 2019.

During 2019, the company, which share space with Forterra, Inc. (NASDAQ:FRTA) , Cornerstone Building Brands, Inc. (NYSE:CNR) and CEMEX, S.A.B. de C.V. (NYSE:CX) in the same industry, incurred higher late year costs for contract services, repairs and supplies that put pressure on incremental margin.

Martin Marietta’s aggregates-related downstream operations have lower gross margins (excluding freight and delivery revenues) than its aggregates product line due to highly competitive market dynamics, lower barriers to entry and volatility in fuel costs. Any further expansion of the segment will be a major hurdle for the company.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Cemex S.A.B. de C.V. (CX): Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM): Free Stock Analysis Report

FORTERRA INC (FRTA): Free Stock Analysis Report

NCI Building Systems, Inc. (CNR): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Martin Marietta Banks On Aggregate Business Amid Weather Woes

Published 03/22/2020, 11:17 PM

Updated 07/09/2023, 06:31 AM

Martin Marietta Banks On Aggregate Business Amid Weather Woes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.