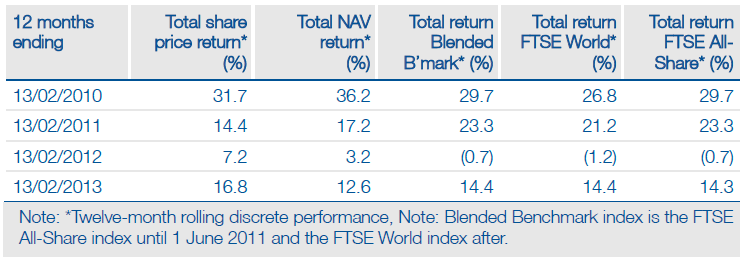

Martin Currie Global Portfolio Trust (MNP) is a global equities investment trust. During the past year MNP has provided absolute returns of 12.6% and 16.8% for NAV and price total return respectively, compared to its benchmark, which returned 14.4%. The portfolio’s defensive positioning has hindered performance a little during this period, although the manager has become more bullish on the outlook for global equities given the continuing global monetary expansion, which the manager believes will support growth and increase the attractiveness of equities as an inflation hedge. The discount has narrowed during the last half year from c 6% to its current 2.0%.

Investment Strategy: International Quoted Investments

MNP is managed using a predominantly bottom-up investment style supported by macro analysis. There are no formal sector, stock or market capitalisation restrictions, and the trust maintains a relatively focused portfolio of around 60 international quoted stocks with a view to providing long-term capital growth. The investment process looks to identify higher-quality global companies at attractive valuations, with superior growth prospects. MNP can gear up to 20% of total assets but is currently ungeared. MNP remains overweight in the UK (c 17% of its portfolio vs c 9% of the benchmark) which is a result of stock selection and the number of attractively priced UK listed stocks with global businesses.

Sector Outlook: Positive Outlook For Global Equities

The manager maintains that equity valuations remain attractive, particularly given the yields available on gilts and bonds, and that, with a general rotation back into equities taking place, there is further upside to equity prices. In terms of downside risks, long term solutions to structural problems such as eurozone competitiveness and US fiscal deficits are yet to be found, but the manager now believes that the worse case scenarios will not come to pass and that, even after a strong performance for equities during January, a further 10% uplift during 2013 is readily achievable.

Valuation: Discount Below Long-Term Averages

MNP’s discount has tightened appreciably during the last six months from c 6% (in line with its longer term averages of 6.0% and 5.6% over three and five years respectively) to its current discount of 2.0%. Compared to other global growth investment trusts, MNP’s discount is appreciably narrower (sector: c 8%) but MNP continues to pay an above-average yield.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Martin Currie Global Portfolio Trust

Published 02/15/2013, 05:55 AM

Updated 07/09/2023, 06:31 AM

Martin Currie Global Portfolio Trust

Global Equities Investment Trust

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.