Online travel agency MakeMyTrip (NASDAQ:MMYT) is attempting to coil on the continuing spread of COVID-19 vaccinations. The rapidly growing Indian market travel platform was a pandemic loser transformed into a benefactor of the reopening.

COVID-19 vaccinations have been the driver for consumers taking trips again to and from India. As of November 8, 2021, the US has opened up its borders to enable fully vaccinated Indian travelers to travel into the US Additionally, e-commerce users are expected to grow to 500 million by 2030, more than doubling the current users today.

India has the second-largest population on the planet with over 1.2 billion people. MakeMyTrip has recovery and e-commerce growth tailwinds in its favor. Prudent investors seeking exposure in the travel segment in the second largest populace can watch for opportunistic pullbacks in shares of MakeMyTrip.

Q2 FY 2021 Earnings Release

On Oct. 26, 2021, MakeMyTrip released its fiscal second-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $0.09 excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.08), a $0.17 beat.

Revenues grew 274.2% year-over-year (YoY) to $86.4 million beating analyst estimates for $10.45 million. Deep Kalra, Group Executive Chairman said,

“MakeMyTrip continued to lead and be instrumental in the recovery of travel in India as the country’s new daily reported COVID-19 infections have declined significantly since May 2021, aided by over one billion vaccine doses that have been administered so far. The results of the reported fiscal quarter clearly showcase the durable strength of its multiple brands, driven by its relentless focus on serving its customers with the best possible experience for their travel booking needs.”

“Entering the peak festive season in India, we are optimistic about the expected ongoing recovery of travel demand in the quarters to come and will continue to leverage our highly variable and more efficient fixed cost structure to maintain our leading position in the travel market in India.”

Conference Call Takeaways

CEO Kalra set the tone,

“On our last call in late July, we shared that India was already seeing a massive reduction in the number of daily new infections since the second wave peaked in early May this year. The good news is that, new daily infections have remained relatively muted with about 16,000 daily new cases on a seven-day average basis.

We believe helping to drive this progress has been the dramatic increase in vaccinations since late July, and natural immunity from unreported vaccinations pardon me – from unreported infections during the second wave. As of last week, over one billion doses of the vaccine had already been administered across the country, which is a significant global landmark.

Nearly 300 million of our own citizens are now fully vaccinated, and we expect that number to rise as many will receive their second dose in the coming months. It's encouraging to see that promoting social distancing and use of masks is gradually helping to restore normalcy, which has quickly spilled over to travel demand.

As of last week, the Directorate General of Civil Aviation or DGCA had lifted the cap for domestic flights restored domestic seat capacity back to 100% and done away with many other restrictions. While scheduled international flights remain suspended for now India has implemented travel bubble arrangements with 28 countries, including the US, Canada, the UK, many EU countries, the UAE, Qatar, and the Maldives.

With declining COVID cases across India starting November 8th, the US will allow fully vaccinated Indian travelers to enter. Similarly, the UK had already relaxed quarantine requirements since October 11. India has also reopened its borders to fully vaccinated inbound tourists on chartered flights in mid-October.”

He concluded,

“We're even more enthused by the fundamental shift in buying behavior that has taken place during the last six quarters. A recent comment from RedSeer Consulting is predicting that e-commerce users in India will reach 500 million to 600 million by 2030, up from roughly 150 million to 200 million today.

This prediction, which is likely to play out will place India only second to China in terms of the overall size of online shoppers, equating to an expected TAM or total addressable market of $350 billion. We fundamentally believe that the long-term upside for our business remains huge, and we continue to adapt and drive innovations to keep pace with ever-changing online travelers' needs."

Opportunistic Pullback Levels

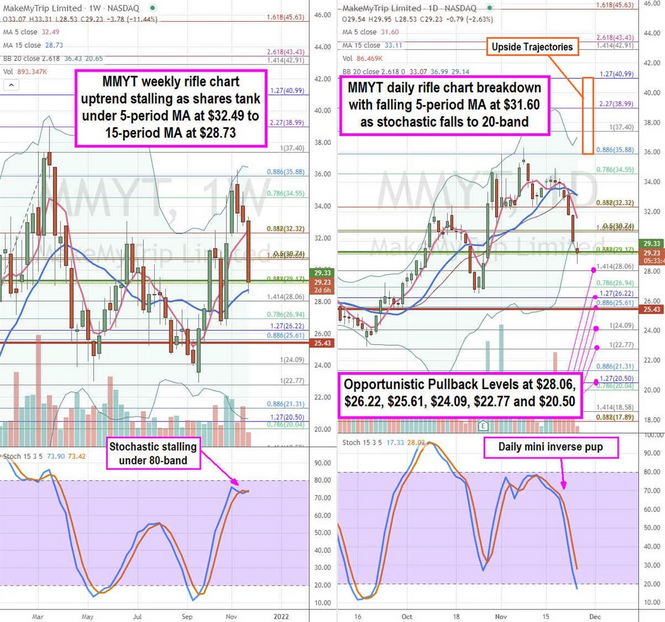

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for MMPT shares. The weekly rifle chart peaked near the $35.88 Fibonacci (fib) level. The weekly rifle chart uptrend was abruptly shaken as shares fell under the 5-period moving average (MA) at $32.49 as it quickly tightened to the 15-period MA at $28.73.

The weekly stochastic stalled just under the 80-band as the weekly uptrend stalls for a potential pup or breakdown. The weekly market structure high (MSH) sell triggers a breakdown under $25.43. The weekly market structure low (MSL) buy triggers above the $29.33 level.

The daily rifle chart breakdown formed on the daily stochastic mini inverse pup sending the stochastic to the 20-band. Shares even overshot the daily lower Bollinger Bands (BBs) at $29.14. The daily 5-period MA is falling at $31.60. Prudent investors can look for opportunistic pullback levels at the $28.06 fib, $26.22 fib, $25.61 fib, $24.09 fib, $22.77 fib, and the $20.50 fib level. Upside trajectories range from the $35.88 fib up towards the $40.99 fib.