LyondellBasell Industries N.V. (NYSE:LYB) recently announced that Hyundai Chemical Co. Ltd has picked its Lupotech T process technology for building a 300 Kilo tons (KT) per year low density polyethylene (LDPE) and ethylene vinyl acetate (EVA) copolymers plant at Daesan, South Korea. Notably, Hyundai Chemical is a joint-venture company formed by Hyundai Oilbank Co. Ltd. and Lotte Chemical Corporation.

Per LyondellBasell, the project highlights the superior benefits that Lupotech T technology offers to its customers for high-pressure tubular LDPE. The technology addresses customers’ key project requirements by balancing investment and operating costs.

Moreover, the technology will enable Hyundai Chemical to serve the high-quality LDPE and EVA copolymers market.

Effective process heat integration and high conversion rates are the main attributes of the Lupotech T process that contributes to sustainable growth of the EVA and LDPE markets. LyondellBasell has so far licensed more than 11,000 KT per year of Lupotech T LDPE production capacity in roughly 65 lines across the globe.

The new licensees are expected to benefit from LyondellBasell’s in-house expertise of continuous production improvement, catalyst knowhow and sustainable product development, which can be availed by optionally joining the Technical Service program.

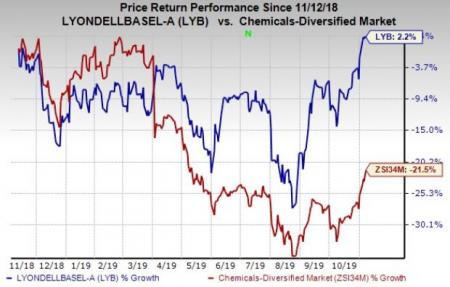

Shares of LyondellBasell have gained 2.2% in the past year against the industry’s 21.5% decline.

LyondellBasell’s adjusted earnings came in at $2.70 per share in the third quarter that missed the Zacks Consensus Estimate of $2.78.

The company generated revenues of $8,722 million, which declined around 14% year over year. The figure also trailed the Zacks Consensus Estimate of $8,983.2 million.

While the company continued to benefit from low-cost natural gas liquid feedstocks with favorable prices continuing into October 2019, it expects seasonal softening of demand for the rest of the year.

Moreover, LyondellBasell expects profitability at its Houston refinery to improve during the fourth quarter. Per the company, the upside is likely to be driven by an increase in demand for low-sulfur marine fuels ahead of the IMO 2020 regulation deadline.

Zacks Rank & Stocks to Consider

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Impala Platinum Holdings Ltd (OTC:IMPUY) , Franco-Nevada Corporation (TSX:FNV) and Agnico Eagle Mines Limited (NYSE:AEM) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Impala Platinum has an expected earnings growth rate of 248.3% for the current fiscal year. The company’s shares have surged 293% in the past year.

Franco-Nevada has projected earnings growth rate of 39.3% for 2019. The company’s shares have rallied 47.7% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 70% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

LyondellBasell Industries N.V. (LYB): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY): Free Stock Analysis Report

Original post