Kinross Gold Corporation (NYSE:KGC) recently announced that it will proceed with the Phase Two expansion of Tasiast mine, Mauritania. The move is expected to transform Tasiast into a large, world-class mine with low-cost operations.

Tasiast Phase Two

Phase Two is anticipated to raise mill capacity to 30,000 tons per day (t/d) to produce roughly 812,000 gold ounces per annum, on an average, for the first five years. The average production cost of sales and all-in sustaining cost is expected to be $440 and $655 per gold ounces, respectively. The project is estimated to generate robust free cash flow of $2.2 billion over the life of mine.

The company expects initial construction of Phase Two to begin in early 2018 and initial plant and infrastructure capital costs are expected to be around $590 million. Kinross expects commercial production to commence in third-quarter 2020.

Round Mountain Phase W

Kinross also announced plans to proceed with the Round Mountain Phase W project in Nevada. The project is awaiting completion of the permitting process and is on schedule.

Project W is anticipated to extend mining by five years and increase life-of-mine production by 1.5 million gold ounces. Round Mountain is one of the best performing mines of Kinross, which is also located in one of the best mining jurisdictions in the world.

Financing Plans

Kinross plans to finance both projects with its robust balance sheet, operating cash flows and existing liquidity. As of Jun 30, the company had cash and cash equivalents of $1,061.3 million. It also has $1,433.1 million of available credit for total liquidity of roughly $2.5 billion. The company has no debt maturities prior to 2021.

According to Kinross, maintaining financial flexibility and strong balance sheet will continue to be the company’s top priorities as it develops both projects.

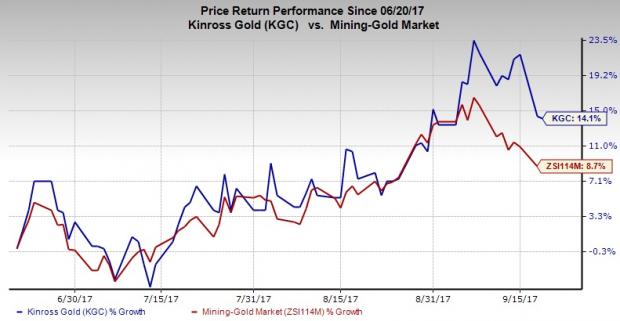

Price Performance

Shares of Kinross have moved up 14.1% in the last three months, outperforming the 8.7% growth recorded by the industry.

Outlook

Kinross, in second-quarter 2017 earnings, reaffirmed its previous gold production guidance for 2017 in range of 2.5-2.7 million gold equivalent ounces. The overall production cost of sales is expected in the range of $660-$720 per gold equivalent ounce, while all-in sustaining cost is estimated to be $925-$1,025.

Kinross is making steady progress in advancing the projects that will provide it with a strong growth profile among leading gold producers. The company also remains focused on managing costs and improving cash flows.

Zacks Rank & Other Stocks to Consider

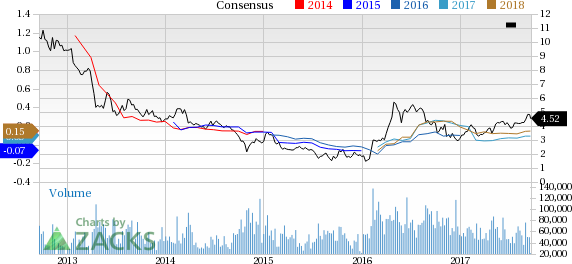

Kinross currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Sociedad Quimica y Minera de Chile S.A. (NYSE:SQM) , Koppers Holdings Inc. (NYSE:KOP) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sociedad Quimica has an expected long-term earnings growth rate of 32.5%.

Koppers Holdings has an expected long-term earnings growth rate of 18%.

Kronos Worldwide has an expected long-term earnings growth rate of 5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Original post

Zacks Investment Research