Gold has surged in the past two weeks as the dollar has faded. It also appears investors are buying some protection after bitcoin faltered at $20,000 before its recent decline back to $14,000. Bitcoin was a store of safety until two weeks ago when it began to crash. Now money is headed back to trusty gold. While I am a long-term bull, there is a significant swing-trade short opportunity in shares of the gold ETF GLD.

Short Strategy

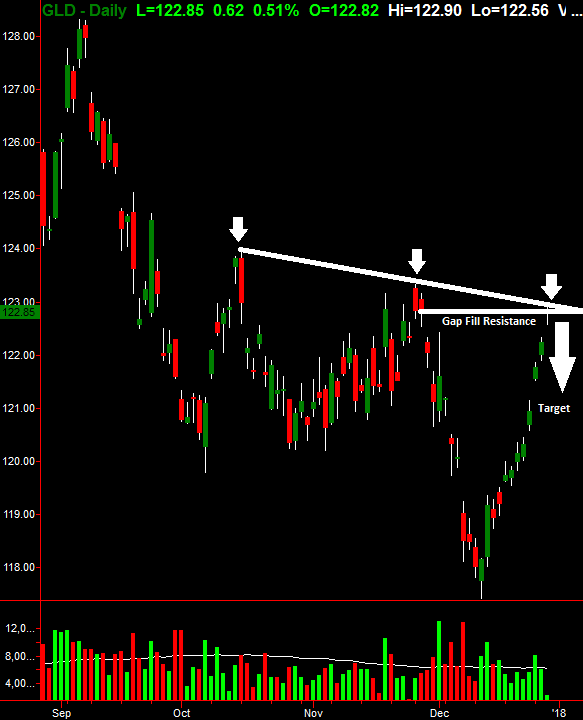

GLD hit a gap fill and also a down-sloping trend line on Thursday, which connected the highs from mid October to late November. The fact that gold is near-term overbought and has hit two major resistance points signals a likely pull back. Swing traders can look to short gold by buying the DGLD (3x gold bear ETF) or just shorting the GLD, which should retrace back from its current price of $122.85 to $121.00 in the coming week.