This is a short idea I came across by accident. I was looking at charts and came across this nice high-priced but weak and toppy-looking chart on both a Monthly and Weekly basis. Illumina Inc (NASDAQ:ILMN) “provides sequencing and array-based solutions for genetic and genomic analysis.”

I can’t say much from a fundamental perspective as I am unfamiliar with the booming genome sequencing business. Still, I can only say that the trajectory has been down since 2021, and it can’t seem to get off the ground down here in the $200 area.

This has a relatively high PE Ratio above 40 (not extreme, but also a bit bloated for the current market environment). Those weak stocks are my favorite to short because resistance tends to hold much more easily than trying to time the general market or market leaders.

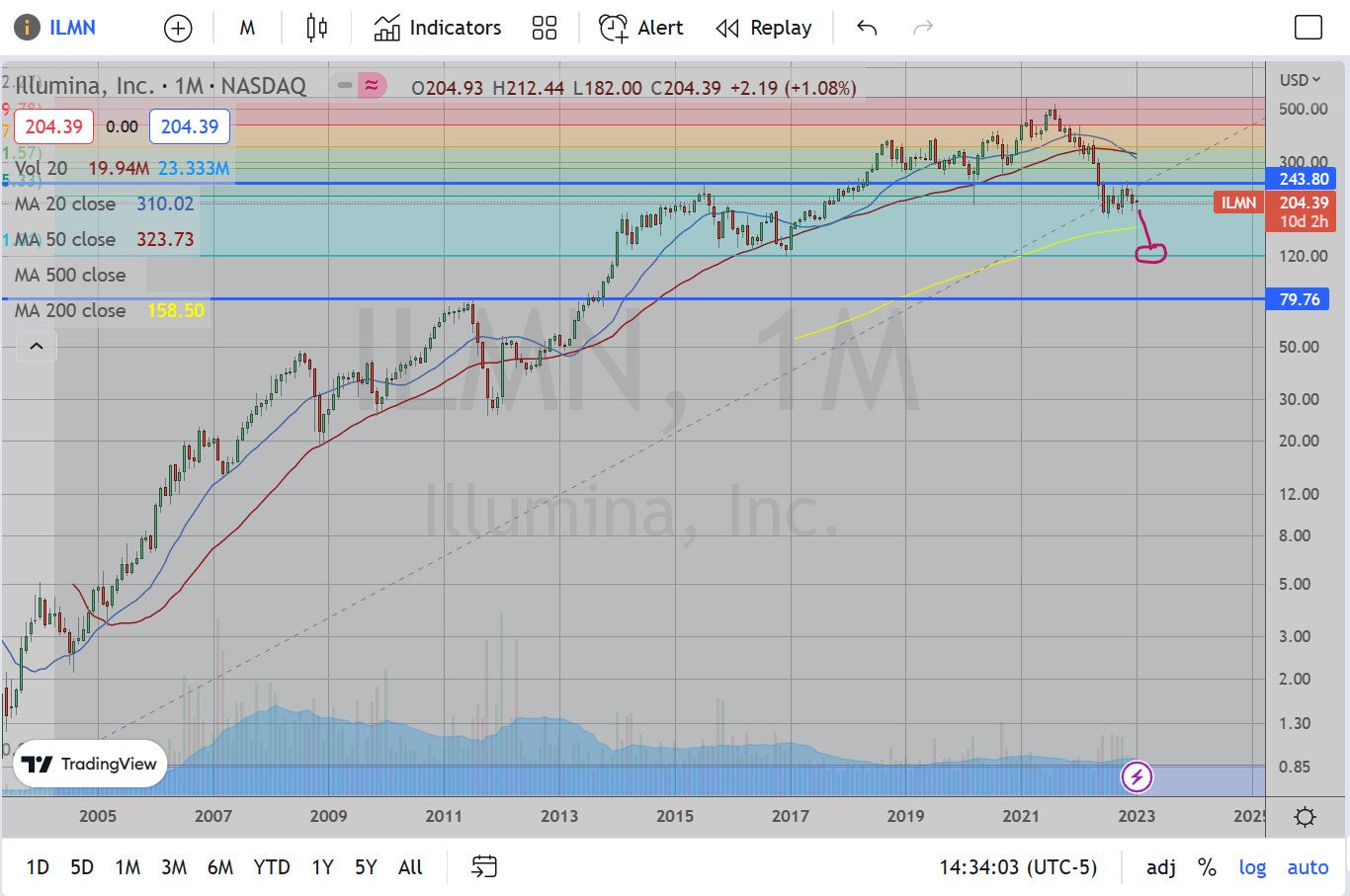

The monthly shows clear weakness from the top in August 2021 through May 2022. Then, since May 2022, it has pretty much been going sideways. So it found support but did not manage to regain any bullish momentum. It has only been able to stop the drop. I wonder how long that may last. I tossed on Fib Retracement levels from all-time lows-highs. The next level looks like clean support (the last supported area from December 2016), near $120.

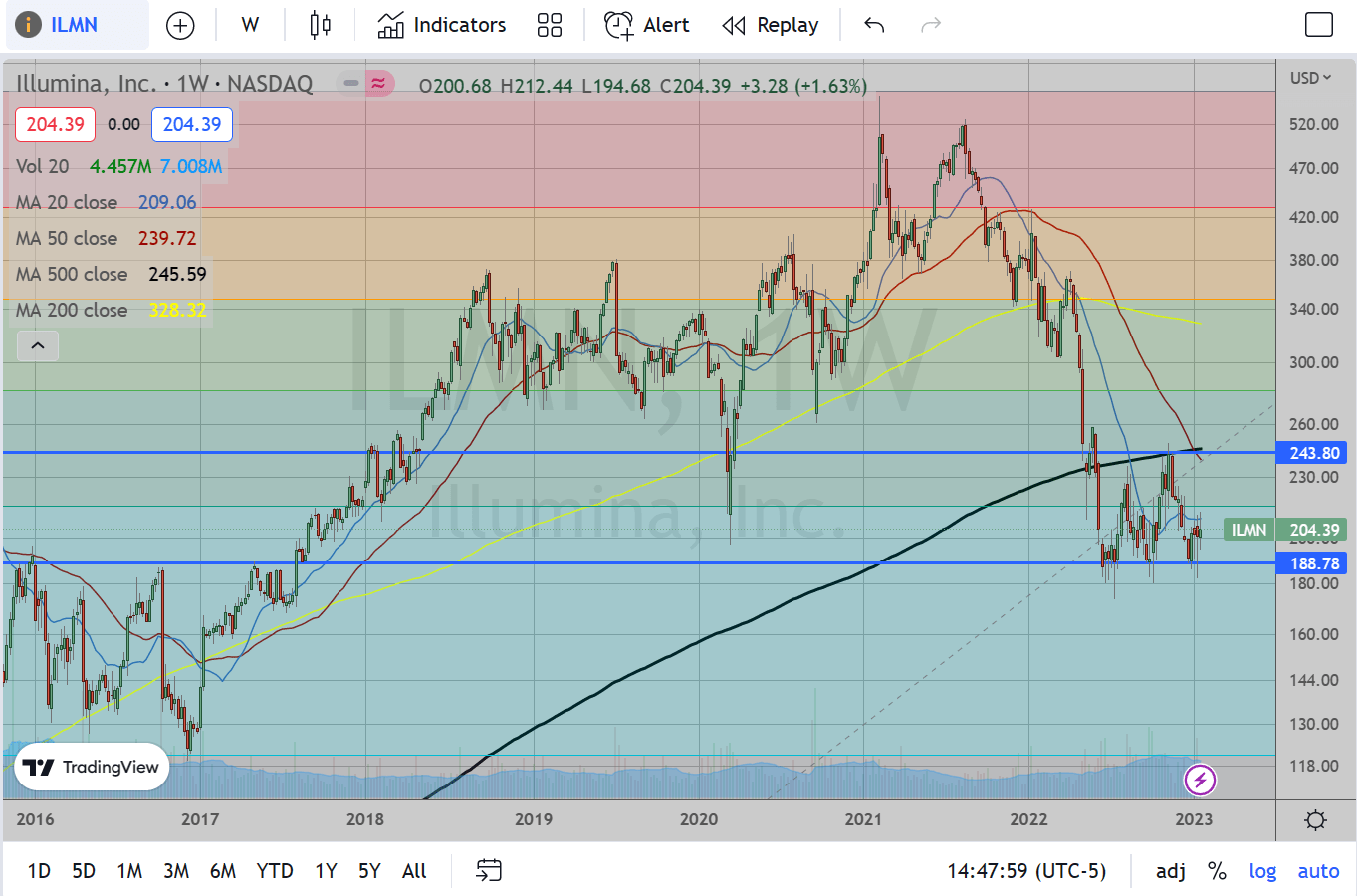

The weekly chart has me quite excited as it managed to break below 245 (the July 2015 peak), which also coincides with the 500 EMA. (Side note: Someone asked me a few weeks ago about where I came up with the 500 EMA, and I explained I never or rarely use it. This is one of those rare times when it seems to mean something). This had found support at 190 (a few weekly wicks beneath this level) and has an evident range which I will be watching intently.

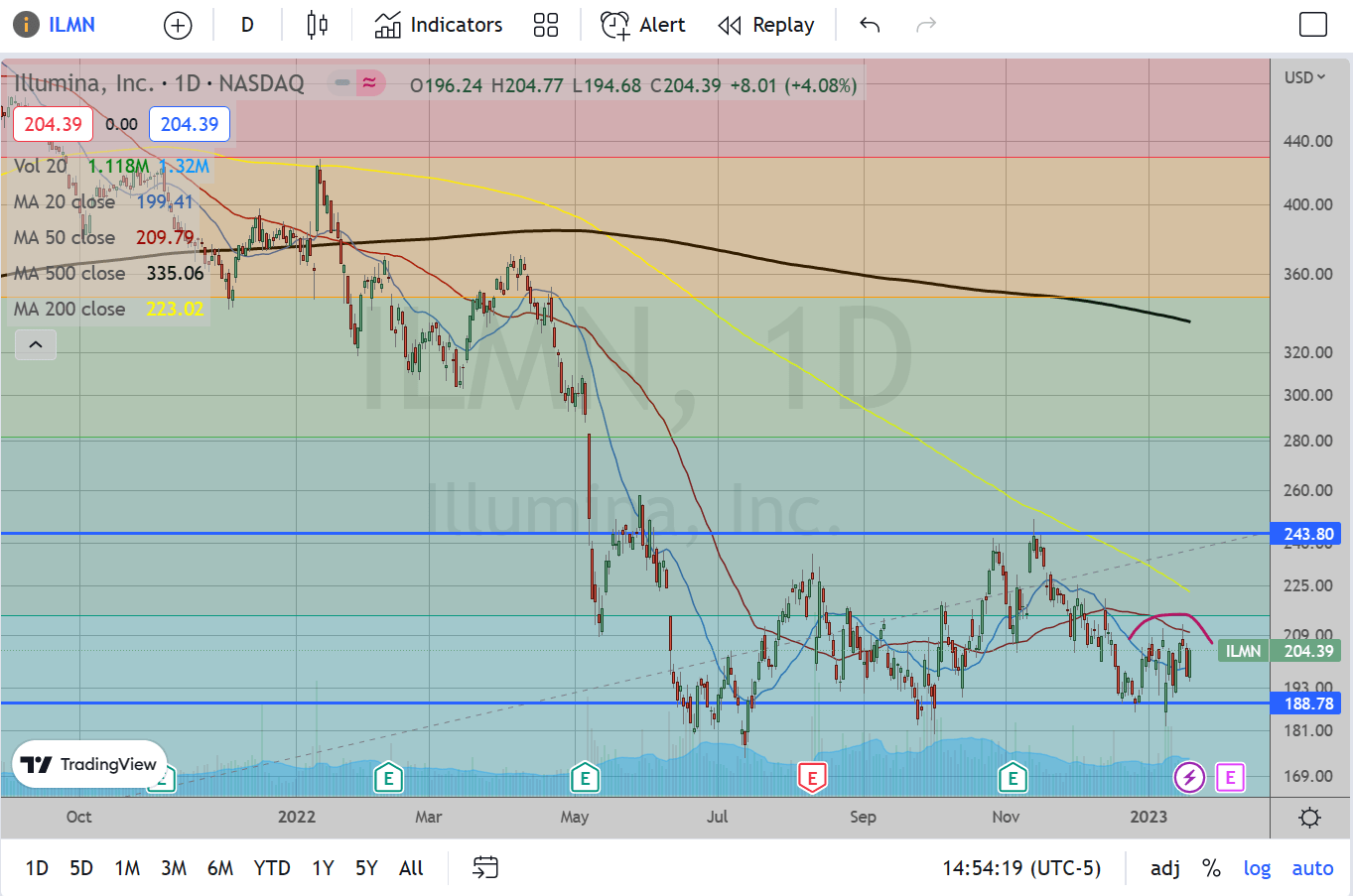

The daily chart is much more unsure. The range looks larger here (190-250), so it has bounce potential in the short term. One could probably look to play the range and get long down here, but I think every move towards the higher end of this range would make sense to sell and get short to get ready for a big move south.

Disclosure: I need to caveat that I am not playing this short myself as I am restricted, but I think this could be a great short if a reasonable price is obtained. As always, do your due diligence and make trades that make sense for your risk tolerance and account size.