Hutchison China MediTech Ltd (NASDAQ:HCM) presented robust SANET-ep Phase III China data at ESMO 2019 on surufatinib in non-pancreatic neuroendocrine tumors (NET). The data support a China NDA submission (imminent), with surufatinib likely to be the first of HCM’s non-partnered assets to reach the market (late 2020). NET tumors are highly prevalent, fragmented in primary origin and are an unmet medical need. Surufatinib could be the first universal drug to treat NET in all patients regardless of tumor subtype; the SANET-p Phase III data in (pancreatic NET H120), is critical to widening its market potential. The global (US and Europe) registration Phase III study is planned for H120. CK Hutchison Holdings (CKHH) reduced its holding by 1.3% to below 50% (49.9%). We see this as a significant positive as it removes the significant overhang on the shares. We value HCM at $5.7bn.

Surufatinib solid data in non-pancreatic NET

Positive Phase III surufatinib data unveiled at the interim analysis of SANET-ep (advanced extra-pancreatic NET) led to trial cessation, as recommended by IDMC, a year ahead of schedule. Surufatinib met superiority criteria in meeting its primary endpoint of progression-free survival (PFS) (9.2 months vs placebo 3.8 months, HR=0.334, p

NET and BTC represents ~$1bn global opportunity

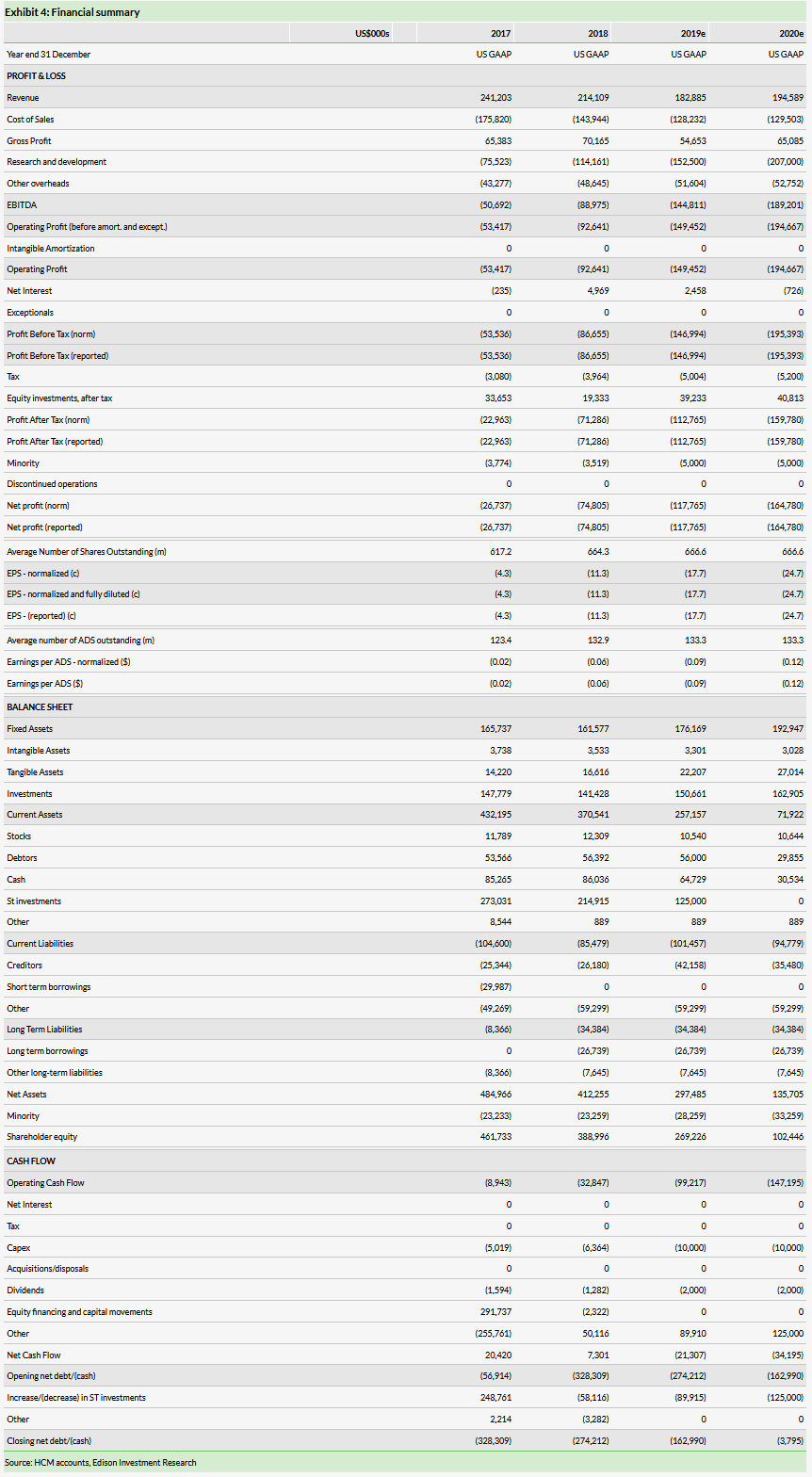

We continue to forecast global peak sales for surufatinib of $953m across the NET and biliary tract cancer (BTC) indications. We now forecast China launch in late 2020 (previously 2021) due to clearer regulatory timelines and US/EU launch in 2024. HCM has accelerated global (ex-China) development of its non-partnered assets (fruquintinib, surufatinib, HMPL-523 and HMPL-689) as evidenced by a leap in R&D expense in 2018/19. In the rapidly changing landscape that is oncology, timeliness is critical and investment in surufatinib is coming to fruition.

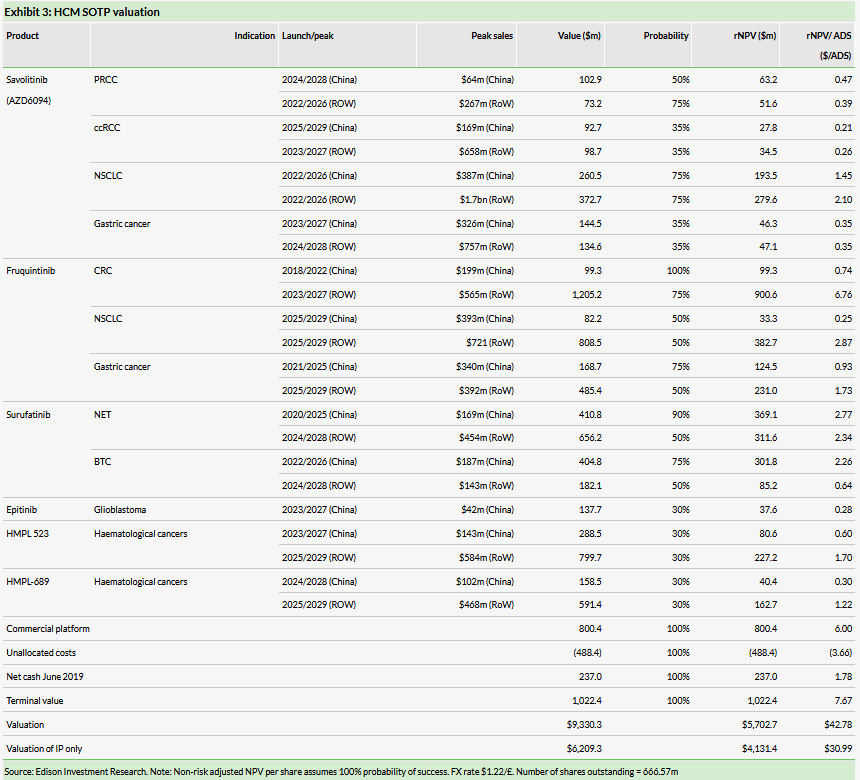

Valuation: $5.7bn or $42.78/ADS

We value HCM at $5.7bn ($42.78/ADS) vs $5.7bn ($42.62/ADS) previously. We now forecast surufatinib launch in China in late 2020 (previously early 2021) based on an October 2019 China NDA submission. We have increased 2020 R&D expenses and rolled forward our model in time.

ADR share price performance

Business description

Hutchison China MediTech is an innovative China-based biopharmaceutical company targeting the global market for novel, highly selective oral oncology and immunology drugs. Its established commercial platform business continues to expand its outreach.

Portfolio rapidly advancing

HCM continues to make rapid progress towards its goal of becoming an international biotech company with a marketed portfolio of innovative drugs. Of its late-stage pipeline, surufatinib, savolitinib and fruquintinib are in pole position to ensure HCM’s goal is reached in the medium term. Surufatinib has made significant strides this year; the Phase III SANET-ep trial cessation one year ahead of schedule due to overwhelming positive efficacy in advanced stage non-pancreatic NET means the drug could launch in China in late 2020. If the global Phase III trial (US and Europe due to initiate in H1 20) results are consistent with data seen in Chinese patients to date, this would pave the way for surufatinib to be the first universal small molecule drug treatment for NET.

NET: Fragmented but highly prevalent disease

Data from Frost & Sullivan indicate the global NET market in 2018 was worth approximately $5.8bn and is expected to grow to $21.2bn by 2030. NET cancers arise out of cells of the endocrine and nervous systems, predominately the digestive and respiratory tracts. NETs can be aggressive or indolent in nature, the latter meaning that patients can survive longer in the course of disease than certain solid tumors. NETs are typically classified as pancreatic NETs or extra pancreatic NETs (a catch all for a tumor that does not arise out the pancreas) and commonly include lung NETs and gastrointestinal (GI) NETs. NETs can be functional (~40% of patients) or non-functional depending on whether the hormones produced by the tumor lead to symptoms (functional NET).

In China there is significant market opportunity with reported incidence of NET in 2018 of approximately 67,600. While the current prevalence of NET in the US is ~150,000 patients (incidence of ~19,000 new cases per year), current treatment modalities are typically limited to subsets of NET with only Afinitor approved for a broad range of NETs (pancreatic, GI and lung).

SANET-ep supports broad use in non-pancreatic NET

Surufatinib’s China Phase III program consists of two studies evaluating the drug (vs placebo) in pancreatic NET (SANET-p, planned n=195) and non-pancreatic NET (SANET-ep, actual n=198), thus covering all NET patient types. In June 2019, HCM announced the independent data monitoring committee had recommended stopping the Phase III SANET-ep early following positive interim data. This was based on the trial meeting its primary endpoint of PFS and the trial was unblinded a year ahead of schedule. Upon unblinding, patients on placebo had the opportunity to cross over to the surufatinib arm. Surufatinib met primary endpoints and significantly improved investigator-assessed PFS (PFS 9.2 months vs placebo 3.8 months, HR=0.334, p

Eligibility criteria for the study included well differentiated extrapancreatic (ep) NET pathological grade 1 or 2 with advanced disease, patients with prior use of VEGF/VEGFR inhibitors were excluded. Around 69% of patients on surufatinib had received prior systemic anti-tumor therapy (chemotherapy, somatostatin analogues, everolimus) vs 64% on placebo.

Safety was in line with previous data; hypertension (64.3% on drug vs 26.5% on placebo) and proteinuria (70.5% on drug vs 52.9% on placebo), while the most common adverse events were medically manageable. Given surufatinib inhibits three different targets (vascular endothelial growth factors, VEGFRs; fibroblast growth factor receptor 1, FGFR1; and colony stimulating factor 1 receptor, CSF-1R) at therapeutic dosing; its tolerability with combination therapies is an important factor. However, median exposure days on surufatinib (217 days) and placebo (146 days) suggests discontinuation rates were largely due to disease progression rather than tolerability issues.

At ESMO 2019 HCM reported preliminary results of the global Phase Ib study of surufatinib in US solid tumor patients – HCM initiated the US Phase Ib/II study in P-NET and BTC in July 2018. The two-part study design including dose escalation and dose expansion assessed safety and tolerability. It confirmed a safety and PK (pharmacokinetic) profile consistent with studies in China patients. Importantly, surufatinib showed early signs of utility (two partial responses, n=15 pNET patients) in heavily pre-treated patients with some receiving up to eight different lines of therapy. The maximum tolerated dose/recommended Phase II dose was established as 300mg daily for global development.

Global development plans closely follow China

HCM is building its China oncology commercial team ahead of surufatinib launch, with the intention to have full coverage of China in preparation for launch late 2020. NET will be surufatinib’s first (potential) approved indication. Non-pancreatic NET is estimated by HCM to represent ~80% of NET cases in China. SANET-p Phase III data (pancreatic NET H1 20) is critical to widening its market potential to an additional 10–20% of patients. Based on the SANET-ep data, of the Chinese patients with advanced disease, prior to enrolment around 40% had received treatment with chemotherapy, 30% with a somatostatin analogue and c 10% with everolimus; on the strength of the data presented we believe that surufatinib could provide a universal treatment for NET, particularly if SANET-p provides a similar benefit to patients with pancreatic NET (reduction in risk of disease progression). Pricing strategies in China will be important given competitor NRDL reference pricing of $2,007 per month for Sutent and $1,320 per month for Affinitor.

HCM plans to investigate surufatinib in other solid tumors both as monotherapy and in combination therapy with a PD-1 focus. HCM has multiple PD-1 collaborations in place; the Tuoyi (Junshi collaboration) dose expansion study in multiple tumor types is anticipated to start in Q419.

Following encouraging proof of concept data from the Phase II study in BTC, a pivotal open-label Phase IIb/III trial (NCT03873532) in China initiated in 2019. Interim data on the first 80 patients recruited into this trial are expected mid-2020. BTC represents a high unmet need due to limited treatment options and an increasing patient population.

Surufatinib’s global registration clinical trial is in planning stage. The end of Phase II meeting with the FDA is expected in Q419, with US and Europe Phase II/III estimated to start in H1 20.

Competitive landscape in NET

To date no targeted therapies have been approved across the broad NET population. Although progress has been made in the treatment of NETs, most approved treatments are for subsets of NET, dependent on the primary site of NET, stage and grade. Treatment options include surgery where possible and long-term systemic treatment to treat symptoms and suppress tumor growth include somatostatin inhibitors such as Novartis’s Sandostatin LAR (octreotide) and Lutathera (177Lu-Affinitor), which slow the hormonal production driving the formation of NETs (ex lung). Approved drugs include somatostatin inhibitors, Afinitor, an mTOR inhibitor, and sunitinib, a tyrosine kinase inhibitor. Exhibit 2 highlights the different treatment options by NET subtype available in the US. In China, the Afinitor label has now been expanded to include the same NET indications as its USA label (pancreatic, GI and lung).

The treatment landscape is fragmented, for example Lanreotide data (CLARINET) supports use in pNET, and GI NET, while Sutent (sunitinib) data support its use in pNET only. Targeting aberrant angiogenic VEGF signalling has been proven with Sutent in treating pancreatic NETs, demonstrating a 5.9-month improvement in mPFS vs placebo (HR=0.42; p

Surufatinib multiple modes of action in cancer

Surufatinib is an oral angio-immunokinase inhibitor that targets VEGF1, 2 and 3; FGFR1 and CSF-1R kinases. During the last decade modalities of cancer treatment that involve targeted therapy (addressing cancer specific mutations), harnessing the power of the immune system and cancer cell blood supply to treat the tumor microenvironment are additional armaments to traditional chemotherapy and surgical treatment options. As such combination therapies evaluating drugs with multiple mechanism of action are approved (eg EGFR inhibitor plus PD-1 inhibition) or undergoing late-stage testing in a multitude of cancer. Surufatinib is a small molecule therapeutic protein that addresses three distinct kinases and thus multiple different regulatory processes that enable cancer proliferation:

Anti-angiogenesis via VEGF receptor and FGFR inhibition. VEGF inhibition is a well-known mechanism of action, with leading antibody Avastin (FY18 sales: $7.0bn) approved for over 30 tumor types in its decade on the market. FGFRs are transmembrane receptor tyrosine kinases that mediate cell differentiation, migration and survival; genetic aberrations to FGFRs can lead to a gain-in-function and have been implicated in the progression of a range of cancers.

CSF-1R is a cell-surface protein that acts as the receptor for the cytokine CSF1, which controls macrophage (a type of white blood cell) function. Inhibition of CSF-1R limits the production of pro-tumor macrophages, which, among other functions, is believed to aid in angiogenesis, tumor cell invasion and evasion of the immune system. CSF-1R activity, which is very novel and potentially important for PD-1 combinations as there may be synergy (both act by activating the immune system against the cancer), may differentiate it from competitor PD-1/PD-L1 inhibitor combination studies with axitinib ( Pfizer (NYSE:PFE)) or lenvatinib.

Surufatinib’s three-in-one profile bodes well for current and evolving treatment paradigms in oncology where immunomodulatory drugs such as checkpoint inhibitors are being used in earlier lines of therapy.

Valuation

We value HCM at $5.7bn ($42.78/ADS) vs $5.7bn ($42.62/ADS) previously. We now forecast surufatinib is launched in China in late 2020 (previously early 2021). We have increased 2020 R&D expenses and rolled our model forward in time. We use a risk-adjusted net present value (NPV) method to discount future cash flows for the innovation platform (savolitinib, fruquintinib, surufatinib, epitinib, HMPL-523 and HMPL-689) (valuation of $4,131.4m). We use earnings-based multiples for HCM’s commercial platform (subsidiaries and JVs). Applying a 20.4x multiple on our forecast 2019 net attributable profit (equity in earnings of equity investees, net of tax) for the JVs of $39.2m yields a valuation of $800.4m (Exhibit 3).

CKHH offering removes a significant overhang on the shares

In June 2019, major shareholder CKHH completed an offering of some of its ADSs, which reduced its holding in HCM to 51.15% (from 60.2% previously). CKHH recently announced it had reduced its holding by 1.3% to below 50% (49.9%). This will enable CKHH to deconsolidate HCM from its accounts. CKHH remains committed to its investment in HCM and has no plans in the near future to reduce its holdings further. We see this as a positive for HCM as it removes a significant overhang on the shares. We note that this latest offering has had no effect on the number of shares in issue and does not dilute any current shareholders.