Cardinal Health Inc. (NYSE:CAH) is well poised for growth backed by diversified product portfolio, acquisition-driven strategy and robust pharmaceutical segment. However, integration risks remain a concern.

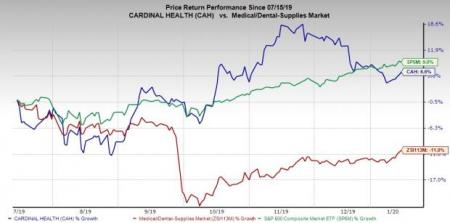

Shares of Cardinal Health have gained 6.6%, against the industry’s decline of 11% in the past six months. Further, the S&P 500 Index rallied 9% in the same timeframe.

The company, with a market capitalization of $15 billion, is a nation-wide drug distributor and provider of services to pharmacies, healthcare providers and manufacturers. It anticipates earnings to improve 6.2% over the next five years. Moreover, it has beat estimates in the trailing four quarters by 16.4%, on average.

Let’s take a closer look at the factors that substantiate the company’s Zacks Rank #3 (Hold).

What’s Weighing on the Stock?

The company’s acquisition-driven strategy makes it susceptible to integration risks.

Moreover, intense competition in each of the business segments remains a woe.

Factors to Bolster Cardinal Health

Cardinal Health’s Medical and Pharmaceutical offerings provide the company a competitive edge in the niche space. It offers industry expertise through an expanding portfolio of safe products.

The company follows an acquisition-driven strategy and remains committed toward investment in key growth businesses to gain market traction and bolster profits.

The company’s Pharmaceutical segment boasts of being the second largest pharmaceutical distributor in the United States. The segment’s products and services consist of pharmaceutical distribution, manufacturer and specialty services, and nuclear and pharmacy services. These, in turn, are anticipated to drive the company in the days ahead.

In fourth-quarter fiscal 2019 earnings call, Cardinal Health announced that it anticipates incremental cost savings of $130 million associated with actions intended to optimize and simplify its operating model and cost structure.

In fact, the company has already delivered $130 million in fiscal 2019. The company remains confident when it comes to generating more than $500 million in savings in comparison with its fiscal 2018 baseline in five years or less. This is likely to aid the company’s margins in the days ahead.

Which Way Are Estimates Headed?

For fiscal 2020, the Zacks Consensus Estimate for revenues is pegged at $152.92 billion, indicating an improvement of 5.1% from the year-ago period. For adjusted earnings per share, the same stands at $5.05, suggesting a decline of 4.4% from the year-ago reported figure.

Stocks to Consider

Some better-ranked stocks from the broader medical space include Patterson Companies, Inc. (NASDAQ:PDCO) , West Pharmaceutical Services, Inc. (NYSE:WST) and DENTSPLY SIRONA, Inc. (NASDAQ:XRAY) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson Companies has an expected long-term earnings growth rate of 6.4%.

West Pharmaceutical has an estimated long-term earnings growth rate of 14%.

DENTSPLY SIRONA has a projected long-term earnings growth rate of 11.6%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Patterson Companies, Inc. (PDCO): Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Original post

Zacks Investment Research