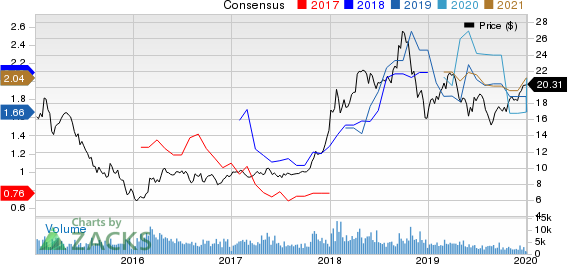

We are upbeat about Ecopetrol SA’s (NYSE:EC) prospects right now.

The company currently carries a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 or 2 (Buy) offer the best opportunities for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s take a look at the other factors that make this integrated energy firm an attractive bet.

Ecopetrol is not only the largest integrated energy firm in Colombia, it is also among the four largest energy players in Latin America. Ecopetrol is also considered among the top 50 energy firms globally.

In Colombia, Ecopetrol contributes 60% to the country’s production. The company also explores oil and natural gas in the Gulf of Mexico, Brazil and Peru. Moreover, Ecopetrol operates almost all the oil pipelines in Colombia and the nation’s largest refinery. To combat global greenhouse gas emissions, the company has been expanding its presence in the bio-fuel business.

Notably, Ecopetrol’s strong upstream operations have been backing the firm to ramp up oil equivalent production volumes over the years, thereby aiding the energy major to boost EBITDA margin. From an EBITDA margin of 37.1% in 2014, the company has increased its margin to 45.8% for the first nine months of 2019.

Moreover, to make the oil pipeline network more efficient, Ecopetrol is planning to invest $1.3 billion, which is among the company’s strategic priorities for 2019 to 2021. Per the plan, the integrated company intends to improve transportation capacity to 1,100 to 1,250 thousand barrel per day, supporting the energy major’s plan to boost EBITDA margin to 75% to 80%.

For the downstream business, the company plans to allocate $1 billion to $1.2 billion maintenance capital, as part of the strategic priorities for 2019 to 2021. This will help the firm generate throughput volumes of 370-400 thousand barrels of oil per day (MBoD), backing the company’s plan of generating refining margin of $12 to $15 per barrel.

Other Stocks to Consider

Other prospective players in the energy space are Murphy USA Inc (NYSE:MUSA) , California Resources Corporation (NYSE:CRC) and CNX Resources Corporation (NYSE:CNX) . While Murphy USA sports a Zacks Rank #1, California Resources and CNX Resources carry a Zacks Rank #2 at present.

Murphy USA’s earnings beat the Zacks Consensus Estimate in three of the prior four quarters.

California Resources’ earnings beat the Zacks Consensus Estimate in three of the past four quarters.

CNX Resources’ earnings surpassed the Zacks Consensus Estimate in two of the prior four quarters. It has a positive earnings surprise of 34.8%, on average, for the trailing four quarters.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

CNX Resources Corporation. (CNX): Free Stock Analysis Report

Murphy USA Inc. (MUSA): Free Stock Analysis Report

Ecopetrol S.A. (EC): Free Stock Analysis Report

California Resources Corporation (CRC): Free Stock Analysis Report

Original post