Shares of Boeing (NYSE:BA) jumped again Thursday, this time on the back of a positive Cowen note. Now that the aerospace powerhouse might be ready to leave the Indonesian crash headlines behind, let’s see why BA stock looks like it might be worth buying at the moment.

Recent News

Boeing stock popped Wednesday after the Wall Street Journal reported that investigators in Indonesia have started to see if maintenance issues were at fault last in month’s fatal Lion Air jet crash that involved a Boeing 737. Boeing also on Wednesday signed an agreement with state-owned Israel Aerospace Industries. The Chicago-based company’s deal, said to be worth billions of shekels, is expected to see them provide new tanker aircraft and other defense products.

On top of that, a Cowen aerospace analyst said that Boeing is his number one stock pick for 2019. Cowen's Cai von Rumohr wrote in a note that clients Thursday that Boeing is “in a production sweet spot” moving into 2019. “Most investors miss the power of BA's favorable production environment and potential to deliver extended cash flow ramp,” the analyst said. “Given visibility of a seven-year backlog and still-solid traffic growth, it would take a sharp economic slowdown to disrupt the favorable current production outlook.”

Price Movement

Cowen currently has a $445 per share price target on Boeing, which marks a roughly 33% upside from Wednesday’s closing price of $333.50 per share.

BA stock is up 23% during the last 12 months to outpace the S&P 500’s 4% climb and its industry’s 3% jump—this includes the likes of General Dynamics (NYSE:GD) , Lockheed Martin (NYSE:LMT) , and Northrop Grumman (NYSE:NOC) . Plus, Boeing stock has performed far better than one of its other main rivals, Airbus (OTC:EADSY) and its 4.1% expansion.

.jpg)

Valuation

Moving on, Boeing is currently trading at 18.7X forward 12-month Zacks Consensus EPS estimates. This does represent a slight premium compared to the S&P and its industry, which are both currently trading at 16.5X. However, BA stock has crushed these two in terms of stock price movement over this stretch.

Plus, Boeing stock has traded as high as 30.6X over the last year, with a one-year median of 22.4X. Boeing is also currently trading not too far above its one-year low of 17.6X. Therefore, we can say that BA stock looks relatively attractive at its current level.

.jpg)

Outlook & Earnings Trends

Boeing is coming off a third quarter that saw its revenues jump 4% from the year-ago period to $25.15 billion. Meanwhile, the firm’s adjusted quarterly earnings soared 37%.

Looking ahead, Boeing’s Q4 revenues are projected to pop 6.3% to $26.96 billion, based on our current Zacks Consensus Estimate. Plus, the company’s full-year revenues are expected to hit $99.85 billion, which would mark a nearly 7% jump from fiscal 2017. Jumping even further ahead, Boeing’s 2019 revenues are projected to pop 6.25% above our current fiscal year estimate.

At the bottom end of the income statement, Boeing’s adjusted Q4 earnings are expected to slip by 6%. Yet, investors should be very pleased to see that the company’s fiscal 2018 earnings are projected to surge 25%. Boeing’s following fiscal year earnings are expected to climb 20% above our 2018 projection.

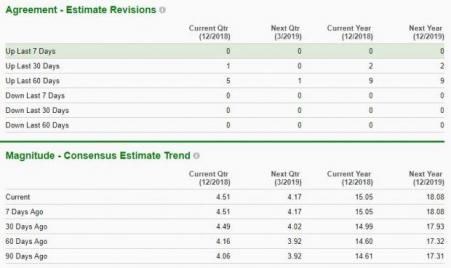

Maybe more importantly, BA’s earnings estimate revisions have been trending upward in a big way recently, as the charts below show us.

Bottom Line

Boeing is currently a Zacks Rank #2 (Buy) and boasts a “B” for Growth in our Style Scores system. The aerospace giant’s stock also currently rests roughly 14% below its 52-week high, including Thursday's climb. Therefore, Boeing might be a stock to consider at the moment, especially when we remember that BA is a dividend payer, which always comes in handy.

Boeing raised its most recent quarterly dividend to $1.71 per share, up from $1.42 in the prior year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

The Boeing Company (BA): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Original post

Zacks Investment Research