Fomento Economico Mexicano, S.A.B. de C.V. (NYSE:FMX) or FEMSA is slated to report third-quarter 2017 results on Oct 26, after the closing bell.

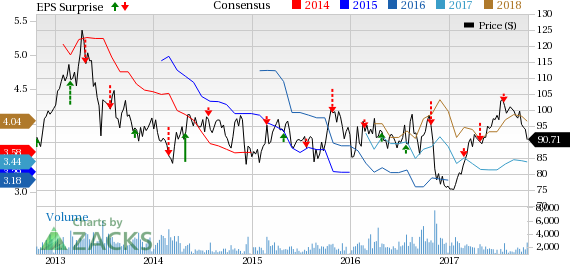

The company’s earnings have missed the Zacks Consensus Estimate in each of the trailing four quarters, with an average of 19.4%. Therefore, the question lingering in investors’ minds now is, whether FEMSA will be able to deliver positive earnings surprise in the quarter to be reported.

What to Expect?

The Zacks Consensus Estimate for the quarter under review is pegged at $1.27, which has moved up by 6 cents in the last 30 days. Additionally, analysts polled by Zacks expect revenues of $6,359 million, representing growth of more than 18% from the year-ago quarter.

Notably, FEMSA forms part of the Consumer Staples sector. As of Oct 20 Earnings Preview, the Consumer Staples sector’s earnings and revenues are expected to grow 1.8% each.

Factors Likely to Impact the Quarter

FEMSA has been grappling with soft margins for more than a year now. This can be attributed to strained margins at Coca-Cola FEMSA and growth of lower-margin businesses at FEMSA Comercio. Additionally, higher operating expenses at Coca-Cola FEMSA and FEMSA Comercio’s Health division weighed upon the company’s operating margin in the last reported quarter. Also, operating margin declined across all of the company’s segments in second-quarter 2017, barring FEMSA Comercio’s Retail division. In fact, margins were hurt by the consolidation of Coca-Cola FEMSA’s results in the Philippines as well.

Further, FEMSA has been facing difficult times due to currency headwinds, which has been weighing on Coca-Cola FEMSA’s results for a while now. We believe the continuation of these trends will impact the future results.

Consequently, FEMSA’s shares have lost 11.7% in the past three months, wider than the industry’s decline of 1.2%.

While these factors pose concern about the company’s upcoming performance, we remain impressed with FEMSA’s focus on strategic measures. These measures include increasing store count, diversifying business portfolio and focusing on core business activities. Evidently, FEMSA has been taking prudent steps to diversify its product portfolio while expanding in the small-box retail segment, which bodes well for future operating performance.

Moreover, the company’s focus on achieving growth via acquisitions bode well. Furthermore, its exposure in various industries including beverage, beer and retail, gives FEMSA an edge over competitors. In fact, the company’s strong cash flow generation capacity enables it to make incremental investments in business expansion.

So, let’s see if FEMSA’s upcoming quarterly performance can help it break the dismal earnings surprise trend backed by its strategic endeavors.

What the Zacks Model Unveils?

Our proven model does not show that FEMSA is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FEMSA has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are currently pegged at $1.27, which when combined with its Zacks Rank #5 (Strong Sell) lowers the chances of an earnings beat.

As it is we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Avon Products, Inc. (NYSE:AVP) has an Earnings ESP of +2.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Colgate-Palmolive Company (NYSE:CL) has an Earnings ESP of +0.50% and a Zacks Rank #2.

The Estee Lauder Companies Inc. (NYSE:EL) has an Earnings ESP of +0.34% and a Zacks Rank #2

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Fomento Economico Mexicano S.A.B. de C.V. (FMX): Free Stock Analysis Report

Avon Products, Inc. (AVP): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Zacks Investment Research