The Hain Celestial Group, Inc. (NASDAQ:HAIN) has recently concluded the sale of Tilda to Ebro Foods in a deal worth $342 million in cash. Part of the net proceeds from this sale will be utilized to reduce the debt level. The company is evaluating options to use the remaining amount in a way to maximize shareholder’s value.

Tilda, a premium basmati and specialty rice brand, is projected to contribute nearly $200 million to sales and $25 million of adjusted EBITDA for the fiscal year.

With this divestiture, the company hopes to lower “exposure to marketplace disruption related to the uncertainty of Brexit and any potential currency headwinds.” This move is in sync with its transformational plan that aims at simplifying portfolio, strengthening core brands, and expanding margins and cash flow. It is also eliminating low-margin or underperforming businesses to enhance the portfolio.

Keeping in these lines, Hain Celestial concluded the sale of a significant chunk of assets related to the Plainville Farms business and also divested WestSoy tofu, seitan and tempeh businesses. Moreover, the company concluded the sale of its entire equity stake in Hain Pure Protein Corporation, which incorporates the FreeBird and Empire Kosher businesses.

These apart, Hain Celestial is well on track with Project Terra, which aims at cutting costs and complexity, and aiding sales growth. The company’s Stock Keeping Unit (“SKU”) rationalization program has helped eliminate SKUs based on lower sales volume or soft margins. It is focused on global strategic goals and continues to make marketing investments in key brands.

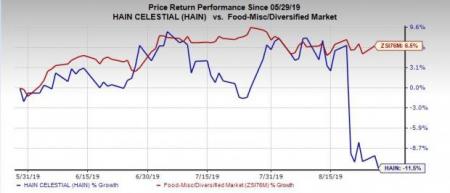

All said, we believe these initiatives to drive the company's performance. Notably, this Zacks Rank #3 (Hold) stock has declined 11.5% in the past three months against the industry’s growth of 6.5%.

Looking for Better-Ranked Food Stocks? Check These

General Mills (NYSE:GIS) currently has a long-term EPS growth rate of 7% and Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danone (OTC:DANOY) presently has a long-term EPS growth rate of 7.9% and Zacks Rank #2.

Medifast (NYSE:MED) delivered average positive earnings surprise of 5.6% in the trailing four quarters and has a Zacks Rank #2 at present.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Danone (DANOY): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

The Hain Celestial Group, Inc. (HAIN): Free Stock Analysis Report

Original post

Zacks Investment Research