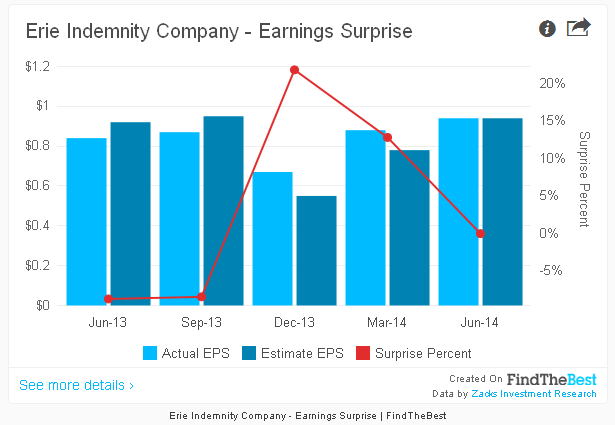

Erie Indemnity Company (NASDAQ:ERIE) reported second-quarter 2014 net income of 94 cents per share, in line with Zacks Consensus Estimate. Results improved year over year by 12%, driven by increased revenues from management operations and a low rise in expense.

The improved performance was also reflected in the share price that gained 1.19% to close at $74.09 in the last trading session.

Operational Update

Total revenue of Erie Indemnity was $1.6 billion, significantly outperforming the Zacks Consensus Estimate of $373 million. Results improved year over year by 12.1%, largely driven by a rise in the premiums earned (up 8.6% year over year) and net investment income (up 6.7% year over year).

The company’s total benefits and expenses increased 25% year over year to $1.4 billion, led by increase in insurance losses and loss expenses as well as policy acquisition and underwriting expenses.

Segments Details

Management operations of Erie Indemnity reported revenue of $374 million, up 8.7% year over year. Direct written premium of the property and casualty group (on which the management fee is calculated) improved 8%.

Premium per policy increased 4.2% year over year. Erie Indemnity’s solid policy holder retention and the increase in new policies resulted in policy growth of 4.5%.

Commissions rose 10% on higher direct written premium of the property and casualty insurance operations.

Non-commission expenses increased 2.8% to $3 million year over year.

Pre-tax income from Investment operations declined 12.5% to $7 million year over year due to low equity and earnings of limited partnerships in the reported quarter. Net investment income increased $1 million year over year.

Financial Updat

Erie Indemnity Company exited the quarter with cash and cash equivalents of $300 million, down 34% from Dec 31, 2013.

Total assets increased 4.7% to $17.4 billion from 2013 end level as of Jun 30, 2014.

Shareholder’s equity rose 2.9% to $755 million from 2013 end level as of Jun 30, 2014.

Dividend and Share Repurchase Update

The board of directors of Erie Indemnity approved a quarterly cash dividend of 63.5 cents per Class A common stock, payable on Oct 17, 2014 to shareholders of record as of Oct 2, 2014. This dividend rate represents a 7.2 % increase from the quarterly dividend rate paid in 2013.

The company spent $8.2 million to repurchase 0.1 million shares in the quarter. Notably, from the beginning of the year through Jul 18, Erie Indemnity bought back 0.3 million shares for $19.2 million. It had shares worth $18 million remaining as on Jul 18.

Zacks Rank

Currently, Erie Indemnity Company has a Zacks Rank #3 (Hold).

Performance of Other Insurance Brokers

Validus Holdings Ltd (NYSE:VR) reported second-quarter 2014 net operating income of $1.39 per share, which missed the Zacks Consensus Estimate by 4.1% but improved 35% year over year.

Brown & Brown Inc (NYSE:BRO) posted an operating net income of 38 cents per share for second-quarter 2014, falling short of the Zacks Consensus Estimate by 7.3%. However, the figure marked a year-over-year increase of 8.6% based on higher revenues.

Aon plc (NYSE:AON) second-quarter 2014 operating earnings of $1.25 per share exceeded the Zacks Consensus Estimate of $1.20 and rose 13% year over year.