Ecopetrol SA (NYSE:EC) reported net income of 3,011 billion Colombian pesos in third-quarter 2019, higher than 2,775 billion Colombian pesos in the September-end quarter of 2018. Moreover, revenues of 18,014 billion Colombian pesos improved from 17,876 billion Colombian pesos reported in the prior-year period.

The increase in crude oil transported volume primarily aided the company’s quarterly results.

Segmental Performances

Being an integrated energy firm, Ecopetrol operates through Upstream, Midstream and Downstream segments.

Upstream: The segment generated operating income of 3,340 billion Colombian pesos, which is below 3,730 billion Colombian pesos reported a year ago. The decline in realization of average oil price and lower crude production volume hurt the segment.

The company produced 660.7 thousand barrels of oil equivalent per day (mboed), down from 666.5 mboed in the September-end quarter of 2018. Crude volume — representing 82.2% of the total production — was 543.1 thousand barrels per day (mbd), down from 551.9 mbd in the prior-year quarter.

Average realized Brent oil price was $62 per barrel, down from $75.8 a year ago.

Midstream: The unit contributed operating profit of 2,359 billion Colombian pesos, up from 1,669 billion Colombian pesos in third-quarter 2018. This resulted from rise in transported volume of crude oil.

Downstream: The segment generated operating profit of 13 billion Colombian pesos, plunging from 254 billion Colombian pesos in the prior-year comparable quarter. Lower margin from Cartagena and Barrancabermeja refineries hurt the segment’s performance.

Financial Position

During third-quarter 2019, the company invested $924 million of capital. Of the total capital budget, 66% was allotted to production.

As of Sep 30, 2019, Ecopetrol had cash and cash equivalents of 9,061 billion Colombian pesos, while total debt, including short-term and long-term loans plus borrowings, was 40,407 billion Colombian pesos. The company’s debt-to-capitalization ratio was roughly 40%.

Zacks Rank & Stocks to Consider

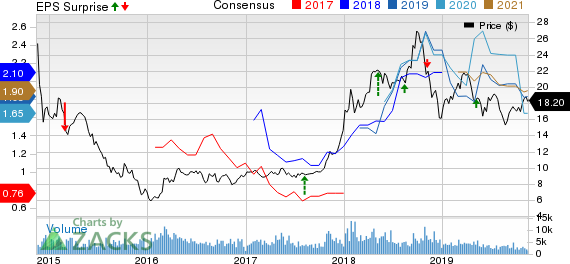

Ecopetrol currently carries a Zacks Rank #5 (Strong Sell). Some better-ranked players in the energy space include Murphy USA Inc (NYSE:MUSA) , CNX Resources Corporation (NYSE:CNX) and Contango Oil & Gas Company (NYSE:MCF) . While Murphy USA sports a Zacks Rank #1 (Strong Buy), CNX Resources and Contango Oil & Gas carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA beat the Zacks Consensus Estimate in three of the prior four quarters.

CNX Resources surpassed the Zacks Consensus Estimate in two of the prior four quarters, the average positive earnings surprise being 34.8%.

Contango Oil & Gas is likely to see bottom-line growth of 87% in 2019.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

CNX Resources Corporation. (CNX): Free Stock Analysis Report

Murphy USA Inc. (MUSA): Free Stock Analysis Report

Ecopetrol S.A. (EC): Free Stock Analysis Report

Contango Oil & Gas Company (MCF): Free Stock Analysis Report

Original post