Ecopetrol S.A. (NYSE:EC) recently agreed to acquire Chevron Corporation’s (NYSE:CVX) stake in Chuchupa and Ballena fields located in La Guajira through its subsidiary, Hocol. These are two major gas fields in the Caribbean.

Ecopetrol currently owns a 57% interest in the fields. Hocol will receive Chevron’s 43% stake in the gas fields and is expected to become the operator. Notably, daily net natural gas output in 2018 was recorded at 82 million cubic feet. While the Chuchupa Field is 7 miles off the northern coast of Colombia, the Ballena Field is partially onshore.

The financial details of the deal, which awaits green signal from the Superintendence of Industry and Commerce of Colombia, are yet to be disclosed. Notably, Ecopetrol announced its 2020 investment plan this Monday, when it stated that the company expects to invest $76 million to continue evaluation and development of offshore natural gas discoveries located in the Colombian Caribbean. Of its 2020 capital spending, 80% will likely be directed toward upstream operations. It intends to drill a total of 18 exploratory wells next year, of which 16 will be drilled in Columbia. The figure is much higher than 2019’s expected level of 12 wells.

Ecopetrol is planning to boost capital expenditure for 2020 to $4.5-$5.5 billion, up from 2019 projected level of $3.5-$4 billion, to maintain sustainable growth. Of this total amount, 78% will be directed toward projects in Columbia, lower than around 90% in the previous years. The higher level of investments is expected to increase average hydrocarbon output for 2020 to 750,000-760,000 barrels of oil equivalent per day (Boe/d), well above the 2019 expectation within 720,000-730,000 Boe/d.

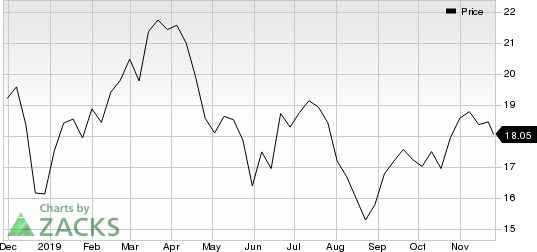

Price Performance

Ecopetrol’s shares have lost 5.8% in the past year.

Zacks Rank & Stocks to Consider

Currently, Ecopetrol has a Zacks Rank #5 (Strong Sell). Some better-ranked players in the energy space are CNX Resources Corporation (NYSE:CNX) and Contango Oil & Gas Company (NYSE:MCF) . Both these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CNX Resources’ 2019 earnings per share have witnessed three upward movements and no downward revision in the past 30 days.

Contango Oil & Gas’ bottom line for the current year is expected to rise around 87% year over year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

CNX Resources Corporation. (CNX): Free Stock Analysis Report

Ecopetrol S.A. (EC): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Contango Oil & Gas Company (MCF): Free Stock Analysis Report

Original post