Eastman Chemical Company’s (NYSE:EMN) board hiked its quarterly cash dividends by 11% to 62 cents per share from 56 cents. The revised dividend is payable on Jan 4, 2019, to shareholders on record as of Dec 17, 2018.

Eastman Chemical raised the dividend for the ninth straight year in sync with its commitment towards balanced and disciplined capital allocation and shareholders returns.

The company generated cash from operating activities of $395 million during the third quarter and returned $125 million to shareholders through stock repurchases during the quarter. Eastman Chemical returned roughly $615 million to shareholders during the first nine months of 2018 leveraging healthy free cash flows.

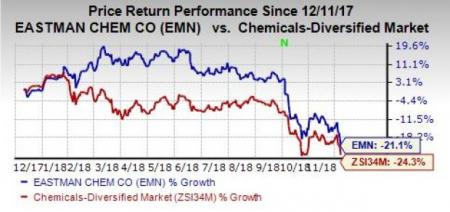

In a year’s time, shares of Eastman Chemical have outperformed the industry it belongs to. The stock has lost around 21.1% compared with the industry’s fall of 24.3%.

During the third-quarter earnings call, Eastman Chemical noted that strong volume gains in the specialty businesses, disciplined cost management and a lower effective tax rate have helped it achieve year-over-year adjusted earnings per share growth of 13% during the first nine months of 2018. The company continues to expect year-over-year adjusted earnings per share growth of 10-14% for 2018. The company also expects to generate roughly $1.1 billion of free cash flow in 2018.

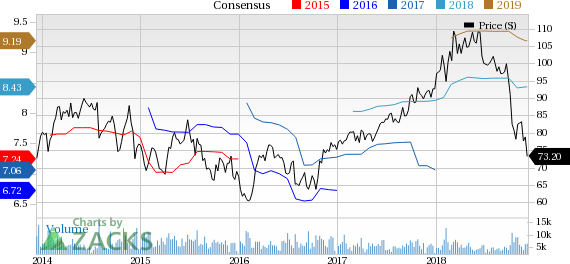

Eastman Chemical Company Price and Consensus

Zacks Rank & Stocks to Consider

Eastman Chemical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Mosaic Company (NYSE:MOS) , Gerdau S.A. (NYSE:GGB) and Ingevity Corporation (NYSE:NGVT) .

Mosaic has an expected long-term earnings growth rate of 7% and a Zacks Rank #1 (Strong Buy). The company’s shares have rallied 40.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gerdau has an expected long-term earnings growth rate of 24.3% and a Zacks Rank #2 (Buy). The company’s shares have climbed 14% in the past year.

Ingevity has an expected long-term earnings growth rate of 12% and a Zacks Rank #2. The company’s shares have gained 15.2% over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Eastman Chemical Company (EMN): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Gerdau S.A. (GGB): Free Stock Analysis Report

Original post