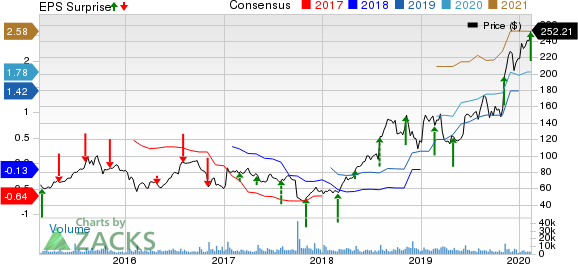

DexCom, Inc. (NASDAQ:DXCM) reported adjusted earnings of $1.15 per share in fourth-quarter 2019, which surpassed the Zacks Consensus Estimate of 75 cents by 53.3%. Moreover, the bottom line soared 105.4% from the prior-year quarter.

Total revenues surged 36.9% to $462.8 million on a year-over-year basis and also beat the Zacks Consensus Estimate by 1.3%. Rising volumes across all channels, strong new patient additions and increasing global awareness of the benefits of real-time Continuous Glucose Monitoring (CGM) contributed to the upside.

2019 at a Glance

In 2019, the company reported revenues worth $1.48 billion, which improved 43.1% from the previous year. The top line also beat the Zacks Consensus Estimate by 2.1%.

Adjusted EPS for the year was $1.84, which improved significantly from that of 2018. The figure also surpassed the consensus mark by 28.7%.

Segmental Details

Revenues at the Sensor segment (78% of total revenues) surged 42.2% on a year-over-year basis to $359.5 million. Transmitter revenues (19%) improved 45.9% year over year to $86.1 million. Receiver revenues (4%) declined 34.6% year over year to $17.2 million.

Geographical Details

U.S. revenues (81% of total revenues) climbed 33.8% on a year-over-year basis to $375.9 million. International revenues (19%) surged 52.5% year over year to $86.9 million.

Margin Analysis

Gross profit in the quarter under review totaled $309.3 million, up 38.8% year over year. However, DexCom generated gross margin (as a percentage of revenues) of 66.8%, which expanded 90 bps year over year.

Research and development (R&D) expenses amounted to $78.8 million in the quarter, up 36.8% year over year. Selling, general and administrative expenses totaled $129 million in the reported quarter, up 15.1% year over year.

The company reported total operating expenses of $207.8 million, down 46.4% year over year.

The company reported operating income of $101.5 million, against the year-ago quarter’s operating loss of $164.9 million.

Financial Position

As of Dec 31, 2019, DexCom had $1.53 billion in cash and marketable securities.

Total cash and cash equivalents came in at $446.2 million, which plunged 60.8% from the prior-year quarter.

2020 Guidance

DexCom expects revenues to range between $1.73 billion and $1.78 billion. The Zacks Consensus Estimate for revenues is currently pegged at $1.75 billion.

Gross profit margin is projected to be around 64% of net revenues.

While adjusted operating margin is expected to be about 13% of net revenues, adjusted EBITDA margin is anticipated to be 23%.

Wrapping Up

DexCom exited the fourth quarter on a strong note, wherein both earnings and revenues beat the Zacks Consensus Estimate. Impressive contributions from the Sensor and Transmitter segments were key catalysts. Expansion in gross margin is a positive. Strong guidance also instills investor optimism in the stock.

Additionally, the glucose monitoring market presents significant commercial opportunity for this company. DexCom’s opportunities in alternative markets such as the non-intensive diabetes management space, the hospital, gestational, pre-diabetes and obesity are likely to provide it a competitive edge in the MedTech space. Notably, during the fourth quarter, the company commenced launch of G6 into Medicare.

Meanwhile, cut-throat competition in the market for blood & glucose monitoring devices remains a concern.

Zacks Rank

Currently, DexCom carries a Zacks Rank of 3 (Hold).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks which reported solid results this earning season are Stryker Corporation (NYSE:SYK) , Accuray Incorporated (NASDAQ:ARAY) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) . You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2.

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, beating the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Stryker Corporation (SYK): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Original post

Zacks Investment Research