Strong momentum in H218 has ensured yet another successful year for Deutsche Grundstuecksauktionen AG (DE:DGRG). Boosted by a bumper €15m Q1 auction lot, 2018 saw a 30% rise in both net profit and dividend as surplus cash (DGA has no debt) allows full profit distribution. The current year has also started well with Q1 gross turnover and net commission slightly above the average of last 10 years and positive indications for Q2 auctions. While 2018 will be a hard act to follow thanks to that bumper sale, the offer of further high-value lots is not wishful thinking, given DGA’s good relationship with the Federal Bundesanstalt and excellent publicity as a reference sale. Therefore management’s target for 2019 gross turnover of €109m (average of last five years) may prove cautious.

Satisfactory H218

While not repeating the exceptional-led step-change in financials of H1, DGA’s H2 performance (see page 2), was creditable, matching year-on-year gross turnover, which had been buoyed by the most valuable item then to date at €7m. Also, the net commission rate improved markedly (9.9% vs 9.5%) despite continued price appreciation (average sales price up 8%). As in the first half, the parent company, which bears central costs, was unusually profitable (more than doubled at the net level) but this was substantially offset by a c 30% fall in the subsidiaries’ contribution on 5% lower gross sales. Regional volatility, if acute in the period, is characteristic of DGA and performances tend to compensate for each other.

More of the same

A favourable outlook statement reflects reiteration of positive fundamentals, notably interest rates, disposable income and employment. Management’s 2019 aim of reaching the average gross turnover of the last five years (€109m) appears undemanding as that would only be flat, adjusted for 2018’s €15m exceptional, and ignores further high-value lots. 8% higher adjusted Q1 gross turnover is complemented by encouraging signs from imminent summer auctions.

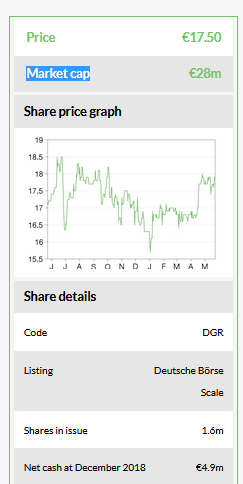

Valuation: Generous yield

While 2018 set a high bar, DGA’s pride in its dividend record (increased for five years in a row) and strong finances (€5m net cash at end 2018 vs €1.6m historical dividend cost) suggest that its payout may at least be maintained. A historical yield of almost 6% is well ahead of that of the small cap market (no direct listed peer).

Business description

Deutsche Grundstücksauktionen AG is market leader in the auctioning of properties in Germany. The company was founded in Berlin in 1984.

Bull

Sustained demand for property thanks to favourable economic and interest rate outlook.

Clear market leader with experienced management and wide client base.

Sound finances, allowing generous, unbroken dividend record.

Bear

Macroeconomic uncertainties; rising interest rates would diminish yield appeal of property.

Intensely competitive.

Potential supply shortage as a result of excess demand and unrealistic seller expectations.

The financial statements are in accordance with HGB. DGA, the parent company, is influenced to a considerable extent by the results of its fully owned subsidiaries but is not obliged to present consolidated accounts and management reports. As a result of profit transfer agreements with its five subsidiaries, the total result of the group is therefore shown in the statements of the parent company.

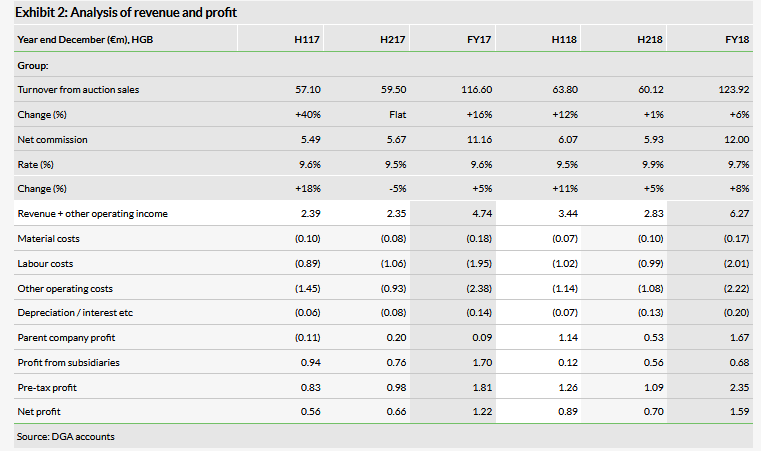

Consequently, for the sake of clarity we show (shaded below) both gross turnover (auction sale proceeds) and net commission at the group level, as these drive the transferred profits. They are also regarded by management as key indicators. However, they are, of course, only proxies for the subsidiaries’ revenue, which is not disclosed, so accurate top-line analysis is not possible.

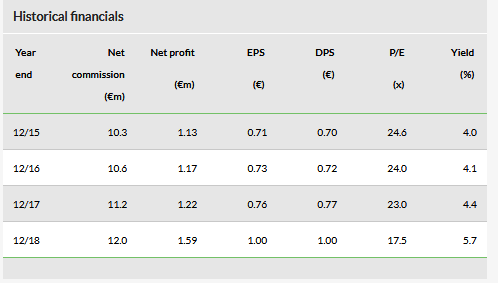

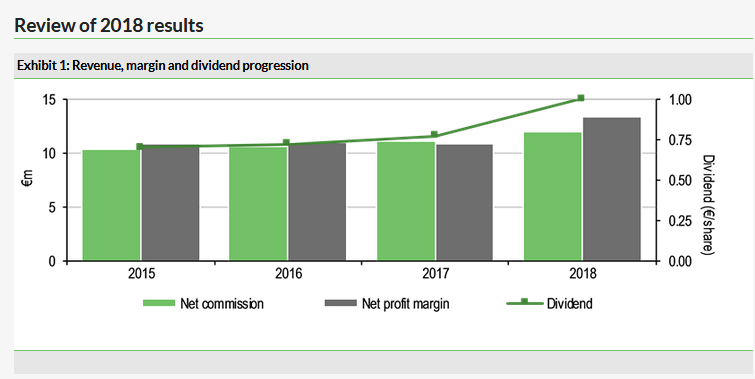

2018 gross turnover was the second best in the company’s history and the highest since the financial crisis. The 6% increase built on an already buoyant 2017, which was up 16%, driving further steady improvement in net commission, net profit and in particular the dividend, as shown in Exhibit 1. Again, it was a year of two halves as H2 top-line and net profit consolidation contrasted with the exuberance (net profit up c 60%) of the first, which was flattered by the bumper lot sale in Berlin.

Given our H1 results review, we focus here on second half performance. Despite the volatility of quarterly auctions (the 11% rise in Q3 gross turnover was substantially offset in subsequent winter auctions), total sale proceeds were maintained at the high level of the three previous second halves. Individual auction house businesses are also inevitably volatile but they tend to compensate for each other; the subsidiaries’ composite reduction of 5% in H2 was more than made up by the parent company’s 10% higher outturn despite the demanding comparative of the €7m Berlin area lot sale in Q4, then a record for the group.

Second half net commission (effectively revenue in terms of company accounts) was up slightly by 5% y-o-y at a rate of 9.9% against 9.5% (see Exhibit 2). This was despite the mix of lots sold (average sales price up 8% at €70,000) and consequently rates, which were lower and indeed potentially negotiable.

Good prospects

While understandably prudent after a bumper year, management guidance for 2019 remains upbeat after auction sale proceeds and net commission in Q1 slightly above the average for the last 10 years and positive indications of the volume of deliveries for the summer auctions in June. Gross turnover, adjusted for Q118’s €15m record transaction, rose by 8% to €23.5m with a sales ratio of almost 90%, up from an already impressive 84%, which confirms the strength of demand for real estate. The net commission rate was appreciably higher (10.5% vs 9.0%), even if such a high-value item was presumably at a lower than average commission rate.

The target for full year gross turnover is the average of the last five years (€109m). This is €15m down on 2018 (€123.9m), thereby effectively excluding the benefit of last year’s bumper sale. Management expectation is thus for underlying proceeds simply to be maintained. Q1’s performance (up 8% adjusted, as mentioned above) suggests this may be cautious. Also, importantly, guidance assumes such a high-value transaction to be exceptional but the company has a good relationship with the Federal Bundesanstalt, so the offer of further such lots is not wishful thinking. The deal brought DGA excellent publicity in terms of using the auction channel for substantial items and as a reference sale in the valuable Berlin market

Balance sheet and cash flow

Finances remain sound with €4.9m net cash at December 2018 (up €1.6m in the year). Surplus cash (the company has no debt) allows profit to be distributed almost entirely by way of dividend. Management is proud of its dividend record and well aware of investor demand for attractive yield at a time of low interest rates.

Valuation

With no direct peer listed on the Frankfurt Stock Exchange, we look at the iShares MSCI Germany Small-Cap ETF, which seeks to track the investment results of an index composed of small-cap German equities. This shows a historical P/E ratio of 13.9x (DGA 17x) and 12-month trailing yield of 2.4% (DGA 5.7%). As noted above, the history of a sustained and attractive dividend should lend support to the shares.