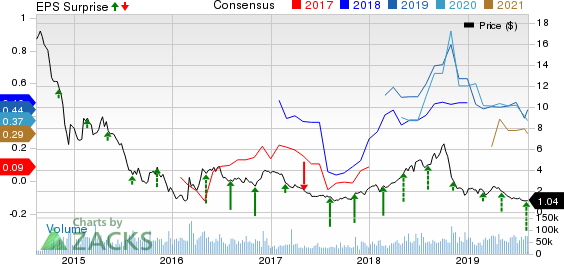

Denbury Resources Inc. (NYSE:DNR) recently reported earnings of 13 cents per share (excluding one-time items) in second-quarter 2019, beating the Zacks Consensus Estimate of 9 cents. The reported earnings were flat year over year.

Total revenues were $343 million, down from $387 million in the year-ago quarter. However, the top line beat the Zacks Consensus Estimate of $332 million.

The better-than-expected results were supported by higher commodity price realizations and cost efficiency. However, the positives were partially offset by lower production volumes.

Operational Performance:

Production Declines

During the quarter, production averaged 59,719 barrels of oil equivalent per day (Boe/d) compared with 61,994 Boe/d in the prior-year period.

Oil production averaged 58,034 barrels per day (BPD), down from the year-ago level of 60,109 BPD. Natural gas daily production averaged 10,111 thousand cubic feet (Mcf/d), lower than the year-ago period’s 11,314 Mcf/d.

The company’s production from tertiary operations averaged 38,423 Boe/d, up from 38,079 Boe/d in the year-ago quarter.

Notably, it achieved a 50% year-over-year increase in production from Bell Creek to 5,951 Boe/d in the reported quarter.

Price Realization Up

Oil price realization (including the impact of hedges) averaged $61.92 per barrel in the quarter, increasing from the year-ago level of $58.23. Gas prices declined to $2.01 per Mcf from $2.21 in the year-ago quarter. On an oil-equivalent basis, overall price realization was $60.52 per barrel, higher than the year-earlier level of $56.86.

Cost & Expenses

During the quarter, the company incurred lease operating expenses of $117.9 million, lower than the year-ago period’s $120.4 million. Costs related to transportation and marketing rose to $11.2 million from the year-ago level of $10.1 million. CO2 discovery and operating expenses also increased to $581 thousand from $500 thousand in second-quarter 2018.

Capital Expenditure

Oil and natural gas capital investments were approximately $56 million compared with $72.3 million in the year-ago quarter. Total capital spending (excluding capitalized interest and acquisitions) was $76.9 million, lower than $81.6 million in second-quarter 2018.

Financials

Cash flow from operations was $148.6 million, down from $154 million in the year-ago quarter.

As of Jun 30, 2019, cash balance was around $0.3 million and total debt was $2,480.9 million, with a debt-to-capitalization ratio of 66.1%.

Guidance

Denbury expects to generate free cash flow in the range of $120-$150 million in 2019, assuming oil price to be $55 per barrel. The company tightened its 2019 production guidance from 56,000-60,000 Boe/d to 57,000-59,500 Boe/d, improving the midpoint from 58,000 Boe/d to 58,250 Boe/d, even after the divestment of the Citronella field on Jul 1. Capital expenditure view is reiterated in the range of $240-$260 million, indicating 20-25% decline from the 2018 capital spending level.

Zacks Rank and Stocks to Consider

Currently, Denbury has a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy sector are given below:

Transportadora de Gas del Sur S.A. (NYSE:TGS) is a midstream energy firm. In the trailing four quarters, the company delivered average positive earnings surprise of 114%. It has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

World Fuel Services Corporation (NYSE:INT) is an oil and gas refining and marketing company. The company beat estimates in the trailing four quarters, delivering average positive surprise of almost 16.4%. The company has a Zacks Rank #2 (Buy).

Dril-Quip, Inc. (NYSE:DRQ) is a provider of oilfield services for upstream energy companies. In the trailing four quarters, the company delivered average positive earnings surprise of almost 49%. It has a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Dril-Quip, Inc. (DRQ): Free Stock Analysis Report

World Fuel Services Corporation (INT): Free Stock Analysis Report

Transportadora De Gas Sa Ord B (TGS): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Original post

Zacks Investment Research