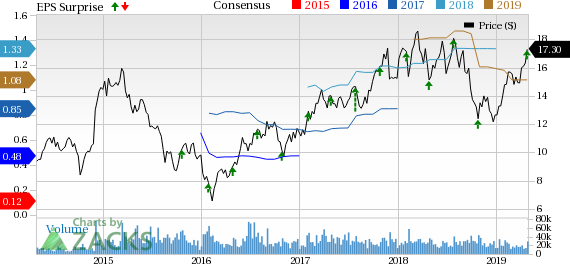

Cypress Semiconductor (NASDAQ:CY) reported first-quarter 2019 non-GAAP earnings of 27 cents per share, beating the Zacks Consensus Estimate by 3 cents. The figure was down 22.9% sequentially but flat year over year.

Revenues of $539 million surpassed the Zacks Consensus Estimate of $535 million. The figure reflects a year-over-year decline of 7.4%.

During the quarter, the company experienced softness in all end-markets served, namely automotive, legacy and IoT.

On Apr 1, Cypress closed its joint venture (JV) with SK hynix system ic, Inc. Post this move, the company expects to focus more on industrial, automotive and IoT end markets.

Top Line in Detail

In Terms of Business Unit: Cypress reports in two organized segments, namely Microcontroller and Connectivity Division (“MCD”), and Memory Products Division (“MPD”).

MCD: This segment generated revenues of $310.4 million (57.6% of the total revenues), down 7.8% year over year and 12.8% from the fourth quarter.

MPD: The segment generated revenues of $228.6 million (42.4% of revenues), down 8.1% sequentially and 6.9% on a year-over-year basis.

In Terms of End Market: The company operates in three high-growth markets, namely IoT, Automotive and Legacy end markets.

IoT: The company generated 28.5% of revenues from this market, down 300 basis points (bps) sequentially and 340 bps year over year, due to softness in wireless connectivity and consumer end markets, along with declines at Nintendo.

Automotive: This market generated 36.7% of its total revenues, up 120 bps from the fourth quarter and 240 bps from the year-ago period, due todeclines in automotive NOR. Automotive microcontrollers and wireless connectivity revenues increased 12% and 17% year over year, respectively, as large platform wins begin to ramp.

Legacy: Cypress generated 34.8% of revenues from this market, up 180 bps sequentially but down 100 bps on a year-over-year basis, due to continued softness in industrial and enterprise customers.

Operating Details

In the first quarter, Cypress’ gross margin was 47.4%, down 40 bps sequentially but up 150 bps from the prior-year period.

Per the company, operating expenses were $170.6 million (31.6% of revenues), down 3.4% sequentially.

Operating margin was 21.1%, up 160 bps from the year-ago quarter but down 340 bps on a sequential basis.

Balance Sheet and Cash Flow

At the end of the first quarter, cash, cash equivalents and short-term investments totaled $285.1 million compared with $285.7 million in the fourth quarter. Accounts receivables were nearly $266.4 million, down from $324.3 million in the fourth quarter.

Inventory grew to $316.9 million from $292.1 million in the fourth quarter.

Cypress generated $61.2 million cash from operations, down from $142.2 million in the fourth quarter. Further, the company generated free cash flow of $50.7 million during the first quarter. CapEx was $10.5 million in the quarter.

Guidance

For second-quarter 2019, Cypress expects revenues in the range of $515-$545 million.The Zacks Consensus Estimate for second-quarter revenues is pegged at $531 million.

Non-GAAP earnings per share for the first quarter are anticipated in the range of 22-26 cents. The Zacks Consensus Estimate for second-quarter revenues is pegged at 25 cents.

The company anticipates non-GAAP gross margin between 47% and 47.5%.

Zacks Rank & Stocks to Consider

Cypress currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the broader technology sector include Juniper Networks (NYSE:JNPR) , Ctrip.com International, Ltd. (NASDAQ:CTRP) and Square (NYSE:SQ) . While Juniper sports a Zacks Rank #1 (Strong Buy), both Ctrip.com and Square carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Juniper, Ctrip.com and Square is currently projected at 7.05%, 23% and 25%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Square, Inc. (SQ): Free Stock Analysis Report

Ctrip.com International, Ltd. (CTRP): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Original post

Zacks Investment Research