Citigroup Inc. (NYSE:C) announced that it expects to achieve a pretax gain of about $150 million from the divesture of Hilton Honors credit card portfolio to American Express Company (NYSE:AXP) . The deal is expected to be completed by first-quarter 2018.

Citigroup’s partnership with Hilton Honors was scheduled to be terminated by the end of this year. The bank disclosed that the pretax gain amount approximates one year of revenues achieved from the portfolio.

Last week, the central bank gave the final nod to the agreement whereby Citigroup shall sell its retail banking unit in Brazil to Itaú Unibanco Holding SA (NYSE:ITUB) for $220 million.

Also, Citigroup has undertaken a lot of restructuring initiatives of late with an aim to focus on core operations. In September 2017, the New York-based bank announced its plan to hire around 100 wealth advisers over the next three years to strengthen its share of high-net worth individuals in Australia. It targets to triple the number of wealthy customers in the country.

Further, in order to sustain the effect of the United States retreating from global business, Citigroup expedited its move to expand corporate banking across the Asia-Pacific region. The bank made new recruits in the region with a view to boost lending volumes.

Also, in April 2017, Citigroup bolstered its revenues by obtaining a license to conduct capital markets business in Saudi Arabia. With this license, the bank would be able to provide investment banking services including debt and equity capital markets operations in the region.

Citigroup’s efforts to streamline international businesses will support revenue growth and drive operational efficiency. However, pending legal hassles are likely to weigh on its financials.

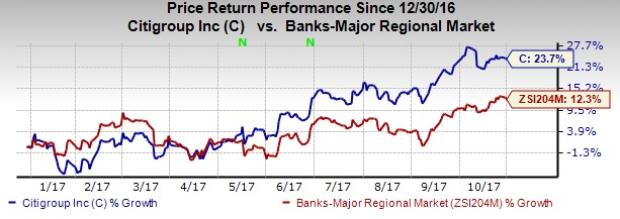

Shares of Citigroup have gained 23.7% year to date, outperforming the industry’s rally of 12.3%.

Currently, Citigroup carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Another Wall Street Giant PNC Financial Services Group (NYSE:PNC) is worth taking a look. It currently carries a Zacks Rank #2 (Buy) with the Zacks Consensus Estimate for its current-year earnings being revised nearly 1% upward over the last 30 days. Also, its shares have gained 17% so far this year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Itau Unibanco Banco Holding SA (ITUB): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Original post

Zacks Investment Research