Cheniere Energy Partners, L.P. (NYSE:CQP) — a subsidiary of liquefied natural gas exporter Cheniere Energy, Inc. (NYSE:LNG) — recently announced the completion of its fourth liquefaction train at Louisiana facility.

Construction of the Train 4 of the Sabine Pass liquefaction project was completed by the contractor Bechtel Oil, Gas and Chemicals, Inc. On completion, Bechtel handed over custody of the train to Cheniere Energy Partners which is ready to operate. Train 4 is set for first commercial delivery in March 2018 under a 20-year sale and purchase contract with GAIL (India) Limited. With the completion of Train 4, revenues of the partnership are likely to benefit from increased LNG sales.

Cheniere Energy Partners intends to construct six liquefaction trains at Sabine Pass. Each train has an estimated nominal production capacity of 4.5 million tons per annum of liquefied natural gas. Construction of the Trains 1, 2 and 3 had been completed in March. First commercial delivery for Train 3 took place in June under a 20-year supply contract with Korea Gas Corporation.

The partnership’s request for regulatory approvals in March to commence commissioning activities at Train 4 has been granted. With the completion of the Train 4 on Oct 9, the total capacity at the export terminal has risen from 13.5 million tons per annum (Mtpa) to 18 Mtpa. Train 5 is under construction and is expected to begin exporting in the second half of 2019. Train 6 is being commercialized and has secured the necessary regulatory approvals.

Cheniere Energy Partners is also developing a liquefaction and export terminal in Corpus Christi, TX. While Train 1 and 2 are under construction, a permission regarding the same for Train 3 has been secured.

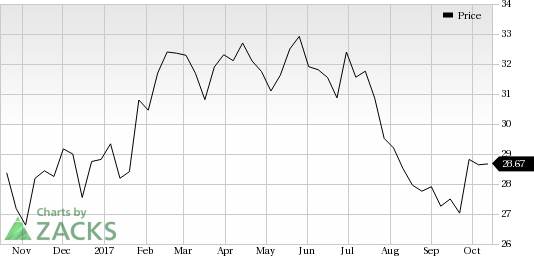

Houston, TX-based Cheniere Energy Partners is an energy partnership focused on liquefied natural gas-related businesses. It owns and operates liquefied natural gas receiving terminals and liquefied natural gas pipelines in Louisiana and Texas. The partnership carries a Zacks Rank #5 (Strong Sell).

Some better-ranked players in the same industry are TransCanada Corporation (TO:TRP) and Ultrapar Participacoes S.A. (NYSE:UGP) . Both companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

TransCanada posted an average positive earnings surprise of 4.06% in the trailing four quarters.

Ultrapar Participacoes delivered positive earnings surprise of 2.33% in the trailing four quarters.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Cheniere Energy Partners, LP (CQP): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Ultrapar Participacoes S.A. (UGP): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Original post

Zacks Investment Research