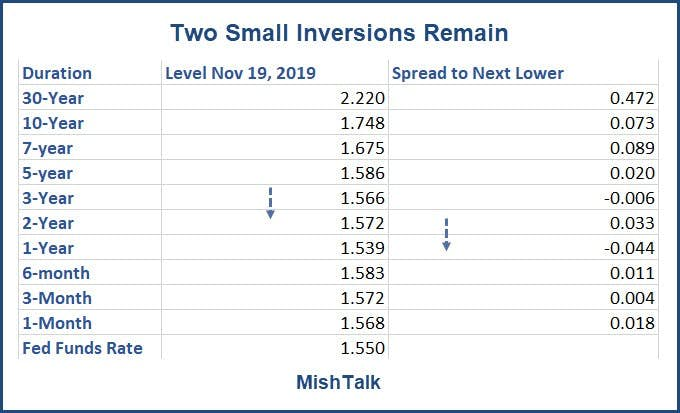

It's been about a month since I last posted on the yield curve. Let's take a current snapshot.

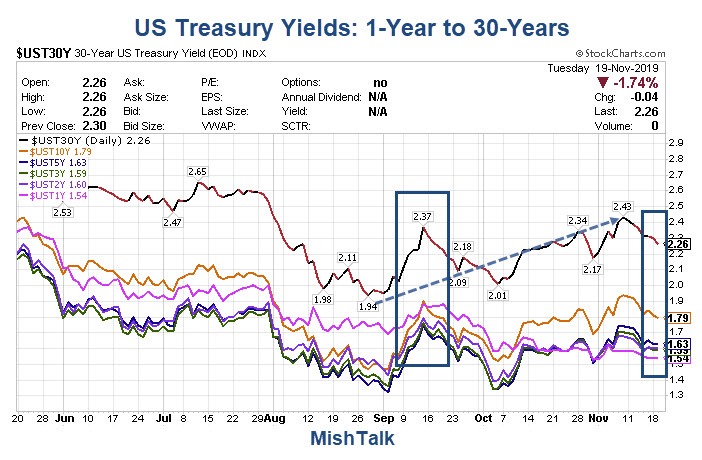

US Treasury Yields 1-Year to 30-Years

The 30-year long bond set a new record low end-of-day yield of 1.94% in late August.

Yields then went on a tear, with the 30-year scorching up to 2.37%. In that time, the yield curve remained strongly inverted throughout. Note the 1-year yield (pink line) was higher than the 10-year yield (orange line) through early October.

It was not until early November that the yield curve mostly uninverted. Only two small inversions remain now as shown in the lead chart.

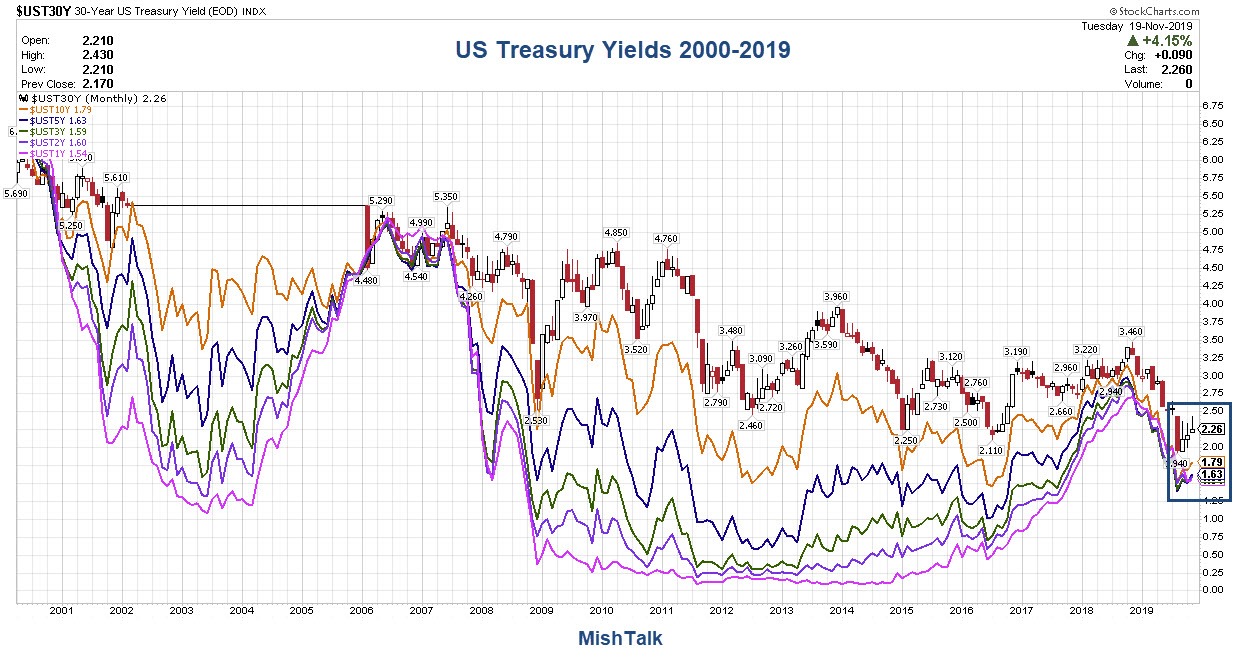

US Treasury Yields 2000 - 2019-11-19

The larger picture shows not much has changed. Bounces in yields come and go.

Attitudes, however, have changed. People have written off the recession because of steepening of the yield curve.

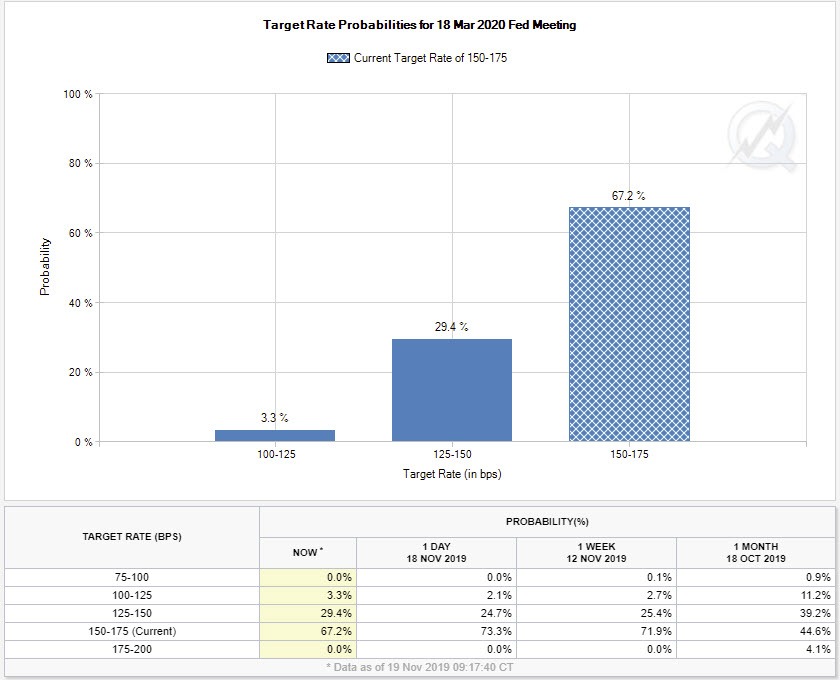

Rate Cut Odds

The financial markets have written off interest rate cuts by the Fed all the way until June of 2020.

Day of Reckoning

As part of the amazing complacency, Fed Chair Jerome Powell Says "Day of Reckoning" Far Off

Color me skeptical.

Note that GDP Estimates Crashed on Dismal Economic Reports.

And in particular, Freight Volumes Negative YoY for 11th Straight Month, sounding a strong recession warning.