Celanese Corporation (NYSE:CE) announced that it will increase the list and off-list selling prices for certain acetyl intermediate products, including Vinyl Acetate Monomer and Acetic Anhydride. The price hike is effective immediately or as contracts allow.

The company will raise the price of Vinyl Acetate Monomer in China by RMB 200/MT. Prices in Asia (outside China) are slated to increase by $50/MT. The prices of Acetic Anhydride will be raised in the U.S. & Canada, Latin America and Europe by $0.025/LB, $60/MT and €50/MT, respectively. Celanese will also hike prices for Ethyl Acetate in Europe by €150/MT.

The company is increasing prices of various products due to a rise in raw material costs. Celanese witnessed raw material price inflation in its Acetyl Chain business in the last reported quarter. The company’s pricing actions are expected to support its margins and top line in 2017.

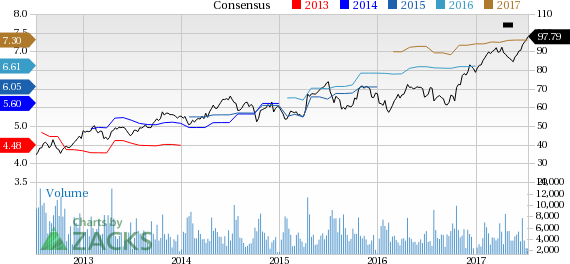

Celanese has outperformed the Zacks categorized Chemicals-Diversified industry in the last three months. The company’s shares have moved up around 9.7%, compared with roughly 6.2% gain recorded by the industry.

Celanese’s strategic measures including cost savings through productivity actions are expected to lend support to its earnings in 2017. The company is also likely to gain from capacity expansion and growth initiatives like acquisitions. Moreover, Celanese remains focused on returning value to shareholders.

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium S.A. has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Celanese Corporation (CE): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research