Cardinal Health Inc. (NYSE:CAH) reported third-quarter fiscal 2017 adjusted earnings of $1.53 per share, which beat the Zacks Consensus Estimate of $1.46 and increased 7% on a year-over-year basis.

Revenues increased 4% on a year-over-year basis to $31.8 billion. The figure, however, came below the Zacks Consensus Estimate of $32.5 billion.

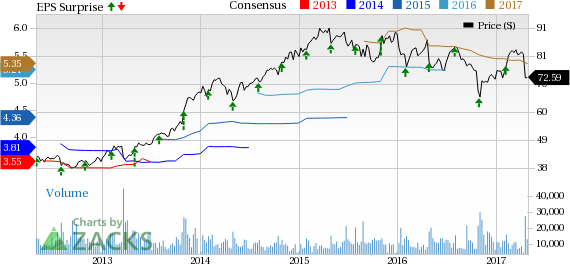

Stock Performance

In the last three months, the stock lost 2.57%, underperforming the Zacks classified Medical - Dental Supplies sub-industry’s gain of almost 6.55%. Also, the current level compares unfavorably with the S&P 500’s return of 5.42% over the same time frame.

However, a long-term expected earnings growth rate of 7.43% instills confidence in investors.

Quarter Details

Pharmaceutical revenues increased 3% to $28.4 billion due to strong growth from net new and existing distribution customers. Strong performance by the Specialty business also drove results.

Medical segment revenues increased 9% to $3.4 billion primarily due to higher contribution from net new and existing customers.

Pharmaceutical segment profit in the quarter decreased 7% to $611 million due to generic pharmaceutical pricing and the loss of a large Pharmaceutical Distribution customer. This was partially offset by solid performance by Red Oak Sourcing.

Medical segment profit soared 16% to $148 million due to higher contribution from Cardinal Health Brand products and distribution services.

Distribution, selling, general and administrative (SG&A) expenses increased 5% on a year-over-year basis to $960 million in the reported quarter. Net income declined 1% to $381 million from year-ago quarterly number of $386 million.

Financial Condition

Cash and cash equivalents were $1.39 billion as of Mar 31, 2017 compared with $2.36 billion as of Jun 30, 2016. Long-term debt was $4.85 billion as of Mar 31, 2017 compared with the Jun 30, 2016 level of $4.95 billion.

Guidance

The company reaffirmed fiscal 2017 guidance range for adjusted earnings per share from continuing operations of $5.35–$5.50. The outlook represents growth of approximately 2–5% from the prior fiscal year.

Zacks Rank & Stocks to Consider

Currently, Cardinal Health carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader medical sector include Inogen Inc. (NASDAQ:INGN) , Hologic, Inc. (NASDAQ:HOLX) and Sunshine Heart Inc (NASDAQ:SSH) . Notably, all the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inogen has a long-term expected earnings growth rate of 17.50%. The stock represents an impressive one-year return of 66.7%.

Hologic has a long-term expected earnings growth rate of 11.33%. The stock has a solid one-year return of roughly 31.5%.

Sunshine Heart posted a positive earnings surprise of 58.24% in the last reported quarter. The stock recorded a stellar EPS growth rate (last 3–5 years of actual earnings) of almost 22%.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500. See today's Zacks "Strong Sells" absolutely free >>

Hologic, Inc. (HOLX): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Sunshine Heart Inc (SSH): Free Stock Analysis Report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Original post