Yesterday was an active trading day. I sold 90 share of the diversified investment group NYSE Euronext (NYX) at $36.50 and bought 100 shares of Coca Cola (KO).

No further fantasy for NYSE Euronext Shares

I sold NYX shares because the stock price is around 10% over the takeover price announced by the IntercontinentalExchange (ICE). I believe that it could be possible that another exchange could start a second offer, and overbid the current price. So my sell-off was only a part of my full position. With the rest I could benefit from a higher offer. However, fantasy with the NYX is over. I don’t see any growth perspectives if the deal passes through. ICE, CME and BOCE are much more interesting now.

My whole NYX stake was up around 40% and I like to hedge these gains. Now, everything is nearly safe and my big risk in this position is off.

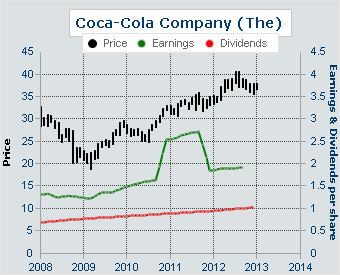

In addition, I bought some shares of Coca Cola (KO) and increased my stake by a significant number. KO was the best performing of my core holdings over the recent years, but compared to the other stocks I own, it is still an underperformer.

Cocal Cola is down, but long-term still a buy

KO was down 2.72% yesterday. The earnings results were solid but the market expected more. I don’t really care about the current price levels and quarter reports as they change too fast. I am a long-term investor. I bought KO shares several times andalways increased my position at a higher rate. That’s not a good choice but if my portfolio grows, I need to increase the total amount of my safe heaven core holdings.

I love stocks with very long dividend growth, a trustful managements and solid market positions in several markets worldwide. KO is definitely not cheap. The EV/EBITDA ratio is at 14! The yield is still acceptable at 2.72%. I expect that the yield should climb over 3% with the next dividend hike.

I have several beverage stocks and they all have a very high valuation. I don’t know why but in there is a huge fight in the marketbout big companies with strong brands and distribution power.

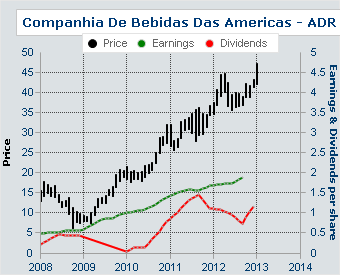

Companhia de Bebidas Das Americas offers a higher risk

Companhia de Bebidas Das Americas (ABV) is an aggressively buying company in the brewing industry. They lend huge amounts of debt to buy the biggest brewers in the world. I don’t like those offensive strategies, especially when they pay prices at 14x of the EBITDA, but they are somehow successful and the stock prices explode. KO is not cheap but solid. I believe that it should be possible to realize a yearly long-term return of 8% or more.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bought KO Shares;Sold NYSE Euronext

Published 02/13/2013, 05:55 AM

Updated 07/09/2023, 06:31 AM

Bought KO Shares;Sold NYSE Euronext

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.