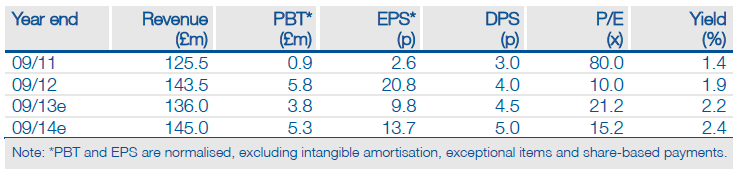

Avesco (AVS.L) finally looks set to receive its US$60m (£40m) payout from the Disney/Celador case within the next few months – earlier than we expected – and has reiterated that it intends to distribute the ‘majority’ of the net proceeds to shareholders. Meanwhile, the small Q1 loss announced last week was slightly better than our estimate and our full-year numbers are unchanged. With potentially 150p of the share price accounted for by the Disney proceeds, the P/E for the rest of the business is only 5.0 times (averaging FY13 and FY14 earnings) and the NAV of 149p per share is backed by high-quality rental assets.

Worth the wait

After a lengthy appeal process Disney has failed to overturn a US jury’s 2010 award of US$320m (£210m) to Celador and the judgement is finally collectible. Avesco announced on 8 March that it expects to collect its US$60m (£40m) share in a few months’ time. The ‘majority’ of the net monies (after costs and taxes) are expected to be distributed to shareholders. Avesco has not yet announced the likely structure of any distribution, but we would imagine it could include both dividend and capital options.

Running a tight ship in FY13

The timing of major events and exhibitions means that Avesco usually experiences stronger trading in ‘even’ years than in ‘odd’ ones, and has some lumpiness in quarterly results. In Q113 this was exacerbated by post-Olympics indigestion in the UK and fiscal cliff worries in the US, but the trading loss was modest at £135,000 (Q1 FY12: profit of £66,000). Q2 trading has shown “encouraging signs” and with China on track to turn in a full year profit (versus a loss of over £1m in FY12) we are leaving our estimates unchanged. There was a capex bulge for the Olympics in FY12 (to £30m) and with such a well-invested rental base we expect a sharp fall (to £16m) in FY13. On this basis we expect net debt to decline to £23m by September.

Valuation: Once payout is known, back to business

Within the next few months investors should know the size, structure and timing of the distribution to shareholders, at which point attention will refocus on the core business. Post the recent investment the rental base is in very good shape, albeit facing tough trading in some markets. We consider it appropriate to average earnings over odd and even years; allocating a potential 150p to Avesco’s Disney windfall puts the rest of the business on a modest FY13/14 P/E of 5.0x and an EV/EBITDA of 2.9x.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Avesco: Running A Tight Ship In FY13

Published 03/19/2013, 08:12 AM

Updated 07/09/2023, 06:31 AM

Avesco: Running A Tight Ship In FY13

Payout finally in sight

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.