Financed Through To FS Release (and beyond)

Avalon (AMEX:AVL) has announced it has successfully closed a raising for gross proceeds of US$4.0m (c US$3.6m net) via the issue of 9.2m units (comprising one common share and 0.7 of a warrant exercisable into one common share at US$0.56 over a 6.5-year term, starting six months after first issue) at US$0.433 each, allowing it to complete its highly anticipated optimised feasibility study (FS) due in August 2014. This FS will outline all the work Avalon has undertaken to both improve the economics and de-risk the execution of its flagship Nechalacho REE project. Avalon has also started a small US$0.5m investment in its East Kemptville tin-indium project in Nova Scotia, a result of recent strength in the tin market.

REE Market Fundamentals Do Not Go Away

Chinese dominance in global REE supply has led to significant illegal mining and, by extension, environmental damage in the country. To tackle both problems, the Chinese government implemented a policy in 2011 to crack down on illegal mining, restricting the supply of these metals to market and looking to clean up the entire REE mining sector. With REE prices depressed, market speculation is that the Chinese could restrict supply further, thereby driving prices up, and in doing so use the higher mining taxes gained to tackle the cost of environmental remediation.

Tin Assets Being Explored (tin at US$23,100/t)

Avalon has always positioned itself as a diversified company with numerous projects containing different and valuable, though sometimes lesser known, metals. With recent Chinese and Indonesian supply restrictions of tin causing its price to rally upwards of US$23,100/t, Avalon has sought to investigate its brownfield East Kemptville tin-indium project in Canada. Surface access rights have been successfully gained and a US$0.5m programme of investigation that will include drilling and completion of a PEA (due end 2014) has started.

Valuation: Revised FS To De-risk Project Execution

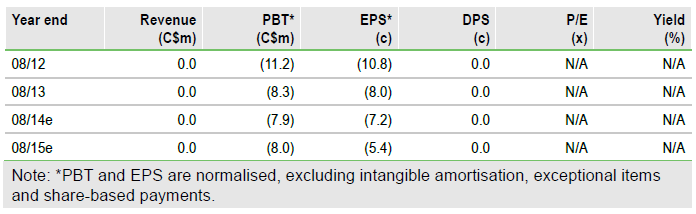

Our current base case valuation is based on Avalon’s April 2012 FS revised for its FY14 interim financial results. Due to minor delays in completing the optimization studies, we also revise our assumption for commissioning the Nechalacho processing plant to 2017 (previously 2016). Our assumptions of a 2015 C$35m equity raise (at a revised C$0.60 per share) and a 30% strategic partner sell-down (for C$270m) to 2015 (previously 2014) are also revised. This results in a valuation of C$4.11 per share (previously C$4.81) using a 10% discount rate, fully diluted share count and commodity prices as supplied by Avalon and stated in our May 2013 Outlook note.

To Read the Entire Report Please Click on the pdf File Below